Middle East & Africa Ice Cream Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 175 | Report Code: BMIRE00026999 | Category: Food and Beverages

No. of Pages: 175 | Report Code: BMIRE00026999 | Category: Food and Beverages

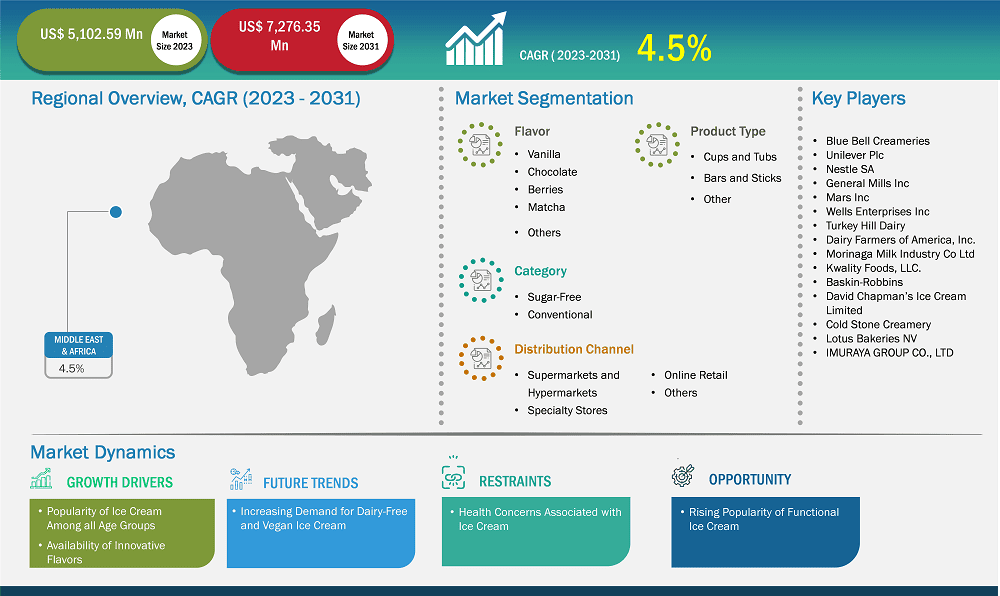

The Middle East & Africa ice cream market size is expected to reach US$ 7,276.35 million by 2031 from US$ 5,102.59 million in 2023. The market is estimated to record a CAGR of 4.5% from 2023 to 2031.

Consumer preferences for healthier and premium options, as well as the hot climate in the Middle East & African countries, boost year-round consumption of ice creams. The ice cream market is experiencing significant growth in the region owing to the introduction of new flavors to avoid saturation with conventional offerings. The demands of health-conscious consumers are also catered to with the availability of low-fat, low-calorie, sugar-free, and organic ice cream options. For instance, Brooklyn Creamery introduced a low-calorie chocolate stick range, following its tubs in the UAE supermarkets.

The temperature of countries in the Middle East & Africa is further elevated due to growing industrialization, which consequently propels the demand for ice cream. The availability of e-commerce services, development of supply chain management, innovations, and the availability of plenty of flavors of ice cream are among the other factors boosting the ice cream market in the Middle East & Africa.

Key segments that contributed to the derivation of the Middle East & Africa ice cream market analysis are flavor, category, form, and distribution channel.

Over the past few years, the demand for ice cream market across all groups has significantly driven the market growth, ensuring a broad and consistent consumer base. Unlike other products that cater to specific demographics, ice cream appeals to children, adults, and seniors. Children enjoy it as a fun and tasty treat, while adults often consume it as a nostalgic comfort food or an indulgent dessert. This universal appeal reduces market segmentation, allowing producers to market their products to a wide audience, which in turn drives market growth. In addition, people's social and emotional connection with ice cream is often associated with positive experiences, celebrations, and comfort, making it a versatile treat for various occasions. This emotional resonance transcends age, creating lifelong customers who continue to enjoy ice cream throughout their lives.

The increasing number of product launches in the frozen dairy products segment by key players in the market is driving the ice cream market. Also, owing to growing demand, several players are expanding their production capabilities. For instance, In May 2025, Pure Ice Cream, a leading private label food manufacturer, commenced construction on a state-of-the-art production facility at Dubai Industrial City. This AED 80 million investment aims to establish one of the UAE's largest ice cream factories, set to launch in 2026. The facility will span 160,000 square feet and increase Pure Ice Cream's annual production capacity to 50 million liters, marking a 300% rise from its current output. The expansion aligns with Dubai's economic initiatives, including Operation 300bn and the 'Make it in the Emirates' program. Further, several initiatives such as mergers & acquisitions and collaborations by various manufacturing companies contribute to the increasing demand for frozen desserts. For instance, In March 2025, Moroccan conglomerate Dislog expanded its portfolio by acquiring Venezia Ice & Bakery, a well-known brand in Morocco's ice cream market. Venezia operates 45 stores nationwide and offers a range of products including ice cream, sorbets, pastries, and artisanal bread. This acquisition strengthens Dislog's presence in the food sector, complementing its existing operations in hygiene and healthcare. Moreover, consumers are seeking different flavors in ice cream; thus, key players are making significant innovations and launching new flavors in the ice cream market. Hence, strategic initiatives by key players, a high level of disposable income, and the presence of various frozen dairy products with innovative flavors are boosting the growth of the ice cream market.

Based on country, the Middle East & Africa ice cream market comprises Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. The Rest of Middle East & Africa held the largest share in 2023.

Iran, Bahrain, Qatar, Turkey, Israel, and Zambia are among the countries contributing to the ice cream market growth in the Rest of Middle East & Africa. The market in this region is expected to grow due to the increasing demand for antioxidant ingredients in ice cream and premium products. Moreover, the manufacturers are investing in research and development activities to produce new products and innovating flavors to cater to the increasing consumer base, which is further fueling the demand for ice cream across the region.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5,102.59 Million |

| Market Size by 2031 | US$ 7,276.35 Million |

| CAGR (2023 - 2031) | 4.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Flavor

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Blue Bell Creameries; Unilever Plc; Nestle SA; General Mills Inc; Mars Inc; Wells Enterprises Inc; Turkey Hill Dairy; Dairy Farmers of America, Inc.; Morinaga Milk Industry Co Ltd; Kwality Foods, LLC.; Baskin-Robbins; David Chapman’s Ice Cream Limited; Cold Stone Creamery; Lotus Bakeries NV; and IMURAYA GROUP CO., LTD among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Middle East & Africa Ice Cream Market is valued at US$ 5,102.59 Million in 2023, it is projected to reach US$ 7,276.35 Million by 2031.

As per our report Middle East & Africa Ice Cream Market, the market size is valued at US$ 5,102.59 Million in 2023, projecting it to reach US$ 7,276.35 Million by 2031. This translates to a CAGR of approximately 4.5% during the forecast period.

The Middle East & Africa Ice Cream Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Ice Cream Market report:

The Middle East & Africa Ice Cream Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Ice Cream Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Ice Cream Market value chain can benefit from the information contained in a comprehensive market report.