Last Mile Delivery Motorcycles Market Outlook (2021-2031)

No. of Pages: 200 | Report Code: BMIPUB00031692 | Category: Automotive and Transportation

No. of Pages: 200 | Report Code: BMIPUB00031692 | Category: Automotive and Transportation

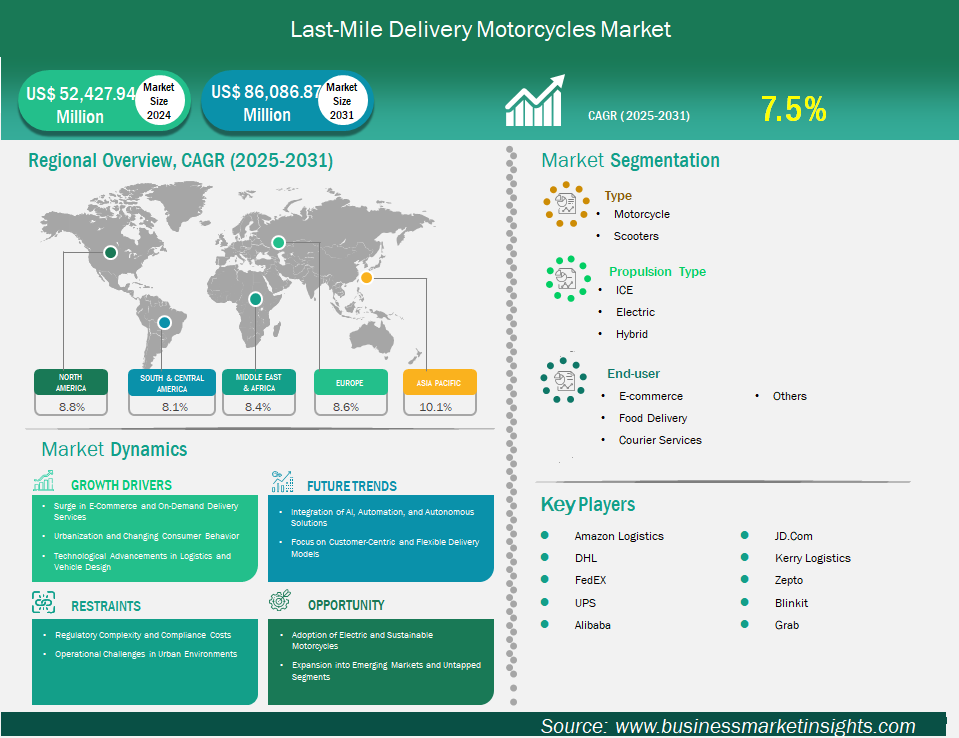

The last-mile delivery motorcycles market size is expected to reach US$ 86,086.87 million by 2031 from US$ 52,427.94 million in 2024. The market is estimated to record a CAGR of 7.5% from 2025 to 2031.

The last-mile delivery motorcycles market is a critical and rapidly evolving segment within the broader logistics and supply chain industry. Driven by the explosive growth of e-commerce, rising consumer expectations for fast and flexible deliveries, and increasing urbanization, this market is experiencing robust expansion globally. Two-wheelers—primarily motorcycles and scooters—dominate last-mile delivery due to their agility, cost-effectiveness, and ability to navigate congested urban environments.

Key trends shaping the market in 2024 include the electrification of delivery fleets, adoption of AI and advanced analytics for route optimization, and a strong push toward sustainability. Companies are investing in innovative technologies such as autonomous vehicles and drones, though motorcycles remain the backbone of urban last-mile logistics. The market is also characterized by heightened customer expectations for real-time tracking, personalized delivery options, and environmentally friendly solutions.

Last Mile Delivery Motorcycles Market Strategic Insights

Last Mile Delivery Motorcycles Market Segmentation Analysis

Key segments that contributed to the derivation of the Last-mile delivery motorcycles market analysis are drive type, propulsion, sales channel, and geography.

Urbanization is transforming consumer behaviour, with more people living in densely populated cities where traffic congestion and limited parking make traditional delivery vehicles less efficient. Motorcycles thrive in such environments due to their maneuverability, speed, and cost-effectiveness. The shift toward same-day and next-day delivery expectations has become a standard, compelling logistics providers to adopt motorcycles as a core part of their fleet. Additionally, the growing middle class in developing regions is increasing disposable income, enabling more consumers to access online shopping and premium delivery services, further fuelling demand for last-mile delivery motorcycles.

Emerging markets in Asia-Pacific, Latin America, and Africa represent significant growth opportunities for the last-mile delivery motorcycles market. Rapid urbanization, rising disposable incomes, and increasing smartphone penetration are driving e-commerce adoption and demand for delivery services. Companies can capitalize on these trends by expanding their operations, forming strategic partnerships, and tailoring services to local needs. Additionally, untapped segments such as healthcare logistics, micro-fulfilment centers, and specialized deliveries offer potential for diversification and revenue growth.

By type, the scooter segment led the market in 2024 – Scooters dominate the motorcycle type segment in the last mile delivery motorcycles market due to their unique attributes that align perfectly with the demands of urban delivery operations. Maneuverability, low-operating cost and storage space are some of the reasons for the segment’s dominance.

By propulsion type, the ICE motorcycles benefit from an extensive and well-established fuel infrastructure, making them highly practical for last mile delivery. Petrol stations are ubiquitous globally, ensuring easy refuelling in urban and rural areas alike, unlike electric vehicles (EVs) which rely on limited charging networks. This accessibility minimizes downtime for delivery riders, critical for time-sensitive services like e-commerce and food delivery. In regions like Asia-Pacific and Latin America, where charging infrastructure is still developing, ICE motorcycles offer unmatched convenience. The robust fuel supply chain supports continuous operations, making ICE vehicles the preferred choice for logistics companies and gig workers.

By end-user, the e-commerce channels the dominant end-user in the last mile delivery motorcycles market due to its explosive growth, high delivery volume, and alignment with consumer expectations for fast, efficient service. he global surge in online shopping has propelled e-commerce as the leading end-user in last mile delivery. Platforms like Amazon, Alibaba, and Flipkart have seen exponential growth, driven by convenience and wider product availability. This translates into millions of daily deliveries, requiring agile vehicles like motorcycles to navigate urban areas. In Asia-Pacific, where e-commerce penetration is high, companies rely on scooters for rapid parcel delivery. Consumer preference for quick turnaround, especially in urban centers, fuels the demand for motorcycle fleets, making e-commerce the largest contributor to the last mile delivery market’s growth.

By geography, the last-mile delivery motorcycles are experiencing robust but regionally varied growth, shaped by economic development, urbanization, government policies, and evolving consumer preferences. Asia Pacific is the fastest-growing last-mile delivery motorcycles, led by China, India, and Japan. Southeast Asian countries like Indonesia, Vietnam, and the Philippines are also witnessing surges in demand due to rising incomes and urbanization.

Last Mile Delivery Motorcycles Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 52,427.94 Million

Market Size by 2031

US$ 86,086.87 Million

Global CAGR (2025 - 2031) 7.5%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Type

By Propulsion Type

By End-User

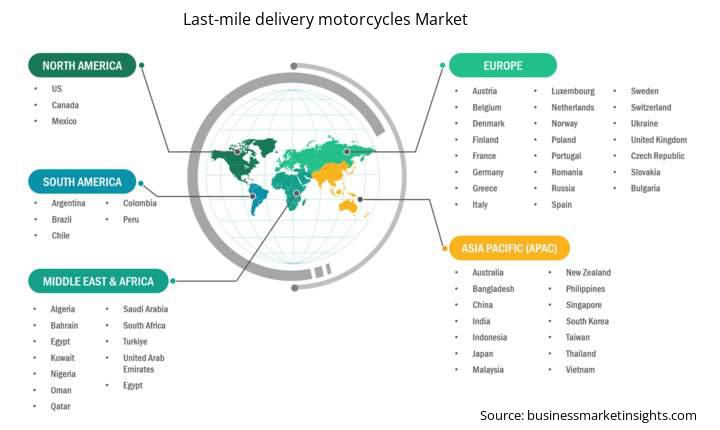

Regions and Countries Covered

North America

Europe

Asia-Pacific

South and Central America

Middle East and Africa

Market leaders and key company profiles

The "Last-mile delivery motorcycles Market Outlook (2021–2031)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the Last-mile delivery motorcycles market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The Last-mile delivery motorcycles market in Asia Pacific is expected to grow significantly during the forecast period.

North America is currently the dominant region in the last-mile delivery market, including the segment for motorcycles. In 2024, North America is expected to hold approximately over 37% of the global market share. North America benefits from a highly developed transportation network, including extensive road systems, distribution centers, and fulfillment hubs. This infrastructure supports efficient, multi-stop delivery routes that keep costs low and delivery times short.

The region is home to major e-commerce players such as Amazon, Walmart, and Target, which have set high standards for fast and reliable delivery. The surge in online shopping has led to increased demand for last-mile delivery services, with consumers expecting same-day or next-day delivery as the norm. North American companies are at the forefront of adopting advanced logistics technologies, including real-time monitoring, route optimization, and automation. The integration of electric vehicles (EVs) and autonomous delivery solutions is accelerating, further enhancing the efficiency and sustainability of last-mile operations.

While North America leads in market size, Asia-Pacific is the fastest-growing region for last-mile delivery services, including motorcycle-based deliveries. Rapid urbanization and population density in cities in countries like India, China, and Indonesia are experiencing explosive growth, creating dense urban clusters that are ideal for motorcycle-based deliveries. Motorcycles can navigate congested streets and narrow lanes more efficiently than larger vehicles. The rise of a middle class, increased smartphone penetration, and growing internet connectivity are driving a surge in online shopping. Platforms like Alibaba, Flipkart, and local quick-commerce apps are investing heavily in last-mile logistics to meet rising consumer expectations.

The Last-mile delivery motorcycles market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Last-mile delivery motorcycles market are:

The Last Mile Delivery Motorcycles Market is valued at US$ 52,427.94 Million in 2024, it is projected to reach US$ 86,086.87 Million by 2031.

As per our report Last Mile Delivery Motorcycles Market, the market size is valued at US$ 52,427.94 Million in 2024, projecting it to reach US$ 86,086.87 Million by 2031. This translates to a CAGR of approximately 7.5% during the forecast period.

The Last Mile Delivery Motorcycles Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Last Mile Delivery Motorcycles Market report:

The Last Mile Delivery Motorcycles Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Last Mile Delivery Motorcycles Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Last Mile Delivery Motorcycles Market value chain can benefit from the information contained in a comprehensive market report.