CNC Drilling Machine Market Outlook (2021-2031)

No. of Pages: 450 | Report Code: BMIPUB00032049 | Category: Manufacturing and Construction

No. of Pages: 450 | Report Code: BMIPUB00032049 | Category: Manufacturing and Construction

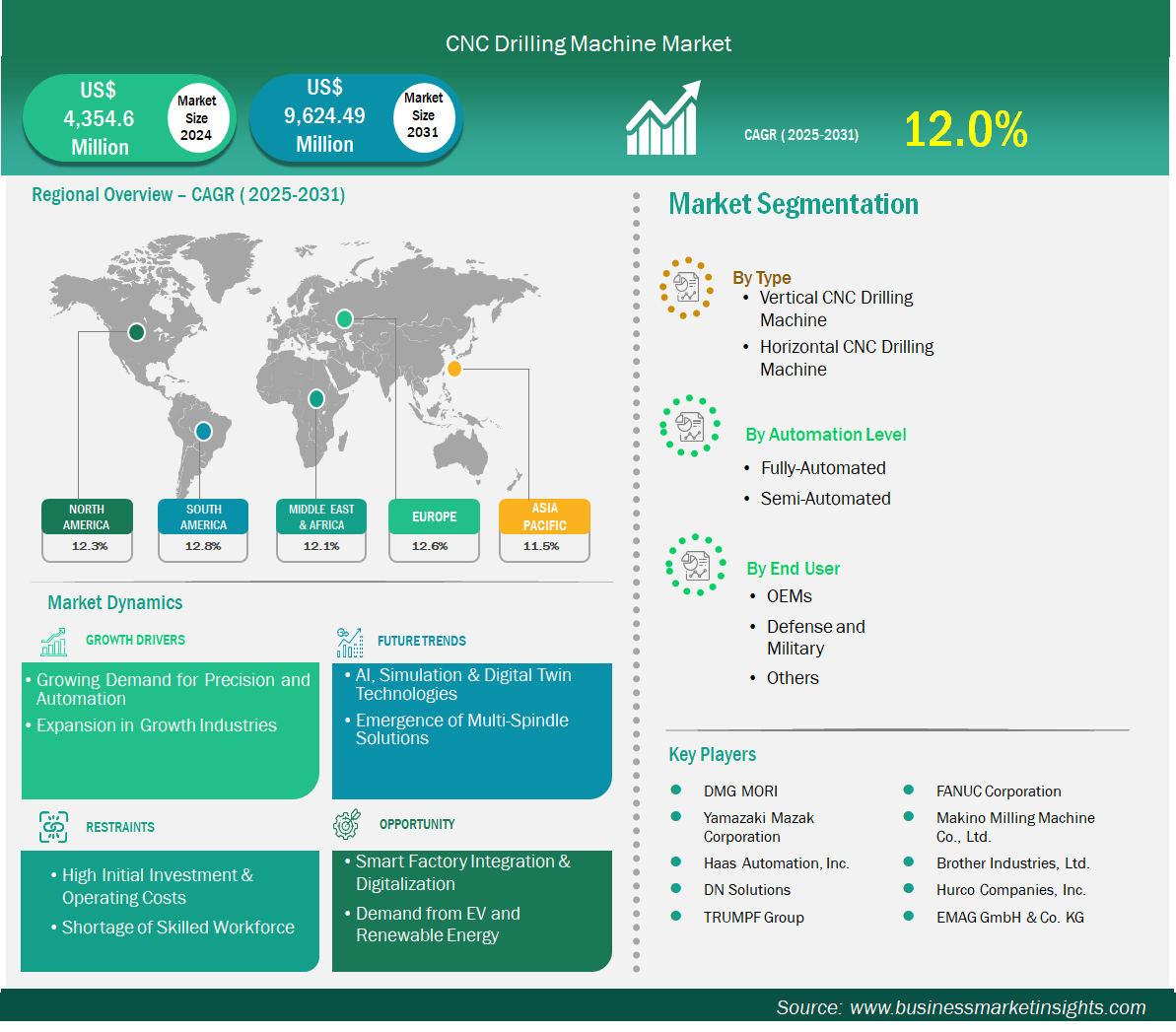

The CNC Drilling Machine market size is expected to reach US$ 9,624.49 million by 2031 from US$ 4,354.6 million in 2024. The market is estimated to record a CAGR of 12.0% from 2025 to 2031.

CNC drilling machines are widely used in modern manufacturing to create precision holes in various materials such as metal, plastic, and composites. They are integral to industries like automotive, aerospace, electronics, construction, and heavy machinery. These machines offer key advantages including enhanced accuracy, repeatability, speed, and the ability to handle complex drilling patterns compared to manual machines. The rising demand for automated machining solutions and smart manufacturing practices (Industry 4.0) is fueling market growth. Additionally, increasing investments in infrastructure, electric vehicles, and renewable energy sectors are boosting the adoption of CNC drilling systems.

However, several challenges can hinder market expansion. High capital investment for advanced CNC drilling equipment and maintenance can be a barrier, especially for small and medium enterprises (SMEs). A shortage of skilled labor to operate and program CNC machines is another restraint. Moreover, fluctuations in raw material prices and supply chain disruptions affect manufacturing operations. On the other hand, growing trends like integration with IoT and AI for predictive maintenance, increased adoption in emerging economies, and technological innovations in multi-axis and high-speed drilling offer strong growth opportunities for the CNC drilling machine market.

Key segments that contributed to the derivation of the CNC Drilling Machine market analysis are type, automation level, and end user.

Growing Demand for Precision and Automation

The global manufacturing landscape is undergoing a paradigm shift toward increased precision and automation, with CNC drilling machines playing a critical role in this transformation. Industries such as aerospace, automotive, electronics, and construction are placing heightened emphasis on achieving exact tolerances, consistent quality, and process repeatability—key parameters that manual drilling solutions often fail to deliver. CNC drilling machines enable manufacturers to meet these demands through computer-controlled precision, reducing human error and significantly improving output efficiency.

Furthermore, the integration of Industry 4.0 technologies—including AI-powered analytics, real-time monitoring, and predictive maintenance—is transforming conventional drilling operations into smart, interconnected systems. This transition allows for seamless machine communication, optimization of tool paths, and enhanced production visibility, leading to increased uptime and reduced operational costs. Businesses are also increasingly relying on automated CNC systems to address labor shortages, minimize downtime, and accelerate product development cycles. These systems are particularly valuable in high-mix, low-volume production environments, where flexibility and speed are critical.

Expansion in Growth Industries

CNC drilling machines are experiencing heightened demand due to robust expansion in several high-growth industries, notably automotive (with a focus on electric vehicles), aerospace, and renewable energy. These sectors require advanced machining capabilities to fabricate complex, lightweight, and high-strength components at scale. In particular, the shift toward electric vehicles (EVs) is creating new requirements for drilling precision in battery casings, motor housings, and powertrain components—driving investment in multi-axis and high-speed CNC drilling systems.

Similarly, the aerospace sector demands extreme accuracy, as even minor deviations can compromise safety and performance. Aircraft manufacturing involves materials like titanium and carbon fiber composites, which require specialized drilling techniques. CNC drilling machines with enhanced capabilities—such as adaptive feed control and coolant-through spindles—are increasingly being deployed to meet these rigorous specifications while maintaining operational efficiency.

By type, the CNC Drilling Machine market is segmented into vertical and horizontal CNC drilling machines, with the vertical CNC drilling machine segment dominating the market in 2024. Vertical machines are favored for their compact design, cost efficiency, and ease of operation, making them highly suitable for small to medium-sized enterprises. These machines are commonly used in industries such as automotive, electronics, and construction for tasks that require vertical alignment and quick tool changes. Vertical CNC drilling machines also offer improved accessibility and visibility during operations, which enhances precision and reduces errors.

By automation level, the CNC drilling machine market is segmented into fully automated and semi-automated systems, with fully automated machines holding the largest share in 2024. Fully automated CNC drilling machines are equipped with advanced features like robotic tool changers, integrated software systems, real-time process monitoring, and self-diagnostic capabilities. These machines require minimal human intervention, significantly boosting productivity, consistency, and precision in drilling operations.

By end-user, the CNC drilling machine market is segmented into OEMs (Original Equipment Manufacturers), Defense & Military, and Others, with OEMs accounting for the largest market share in 2024. OEMs heavily rely on CNC drilling machines for precision manufacturing of critical components across industries such as automotive, aerospace, electronics, and industrial machinery. The rising demand for high-precision, mass-produced components is pushing OEMs to invest in advanced CNC technologies, including drilling systems with multi-axis capabilities.

The defense & military segment is also a significant user of CNC drilling equipment, given the critical need for precision in the fabrication of weapons, vehicles, and structural components. CNC machines ensure the consistency and reliability required in defense applications.

The “Others” category includes industries like construction, renewable energy, and marine, which are also adopting CNC drilling machines to meet specific fabrication needs. However, OEMs remain the primary drivers of market growth due to their continuous innovation and production scale.

The "CNC Drilling Machine Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

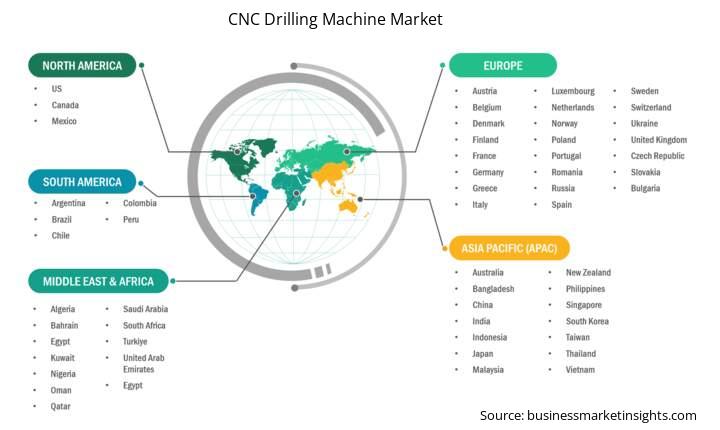

The geographical scope of the CNC Drilling Machine market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The CNC Drilling Machine market in Asia Pacific is expected to grow significantly during the forecast period.

The Asia-Pacific CNC Drilling Machine market includes countries such as China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Taiwan, Bangladesh, and the Rest of Asia. The region's manufacturing sector is rapidly evolving due to favorable government policies, infrastructure investments, and increasing FDI in industrial machinery. China and India lead the region owing to large-scale industrial output, robust domestic demand, and increasing adoption of smart manufacturing practices. Countries like Vietnam, Thailand, and Indonesia are also witnessing rising demand due to expanding electronics and automotive sectors. The availability of skilled labor, cost-competitive manufacturing, and the push for Industry 4.0 are positioning Asia-Pacific as a global manufacturing hub. This dynamic environment is fueling the adoption of CNC drilling machines across a wide range of industries in the region.

CNC Drilling Machine Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 4,354.6 Million

Market Size by 2031

US$ 9,624.49 Million

Global CAGR (2025 - 2031) 12.0%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Type

By Automation Level

By End User

Regions and Countries Covered

North America

Europe

Asia-Pacific

South and Central America

Middle East and Africa

Market leaders and key company profiles

The CNC Drilling Machine market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the CNC Drilling Machine market are:

The CNC Drilling Machine Market is valued at US$ 4,354.6 Million in 2024, it is projected to reach US$ 9,624.49 Million by 2031.

As per our report CNC Drilling Machine Market, the market size is valued at US$ 4,354.6 Million in 2024, projecting it to reach US$ 9,624.49 Million by 2031. This translates to a CAGR of approximately 12.0% during the forecast period.

The CNC Drilling Machine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the CNC Drilling Machine Market report:

The CNC Drilling Machine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The CNC Drilling Machine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the CNC Drilling Machine Market value chain can benefit from the information contained in a comprehensive market report.