South & Central America Boron Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 153 | Report Code: BMIRE00032113 | Category: Chemicals and Materials

No. of Pages: 153 | Report Code: BMIRE00032113 | Category: Chemicals and Materials

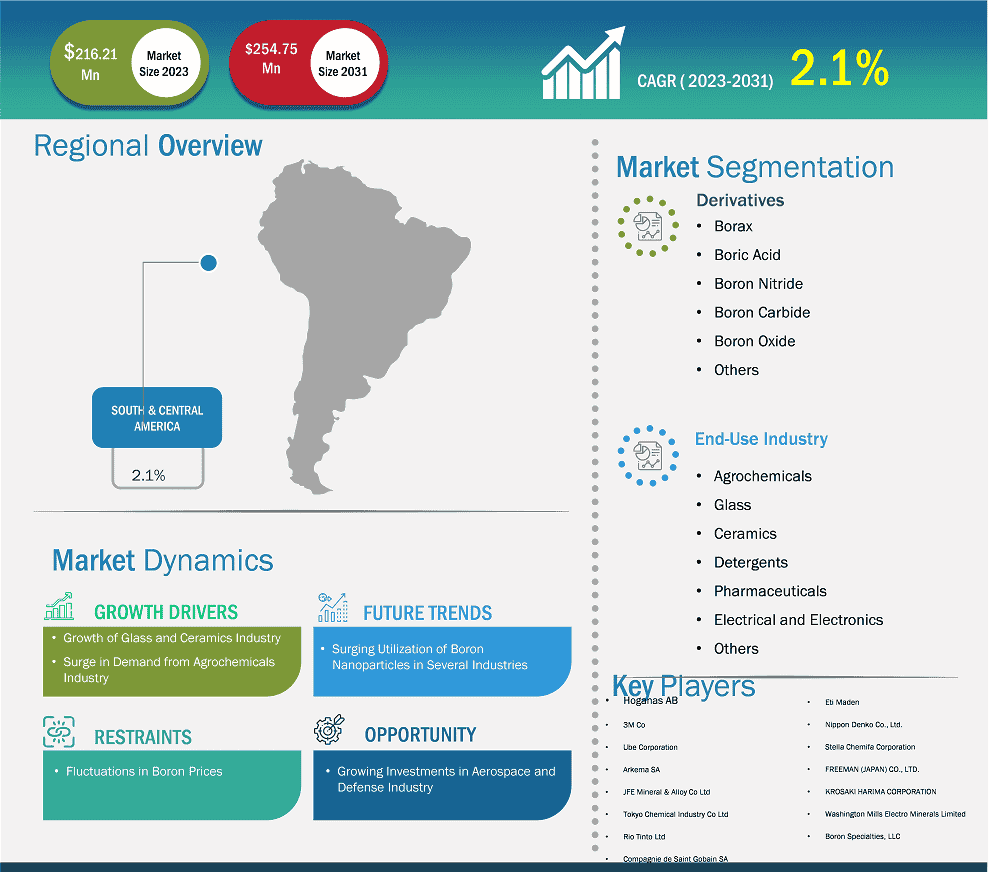

The South & Central America boron market size is expected to reach US$ 254.75 million by 2031 from US$ 216.21 million in 2023. The market is estimated to record a CAGR of 2.1% from 2023 to 2031.

The growth of the boron market in Brazil and Argentina is ascribed to the surging glass manufacturing. The regional glass manufacturers are focused on developing innovative glass solutions for various applications in corporate, residential, and institutional buildings in Brazil. For instance, in November 2019, GlassecViracon developed smart and innovative solutions that offer thermal and acoustic performance, safety, and a unique design to the construction project. Therefore, the rise in infrastructure projects and the development of innovative glass are expected to fuel the boron market growth during the forecast period. Various environmental and energy policies are playing an important role in developing solar technology in the region. The regulations related to building energy efficiency are boosting the adoption of solar glass in the region. Further, in 2022, Brazil ranked fourth in the world on the US Green Building Council's annual list of Top 10 Countries and Regions for LEED. The growing penetration of solar glass, coupled with the utilization of boron in manufacturing solar glass, plays a key role in the development of the boron market in the region.

South & Central America Boron Market Strategic Insights

South & Central America Boron Market Segmentation Analysis

Key segments that contributed to the derivation of the South & Central America boron market analysis are derivatives and end-use industry.

The development and utilization of boron nanoparticles are rapidly increasing due to their unique properties and potential applications across various industries. Boron nanoparticles offer several characteristics such as high durability, thermal stability, chemical inertness, and neutron absorption capabilities. In the aerospace industry, boron nanoparticles are used to enhance the strength and durability of composites. These nanoparticles are also being researched for their electronic properties, high thermal conductivity, biocompatibility, and chemical stability. In June 2023, a study by the ARC Centre of Excellence for Transformative Meta-Optical Systems (Australia) revealed that hexagonal boron nitride has the potential to replace diamond as a quantum sensing material.

Boron nanoparticles are researched for targeted drug delivery systems due to their ability to penetrate cells and reduce clonogenic activity after irradiation. In April 2024, a research study published by the American Chemical Society revealed that a boron-containing delivery agent is a promising technology targeted for liver cancer cells using Boron Neutron Capture Therapy. Boron nitride quantum dots, or white graphene, are zero-dimensional substances in the early stages of research. Boron nitride quantum dots are biocompatible and offer unique chemical, optical, electrochemical, and catalytic characteristics. These materials have the potential for enormous applications in sectors involving sensing, photocatalysis, chemotherapy, bioimaging, and the detection of metal ions. Therefore, the surging utilization of boron nanoparticles in several industries is expected to foster the market growth in the coming years.

Based on country, the South & Central America boron market comprises Brazil, Argentina, and the Rest of South & Central America. Brazil held the largest share in 2023.

Brazil is one of the largest glass producers in South & Central America. The total number of Glass manufacturing companies in Brazil was 3,365 in 2023. São Paulo is the largest province for glass manufacturing in the country. In addition, domestic and export opportunities also drive the country's production capacity to regional and global markets. Brazil has become the leading country in the region that is witnessing good growth in the boron market due to the expansion of the agricultural industry. The country is strategically focused on expanding crop cultivation, which is expected to stimulate the demand for crop protection chemicals in recent years. The Brazilian agricultural sector is mainly driving the country's economic growth. According to the Food and Agriculture Organization of the United Nations (FAO), the country is the world's fourth largest producer of grains, including rice, barley, soybeans, corn, and wheat, after the US, China, and India, with 7.8% of the global production. The growing glass and agriculture production fuels the boron market growth in Brazil.

South & Central America Boron Market Report Highlights

Report Attribute

Details

Market size in 2023

US$ 216.21 Million

Market Size by 2031

US$ 254.75 Million

CAGR (2023 - 2031) 2.1%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Derivatives

By End-use Industry

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Boron Market Company Profiles

Some of the key players operating in the market are Hoganas AB; 3M Co; Ube Corporation; Arkema SA; JFE Mineral & Alloy Co Ltd; Tokyo Chemical Industry Co Ltd; Rio Tinto Ltd; Compagnie de Saint Gobain SA; Eti Maden; Nippon Denko Co., Ltd.; Stella Chemifa Corporation; FREEMAN (JAPAN) CO., LTD; KROSAKI HARIMA CORPORATION; Washington Mills Electro Minerals Limited; and Boron Specialties LLC, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The South & Central America Boron Market is valued at US$ 216.21 Million in 2023, it is projected to reach US$ 254.75 Million by 2031.

As per our report South & Central America Boron Market, the market size is valued at US$ 216.21 Million in 2023, projecting it to reach US$ 254.75 Million by 2031. This translates to a CAGR of approximately 2.1% during the forecast period.

The South & Central America Boron Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Boron Market report:

The South & Central America Boron Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Boron Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Boron Market value chain can benefit from the information contained in a comprehensive market report.