Automotive Carbon Fiber Composites Market Outlook (2021-2031)

No. of Pages: 450 | Report Code: BMIPUB00031714 | Category: Chemicals and Materials

No. of Pages: 450 | Report Code: BMIPUB00031714 | Category: Chemicals and Materials

The automotive carbon fiber composites market size is expected to reach US$ 5,319.91 million by 2031 from US$ 2,179.25 million in 2024. The market is estimated to record a CAGR of 14.0% from 2025 to 2031.

Carbon fiber composites have revolutionized the automotive industry due to their exceptional combination of strength, lightness, and durability. These materials consist of thin fibers of carbon tightly woven and bonded with a resin matrix, resulting in a composite that is both incredibly strong and lightweight compared to traditional metals like steel and aluminum. The primary meaning of carbon fiber composites lies in their ability to provide high performance without adding excessive weight, which is critical for vehicles aiming to improve fuel efficiency and overall performance. One of the major benefits of using carbon fiber composites in the automotive sector is their significant weight reduction, which directly translates into better fuel economy and lower emissions, aligning with global environmental regulations and consumer demand for greener vehicles. Moreover, carbon fiber composites offer superior resistance to corrosion and fatigue, ensuring longer vehicle life and reduced maintenance costs. Their versatility allows manufacturers to design complex shapes that improve aerodynamics and aesthetics, which is challenging with metals.

The usage of carbon fiber composites spans from structural components such as chassis and body panels to interior parts and even drive shafts. High-performance sports cars, luxury vehicles, and increasingly mainstream cars are incorporating carbon fiber to meet rising consumer expectations for safety, performance, and efficiency. The increasing demand for carbon fiber composites in the automotive industry stems from multiple converging factors. Governments worldwide are implementing stricter fuel efficiency and emission standards, pushing manufacturers to innovate with lightweight materials. Consumers are becoming more conscious about environmental impact and vehicle performance, further driving demand for advanced materials. Additionally, advancements in manufacturing processes have made carbon fiber composites more affordable and accessible, expanding their application beyond niche markets to mass production. Overall, carbon fiber composites represent a crucial evolution in automotive materials, combining innovation, performance, and sustainability to meet the challenges of modern vehicle design and environmental responsibility.

The demand for carbon fiber composites in the European automotive industry is rapidly increasing due to several key factors. Primarily, the push for lightweight vehicles to improve fuel efficiency and reduce carbon emissions drives manufacturers to adopt carbon fiber materials. Compared to traditional metals like steel and aluminum, carbon fiber composites offer superior strength-to-weight ratios, enabling carmakers to design lighter yet stronger vehicles. Additionally, stricter environmental regulations in Europe encourage the development of eco-friendly automobiles, making carbon fiber composites an attractive option for meeting these standards. The growing popularity of electric vehicles (EVs) also boosts demand, as reducing vehicle weight directly enhances battery range and overall performance. Furthermore, advancements in manufacturing processes have lowered production costs and improved the scalability of carbon fiber composites, making them more accessible to mainstream automotive applications. These combined factors contribute to the increasing reliance on carbon fiber composites in Europe’s automotive sector, driving innovation and sustainability in vehicle design.

Increasing Demand for Lightweight Vehicles

The growing demand for lightweight vehicles is a key driver propelling the automotive carbon fiber composites market. As governments worldwide implement stringent fuel efficiency standards and emission regulations, automotive manufacturers are under increasing pressure to produce vehicles that consume less fuel and emit fewer greenhouse gases. Carbon fiber composites offer a unique combination of high strength and extremely low weight compared to traditional materials like steel and aluminum. By incorporating these composites, automakers can significantly reduce vehicle weight, leading to improved fuel economy and lower carbon emissions. Additionally, lightweight vehicles enhance overall vehicle performance, including acceleration and handling, which appeals to consumers seeking both efficiency and driving experience. This shift towards sustainable mobility solutions encourages continuous innovation and adoption of advanced materials like carbon fiber composites in vehicle manufacturing. Consequently, the rising emphasis on environmental responsibility and operational efficiency is driving robust growth and investment in the automotive carbon fiber composites market.

Stringent Emission Regulations

Stringent emission regulations imposed by governments globally are a key driving force behind the growth of the automotive carbon fiber composites market. As countries strive to meet ambitious CO2 reduction targets to combat climate change, automakers are compelled to innovate by reducing vehicle weight without compromising safety or performance. Carbon fiber composites offer an ideal solution due to their exceptional strength-to-weight ratio, significantly lowering the overall weight of vehicles compared to traditional steel or aluminum components. Lighter vehicles consume less fuel and emit fewer greenhouse gases, helping manufacturers comply with increasingly strict emission standards set by regulatory bodies such as the European Union, EPA in the U.S., and China’s Ministry of Ecology and Environment. Additionally, these regulations encourage the development of electric and hybrid vehicles, which also benefit from lightweight materials to maximize battery efficiency and range. Consequently, the rising demand for carbon fiber composites is directly linked to the automotive industry's urgent need to meet environmental regulations while delivering high-performance, fuel-efficient vehicles.

Integration of Hybrid Materials

The integration of hybrid materials, such as combining carbon fiber with other composites like glass fiber, creates significant opportunities in the automotive carbon fiber composites market by addressing key challenges of cost and performance. Carbon fiber offers exceptional strength-to-weight ratio and stiffness but comes with a high price tag. By blending it with more affordable materials like glass fiber, manufacturers can reduce overall production costs while still enhancing critical performance metrics such as durability and weight reduction. This hybrid approach allows automakers to optimize material properties tailored to specific vehicle components, striking a balance between high strength and cost-efficiency. Additionally, hybrid composites improve design flexibility, enabling innovative structural solutions that meet safety and fuel efficiency regulations. As automotive companies increasingly focus on lightweighting to boost electric vehicle range and reduce emissions, hybrid composites serve as a practical, scalable solution, thereby accelerating market adoption and expanding the demand for carbon fiber-based materials across diverse vehicle segments.

The global automotive carbon fiber composites market, by vehicle type, is segmented into passenger car and commercial. The passenger car segment held the largest share of the automotive carbon fiber composites market in 2024. The increasing adoption of passenger cars is a significant factor driving the growth of the automotive fiber composites market. As consumer demand for lighter, more fuel-efficient, and environmentally friendly vehicles rises, automakers are turning into fiber composites to meet these needs. Fiber composites, which combine materials like carbon fiber or glass fiber with polymers, offer superior strength-to-weight ratios compared to traditional metals. This allows manufacturers to reduce vehicle weight without compromising safety or performance, directly contributing to improved fuel efficiency and lower emissions. Additionally, regulatory pressures worldwide to meet stricter emission standards are pushing carmakers to innovate with lightweight materials, further boosting the use of fiber composites. Passenger cars, being the largest segment of vehicles on the road, present a massive opportunity for material innovation. The rise in electric vehicle production also plays a critical role, as electric cars benefit greatly from weight reduction to extend battery life and driving range. Furthermore, consumer preference for stylish, durable, and high-performance cars fuels the demand for fiber composites, which allow for more flexible design options. All these factors collectively accelerate the integration of fiber composites in passenger cars, thus propelling the overall automotive fiber composites market forward.

The global automotive carbon fiber composites market, by propulsion, is segmented into internal combustion engines, battery electric vehicles, hybrid electric vehicles, plug-in hybrid electric vehicles, and fuel cell electric vehicles. The internal combustion engine segment held the largest share of the automotive carbon fiber composites market in 2024. The increasing adoption of internal combustion engines (ICE) in the automotive sector is significantly driving the demand for fiber composites. ICE vehicles require lightweight yet strong materials to improve fuel efficiency and reduce emissions, making fiber composites ideal due to their high strength-to-weight ratio. Additionally, fiber composites offer enhanced durability and corrosion resistance, which extends vehicle lifespan. As manufacturers focus on optimizing performance while adhering to environmental regulations, the use of fiber composites in ICE-powered vehicles continues to grow rapidly.

The global automotive carbon fiber composites market, by application, is segmented into structural assembly, powertrain components, interiors, and exteriors. The powertrain components segment held the largest share of the automotive carbon fiber composites market in 2024. The increasing adoption of powertrain components made from fiber composites is driven by the automotive industry's push for lightweight, fuel-efficient vehicles. Fiber composites offer superior strength-to-weight ratios compared to traditional metals, reducing overall vehicle weight and improving performance. Additionally, these materials enhance durability and corrosion resistance, leading to longer component life. As emissions regulations tighten globally, manufacturers are prioritizing innovative materials like fiber composites to meet environmental standards while maintaining powertrain efficiency and reliability, fueling market growth.

Automotive Carbon Fiber Composites Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 2,179.25 Million

Market Size by 2031

US$ 5,319.91 Million

Global CAGR (2025 - 2031) 14.0%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Vehicle Type

By Propulsion

By Application

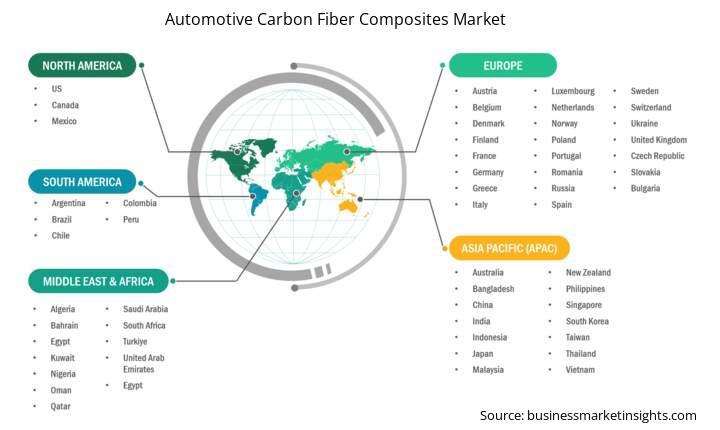

Regions and Countries Covered

North America

Europe

Asia-Pacific

South and Central America

Middle East and Africa

Market leaders and key company profiles

The "automotive carbon fiber composites market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the automotive carbon fiber composites market report is divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America. The automotive carbon fiber composites market in the Asia Pacific is expected to grow significantly during the forecast period.

Several key factors drive the increasing adoption of automotive fiber composites in the Asia Pacific region. Firstly, the rapid growth of the automotive industry in countries like China, India, Japan, and South Korea is fueling demand for lightweight and high-performance materials to improve vehicle efficiency and reduce emissions. Fiber composites, known for their high strength-to-weight ratio, help manufacturers meet stringent government regulations on fuel economy and environmental standards. Additionally, the rising consumer preference for electric vehicles (EVs) in the region is pushing automakers to adopt composites, as these materials significantly reduce vehicle weight, thereby extending EV battery range. The advancements in composite manufacturing technologies, such as resin transfer molding and automated fiber placement, have also made the production process more cost-effective and scalable, encouraging wider usage. Moreover, Asia Pacific’s expanding infrastructure and increasing investment in research and development are accelerating innovation and adoption of fiber composites. The region's automotive supply chain is becoming more mature, with local suppliers offering high-quality composite materials, reducing their dependency on imports. Furthermore, rising labor costs in the Asia Pacific have increased interest in lightweight materials that improve vehicle performance without significantly increasing manufacturing complexity. All these factors combined are contributing to the robust growth and increasing adoption of automotive fiber composites market in Asia Pacific.

The automotive carbon fiber composites market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the automotive carbon fiber composites market are:

The Automotive Carbon Fiber Composites Market is valued at US$ 2,179.25 Million in 2024, it is projected to reach US$ 5,319.91 Million by 2031.

As per our report Automotive Carbon Fiber Composites Market, the market size is valued at US$ 2,179.25 Million in 2024, projecting it to reach US$ 5,319.91 Million by 2031. This translates to a CAGR of approximately 14.0% during the forecast period.

The Automotive Carbon Fiber Composites Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Automotive Carbon Fiber Composites Market report:

The Automotive Carbon Fiber Composites Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Automotive Carbon Fiber Composites Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Automotive Carbon Fiber Composites Market value chain can benefit from the information contained in a comprehensive market report.