Europe Boron Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 164 | Report Code: BMIRE00032110 | Category: Chemicals and Materials

No. of Pages: 164 | Report Code: BMIRE00032110 | Category: Chemicals and Materials

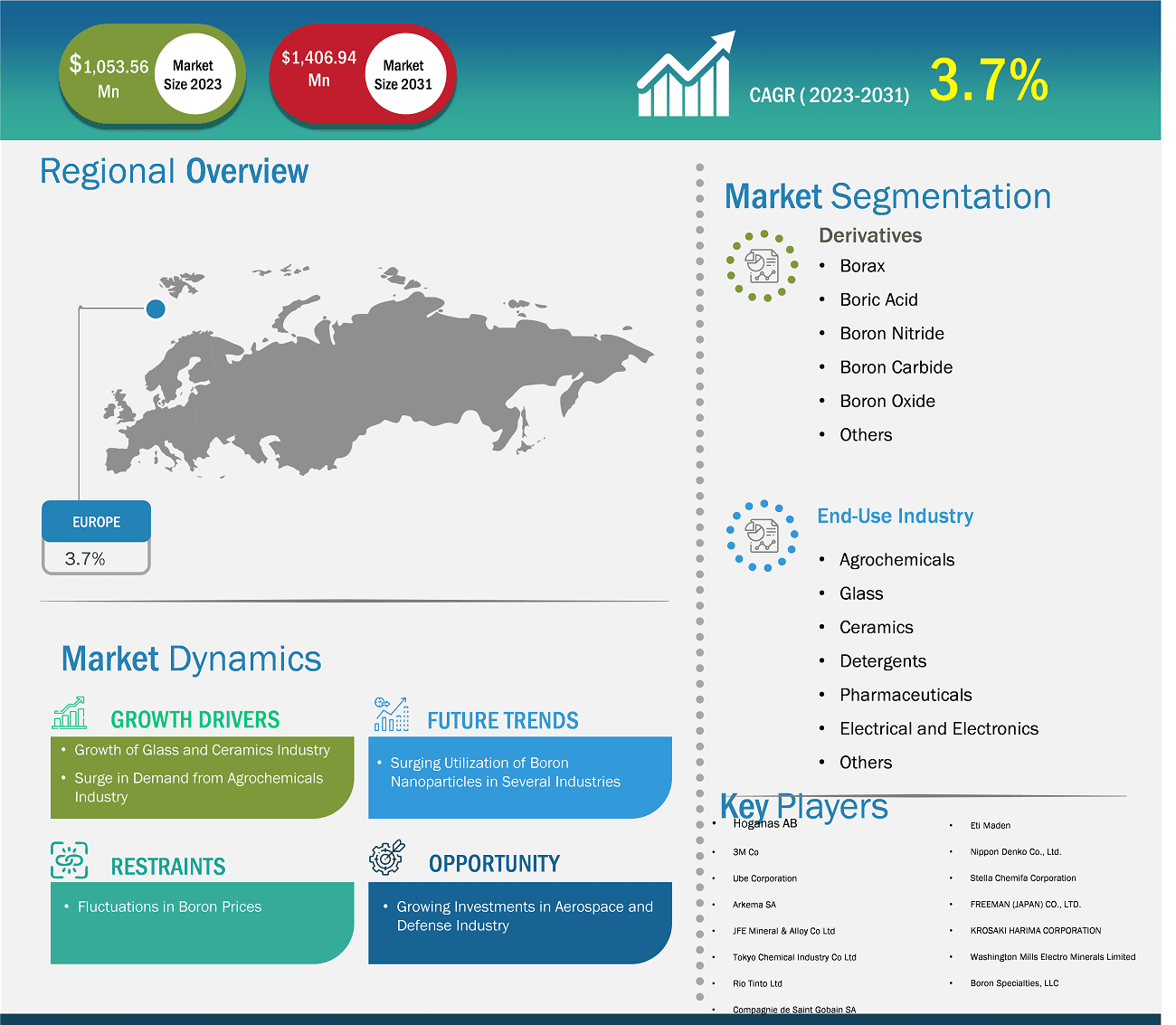

The Europe boron market size is expected to reach US$ 1,406.94 million by 2031 from US$ 1,053.56 million in 2023. The market is estimated to record a CAGR of 3.7% from 2023 to 2031.

The glass industry is one of the largest manufacturing industries in Europe. According to data published by the European Commission, Europe is the world's largest glass producer, with a market share of around one-third of total world production. Europe is a diverse market with several developed and developing economies such as Germany, France, Italy, the UK, Spain, and Russia. The region has several major glass manufacturers, such as Saint-Gobain, Schott, and AGC Inc. The manufacturers are involved in the strategic expansion and product development to meet the rising demand for glass from end-use industries. For instance, in February 2022, AGC Inc invested ~US$ 10.57 million in its laminating line to be installed in its Osterweddingen Plant (Germany). This development in the company's glass division—aimed to meet the growing demand—provides safety, security, acoustic comfort, daylight, and high-performance glazing.

The surge in requirement for energy efficiency and the rise in building renovations in the past few years are creating a demand for glass in the region, which, in turn, is strengthening the scope of the boron market in the region, as boron enables glasses with strong chemical durability and low coefficient of thermal expansion. Further, the rise in investments in solar power plant infrastructure is boosting the demand for solar glass. For instance, in 2021, a solar power plant of 300–350 MW capacity was constructed by the Government of North Macedonia in collaboration with Elektrani na Severna Makedonija (ESM). The country is planning to expand its solar power plant capacity to 400 MW by the end of 2024. Countries such as France, Germany, and Luxembourg have strict regulations regarding photovoltaic (PV) building incentives. This has accelerated the adoption of solar glasses in these countries.

There is a growing interest in architectural solar applications in Europe. Architects are increasingly considering including solar glasses in designs to add value to buildings and comply with new regulations. Borosilicate glass is also used in solar water heating systems. This glass is the key component of a highly efficient type of solar collector called an evacuated tube collector (ETC). Europe is recognized for its pharmaceutical manufacturing, with Germany, France, Switzerland, and Italy being the major producers in the region. In the pharmaceutical industry, boron is used in eye care products, as boron retains moisture, controls pH, and relieves irritants.

Europe Boron Market Strategic Insights

Europe Boron Market Segmentation Analysis

Key segments that contributed to the derivation of the Europe boron market analysis are derivatives and end-use industry.

Boron fibers and boron carbide are high-strength and low-weight materials used in aerospace structures. The growing use of lightweight materials in the aerospace & defense industries is driving the demand for boron. Boron compounds such as boron nitride can withstand high temperatures, thereby having applications in heat shields, thermal protection systems, and other high-temperature applications. Boron is used as a dopant in semiconductors to improve the properties of advanced electronics utilized in the aerospace & defense industry.

The European Union established Horizon Europe in 2021, a research and innovation program with a total budget of ~US$ 103 billion, which also focuses on aerospace research, according to the European Commission. Governments of various countries have increased investments in aerospace-related research, including defense and ballistic protection, owing to a rise in security risks and the need to enhance national border security.

France is the home to five major aircraft manufacturers—Airbus SE (large commercial and military aircraft, drones, and spacecraft), Airbus Helicopters SAS, Dassault Aviation SA (high-end business jets, fighter aircraft, and UAVs), ATR (passenger and cargo turboprop aircraft for regional transport), and Daher (TBM and Kodiak light aircraft and business turboprops). As per the International Trade Administration (ITA), France has full-range military production capabilities, including fighter jets, nuclear submarines, aircraft carriers, and ballistic missile production.

Thus, the rising investments in the aerospace & defense industry are expected to create lucrative opportunities for the boron market growth during the forecast period.

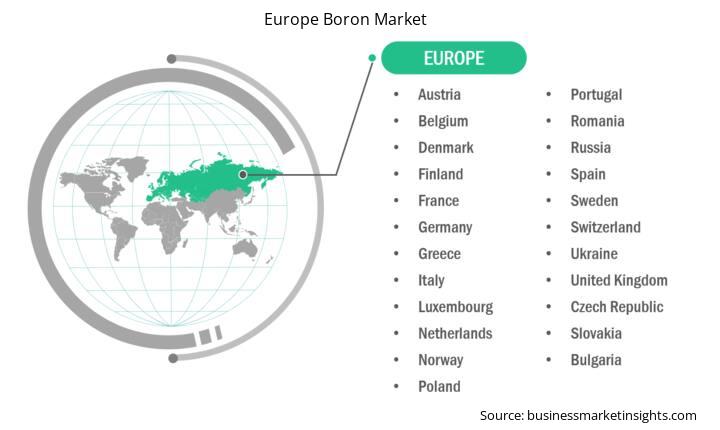

Based on country, the Europe boron market comprises Germany France, Italy, the UK, Russia, and the Rest of Europe. Germany held the largest share in 2023.

In Germany, the demand for boron is mainly driven by the rising adoption of fiber glass and solar glass. Insulation grade fiber glass contains 5–12% of boron concentration. Incorporating boron in fiber glass reduces the melt's viscosity, thereby assisting fiberization. The strategic initiatives taken by fiber glass manufacturers play a major role in driving the boron market in the country. For instance, in May 2024, the Niedax Group agreed on a strategic partnership with GIGA FIBER GmbH to promote the expansion of the fiber glass network in Germany. As part of this partnership, the Niedax Group has acquired a 10% stake in GIGA FIBER GmbH. Further, there is a growing interest in integrating photovoltaics into roofs and building facades. Germany's strong incentives and policies are crucial to expanding the solar glass business. The country's Buildings Energy Act (GEG), which has been in force since 2020, stipulates renewable energy use and energy efficiency in the building sector. Thus, the growing requirement from the glass industry drives the demand for boron in Germany.

Europe Boron Market Report Highlights

Report Attribute

Details

Market size in 2023

US$ 1,053.56 Million

Market Size by 2031

US$ 1,406.94 Million

CAGR (2023 - 2031) 3.7%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Derivatives

By End-use Industry

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Boron Market Company Profiles

Some of the key players operating in the market are Hoganas AB; 3M Co; Ube Corporation; Arkema SA; JFE Mineral & Alloy Co Ltd; Tokyo Chemical Industry Co Ltd; Rio Tinto Ltd; Compagnie de Saint Gobain SA; Eti Maden; Nippon Denko Co., Ltd.; Stella Chemifa Corporation; FREEMAN (JAPAN) CO., LTD; KROSAKI HARIMA CORPORATION; Washington Mills Electro Minerals Limited; and Boron Specialties LLC, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Europe Boron Market is valued at US$ 1,053.56 Million in 2023, it is projected to reach US$ 1,406.94 Million by 2031.

As per our report Europe Boron Market, the market size is valued at US$ 1,053.56 Million in 2023, projecting it to reach US$ 1,406.94 Million by 2031. This translates to a CAGR of approximately 3.7% during the forecast period.

The Europe Boron Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Boron Market report:

The Europe Boron Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Boron Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Boron Market value chain can benefit from the information contained in a comprehensive market report.