US Pharmaceutical Fluid Handling Market Forecast to 2028 – COVID-19 Impact and Country Analysis – by Offering (Equipment and Solutions & Services), Tubing (TPE, PVC, and Silicone), Application (Fluid Handling & Management, Fluid Preparation, Integration & Automation, Aseptic Processing, Buffer Management, and Others), Usage [Cough Syrup, Intravenous Products, Complex Active Pharmaceutical Ingredients (APIs), and Others], and End User (Biotechnology Companies, Pharmaceutical & Medical Companies, and Others)

The US pharmaceutical fluid handling market is expected to grow from US$ 3,863.89 million in 2021 to US$ 5,179.71 million by 2028; it is estimated to grow at a CAGR of 4.3% from 2022 to 2028.

Rising use of fluid handling during the innovation and development in the biotechnological industry fuels the growth of the US market. However, challenges related to fluid handling in active pharmaceutical ingredient production restrain the market growth.

Pharmaceutical fluid handling is one of the critical components that ensure safe and timely delivery of products such as cough syrups, intravenous products, and complex active pharmaceutical ingredients. The usage of correct handling equipment/instruments is essential for business success and reliability.

In pharmaceutical and biopharmaceutical product manufacturing, sterilization helps kill pathogens and bacteria and ensures that the products are safe to use. Sterilization destroys all microorganisms on the surface of an article or in a fluid to prevent disease transmission associated with those organisms. Contamination prevention in pharmaceutical manufacturing is crucial. Also, the proper handling and storage of fluids are essential to limit the possibility of contamination. Facility layout helps determine how companies handle fluid transfer and storage. The increased use of modular facilities and single-use systems (SUS) in the production and transfer of sterile fluids is helping shape the fluid handling landscape.

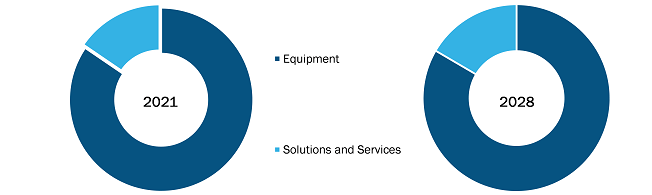

US Pharmaceutical Fluid Handling Market, by Offering – 2021 & 2028

Single-use systems will be used most often with fluids that require sterile processing. Disposables could significantly benefit facility design, validation, and investment. Single-use systems increase a product’s speed-to-market and return on investment. Due to the nature of the drugs, pharmaceutical companies select suppliers with adequate knowledge and expertise in single-use products to ensure sterile processing and regulatory compliance.

The aseptic process and the terminal sterilization of a product are essential in pharmaceutical manufacturing to avoid contamination of the product. The fluid used in the pharmaceutical industry should also be sterile throughout the process, and the fluid handling process ensures that the fluid is sterile throughout the production process. Due to all the factors mentioned above, the demand for pharmaceutical fluid handling is increasing.

Offering-Based Insights

Based on offerings, the US pharmaceutical fluid handling market is segmented into equipment and solution & services. The market in the equipment segment is further segmented into metering pumps and capsule equipment (filling/sorting), mixing equipment and valves, thermal processing equipment (coolers/chillers/dryers/heat-exchangers), x-ray inspection systems, tanks for holding liquids and flow control products, filters/filter sets (pre-filters/ sterilizing grade filters/ virus filters), powder handling bags, sterile connectors/disconnectors and membrane filter cartridges, and others. The equipment segment held a larger market share in 2021.

Tubing-Based Insights

Based on tubing, the US pharmaceutical fluid handling market is segmented into TPE, PVC, and silicone. The silicone segment held the largest market share in 2021 and is expected to register the highest CAGR during 2022–2028.

Application-Based Insights

Based on application, the US pharmaceutical fluid handling market is segmented into fluid handling & management, fluid preparation, integration & automation, aseptic processing, buffer management, and others. The market in the fluid handling and management segment is further segmented into single-use systems and multi-use systems, bioprocessing workstations, standard storage systems and bio containers, totes, and others. The fluid handling and management segment held the largest market share in 2021. However, the integration and automation segment is expected to register the highest CAGR during the forecast period.

Usage-Based Insights

Based on usage, the US pharmaceutical fluid handling market is segmented into cough syrup, intravenous products, complex APIs, and others. The market in the complex APIs segment is further segmented into vaccines, medication for cancer treatments, and others. The cough syrup segment held the largest market share in 2021, whereas the intravenous products segment is expected to register the highest CAGR during the forecast period.

End User-Based Insights

Based on end user, the US pharmaceutical fluid handling market is segmented into biotechnology companies, pharmaceutical and medical companies, and others. The biotechnology companies segment held the largest share of the market in 2021. Moreover, the same segment is expected to register the highest CAGR during the forecast period.

A few major primary and secondary sources referred to while preparing the report on the US pharmaceutical fluid handling market is The Bill & Melinda Gates Foundation and Organization for Economic Co-operation and Development (OECD).

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 United States Pharmaceutical Fluid Handling Market – By Offerings

1.3.2 United States Pharmaceutical Fluid Handling Market – By Tubing

1.3.3 United States Pharmaceutical Fluid Handling Market – By Application

1.3.4 United States Pharmaceutical Fluid Handling Market – By Usage

1.3.5 United States Pharmaceutical Fluid Handling Market – By End User

2. United States Pharmaceutical Fluid Handling Market Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. United States Pharmaceutical Fluid Handling - Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 United States Pharmaceutical Fluid Handling Market

4.3 Expert Opinion

5. United States Pharmaceutical Fluid Handling Market Key Market Dynamics

5.1 Market Drivers

5.1.1 Need for Fluid Handling in the Biotechnology Industry

5.1.2 Rising Need for Sterilization in the Pharmaceutical Industry

5.2 Market Restraints

5.2.1 Challenges Related to Fluid Handling in Active Pharmaceutical Ingredient (APIs) Production

5.3 Market Opportunities

5.3.1 Automated Fluid Handling Systems with Machine Learning

5.4 Future Trends

5.4.1 Increase in Vaccine Production

5.5 Impact Analysis

6. Pharmaceutical Fluid Handling Market – United States Analysis

6.1 United States Pharmaceutical Fluid Handling Market Revenue Forecasts and Analysis

6.2 Company Analysis

6.2.1 Market Positioning of Key Players

6.3 Comparative Company Analysis

6.4 Growth Strategy Analysis

6.5 Performance of Key Players

6.5.1 Rochling SE & CO KG

6.5.2 MercK Global.

7. United States Pharmaceutical Fluid Handling Market Analysis – By Offering

7.1 Overview

7.2 United States Pharmaceutical Fluid Handling Market Revenue Share, by Offering (2021 and 2028)

7.3 United States: Pharmaceutical Fluid Handling Market, by Offering, 2019–2028 (US$ Million)

7.3.1 Equipment

7.3.1.1 Overview

7.3.1.2 Equipment: Pharmaceutical Fluid Handling Market– Revenue and Forecast to 2028 (US$ Million)

7.3.2 Solution and services

7.3.2.1 Overview

7.3.2.2 Solution and services: Pharmaceutical Fluid Handling Market– Revenue and Forecast to 2028 (US$ Million)

8. United States Pharmaceutical Fluid Handling Market Revenue and Forecasts To 2028 – Tubing

8.1 Overview

8.2 United States Pharmaceutical Fluid Handling Market Revenue Share, by Tubing (2021 and 2028)

8.3 United States: Pharmaceutical Fluid Handling Market, by Tubing, 2019–2028 (US$ Million)

8.3.1 TPE

8.3.1.1 Overview

8.3.1.2 TPE: Pharmaceutical Fluid Handling Market– Revenue and Forecast to 2028 (US$ Million)

8.3.2 PVC

8.3.2.1 Overview

8.3.2.2 PVC: Pharmaceutical Fluid Handling Market– Revenue and Forecast to 2028 (US$ Million)

8.3.3 Silicone

8.3.3.1 Overview

8.3.3.2 Silicone: Pharmaceutical Fluid Handling Market– Revenue and Forecast to 2028 (US$ Million)

9. Pharmaceutical Fluid Handling Market Revenue and Forecasts To 2028– by Application

9.1 Overview

9.2 Pharmaceutical Fluid Handling Market, By Application, 2021 & 2028 (%)

9.3 United States: Pharmaceutical Fluid Handling Market, by Application, 2019–2028 (US$ Million)

9.3.1 Fluid Handling and Management

9.3.1.1 Overview

9.3.1.2 Fluid Handling and Management: Pharmaceutical Fluid Handling Market Revenue and Forecasts to 2028 (US$ Million)

9.3.1.2.1 Single-use Systems and Multi-Use Systems: Pharmaceutical Fluid Handling Market Revenue and Forecasts to 2028 (US$ Million)

9.3.1.2.2 Bioprocessing Workstations: Pharmaceutical Fluid Handling Market Revenue and Forecasts to 2028 (US$ Million)

9.3.1.2.3 Standard Storage Systems and Biocontainers: Pharmaceutical Fluid Handling Market Revenue and Forecasts to 2028 (US$ Million)

9.3.1.2.4 Totes: Pharmaceutical Fluid Handling Market Revenue and Forecasts to 2028 (US$ Million)

9.3.1.2.5 Others: Pharmaceutical Fluid Handling Market Revenue and Forecasts to 2028 (US$ Million)

9.3.2 Fluid Preparation

9.3.2.1 Overview

9.3.2.2 Fluid Preparation: Pharmaceutical Fluid Handling Market Revenue and Forecasts to 2028 (US$ Million)

9.3.3 Integration and Automation

9.3.3.1 Overview

9.3.3.2 Integration and Automation: Pharmaceutical Fluid Handling Market Revenue and Forecasts to 2028 (US$ Million)

9.3.4 Aseptic Processing

9.3.4.1 Overview

9.3.4.2 Aseptic Processing: Pharmaceutical Fluid Handling Market Revenue and Forecasts to 2028 (US$ Million)

9.3.5 Buffer Management

9.3.5.1 Overview

9.3.5.2 Buffer Management: Pharmaceutical Fluid Handling Market– Revenue and Forecast to 2028 (US$ Million)

9.3.6 Others

9.3.6.1 Overview

9.3.6.2 Others: Pharmaceutical Fluid Handling Market– Revenue and Forecast to 2028 (US$ Million)

10. United States Pharmaceutical Fluid Handling Market Analysis and Forecasts To 2028 - Usage

10.1 Overview

10.2 United States Pharmaceutical Fluid Handling Market Revenue Share, By Usage 2021 & 2028 (%)

10.3 United States: Pharmaceutical Fluid Handling Market, by Usage, 2019–2028 (US$ Million)

10.3.1 Cough Syrup

10.3.1.1 Overview

10.3.1.2 Cough Syrup: Pharmaceutical Fluid Handling Market Revenue and Forecast to 2028 (US$ Million)

10.3.2 Intravenous products

10.3.2.1 Overview

10.3.2.2 Intravenous products: Pharmaceutical Fluid Handling Market Revenue and Forecast to 2028 (US$ Million)

10.3.3 Complex Active Pharmaceutical Ingredients (APIs)

10.3.3.1 Overview

10.3.3.2 Complex Active Pharmaceutical Ingredients (APIs): Pharmaceutical Fluid Handling Market Revenue and Forecast to 2028 (US$ Million)

10.3.3.2.1 Vaccine

10.3.3.2.1.1 Overview

10.3.3.2.1.2 Vaccine: Pharmaceutical Fluid Handling Market Revenue and Forecast to 2028 (US$ Million)

10.3.3.2.2 Medications for cancer treatments

10.3.3.2.2.1 Overview

10.3.3.2.2.2 Medications for cancer treatments: Pharmaceutical Fluid Handling Market Revenue and Forecast to 2028 (US$ Million)

10.3.3.2.3 Others

10.3.3.2.3.1 Overview

10.3.3.2.3.2 Others: Pharmaceutical Fluid Handling Market Revenue and Forecast to 2028 (US$ Million)

10.3.4 Others

10.3.4.1 Overview

10.3.4.2 Others: Pharmaceutical Fluid Handling Market Revenue and Forecast to 2028 (US$ Million)

11. United States Pharmaceutical Fluid Handling Market Analysis and Forecast to 2028 – by End User

11.1 Overview

11.2 United States Pharmaceutical Fluid Handling Market Revenue Share, By End User 2021 & 2028 (%)

11.3 United States: Pharmaceutical Fluid Handling Market, by End User, 2019–2028 (US$ Million)

11.4 Biotechnology Companies

11.4.1 Overview

11.4.2 Biotechnology Companies: Pharmaceutical Fluid Handling Market – Revenue and Forecast to 2028 (US$ Million)

11.5 Pharmaceuticals and Medical Companies

11.5.1 Overview

11.5.2 Pharmaceuticals and Medical Companies: Pharmaceutical Fluid Handling Market – Revenue and Forecast to 2028 (US$ Million)

11.6 Others

11.6.1 Overview

11.6.2 Others: Pharmaceutical Fluid Handling Market – Revenue and Forecast to 2028 (US$ Million)

12. United States Pharmaceutical Fluid Handling Market Revenue and Forecast To 2028 – Country Analysis

12.1 United States Pharmaceutical Fluid Handling Market

12.1.1 Overview

12.2 United States Pharmaceutical Fluid Handling Market – Revenue and Forecast to 2028 (US$ Million)

12.3 United States Pharmaceutical Fluid Handling Market, by Offering, 2019–2028 (US$ Million)

12.3.1.1 United States Pharmaceutical Fluid Handling Market, by Equipment, 2019–2028 (US$ Million)

12.3.2 United States Pharmaceutical Fluid Handling Market, by Tubing, 2019–2028 (US$ Million)

12.3.3 United States Pharmaceutical Fluid Handling Market, by Application, 2019–2028 (US$ Million)

12.3.3.1 United States Pharmaceutical Fluid Handling Market, by Fluid Handling and Management, 2019–2028 (US$ Million)

12.3.4 United States Pharmaceutical Fluid Handling Market, by Usage, 2019–2028 (US$ Million)

12.3.4.1 United States Pharmaceutical Fluid Handling Market, by Complex APIs, 2019–2028 (US$ Million)

12.3.5 United States Pharmaceutical Fluid Handling Market, by End User, 2019–2028 (US$ Million)

12.3.6 Northeast: United States Pharmaceutical Fluid Handling Market – Revenue and Forecast to 2028 (US$ Million)

12.3.7 Northeast: United States Pharmaceutical Fluid Handling Market, by Offering, 2019–2028 (US$ Million)

12.3.7.1 Northeast: United States Pharmaceutical Fluid Handling Market, by Equipment, 2019–2028 (US$ Million)

12.3.8 Northeast: United States Pharmaceutical Fluid Handling Market, by Tubing, 2019–2028 (US$ Million)

12.3.9 Northeast: United States Pharmaceutical Fluid Handling Market, by Application, 2019–2028 (US$ Million)

12.3.9.1 Northeast: United States Pharmaceutical Fluid Handling Market, by Fluid Handling and Management, 2019–2028 (US$ Million)

12.3.10 Northeast: United States Pharmaceutical Fluid Handling Market, by Usage, 2019–2028 (US$ Million)

12.3.10.1 Northeast: United States Pharmaceutical Fluid Handling Market, by Complex APIs, 2019–2028 (US$ Million)

12.3.11 Northeast: United States Pharmaceutical Fluid Handling Market, by End User, 2019–2028 (US$ Million)

12.3.12 Midwest: United States Pharmaceutical Fluid Handling Market – Revenue and Forecast to 2028 (US$ Million)

12.3.13 Midwest: United States Pharmaceutical Fluid Handling Market, by Offering, 2019–2028 (US$ Million)

12.3.13.1 Midwest: United States Pharmaceutical Fluid Handling Market, by Equipment, 2019–2028 (US$ Million)

12.3.14 Midwest: United States Pharmaceutical Fluid Handling Market, by Tubing, 2019–2028 (US$ Million)

12.3.15 Midwest: United States Pharmaceutical Fluid Handling Market, by Application, 2019–2028 (US$ Million)

12.3.15.1 Midwest: United States Pharmaceutical Fluid Handling Market, by Fluid Handling and Management, 2019–2028 (US$ Million)

12.3.16 Midwest: United States Pharmaceutical Fluid Handling Market, by Usage, 2019–2028 (US$ Million)

12.3.16.1 Midwest: United States Pharmaceutical Fluid Handling Market, by Complex APIs, 2019–2028 (US$ Million)

12.3.17 Midwest: United States Pharmaceutical Fluid Handling Market, by End User, 2019–2028 (US$ Million)

12.3.18 South: United States Pharmaceutical Fluid Handling Market – Revenue and Forecast to 2028 (US$ Million)

12.3.19 South: United States Pharmaceutical Fluid Handling Market, by Offering, 2019–2028 (US$ Million)

12.3.19.1 South: United States Pharmaceutical Fluid Handling Market, by Equipment, 2019–2028 (US$ Million)

12.3.20 South: United States Pharmaceutical Fluid Handling Market, by Tubing, 2019–2028 (US$ Million)

12.3.21 South: United States Pharmaceutical Fluid Handling Market, by Application, 2019–2028 (US$ Million)

12.3.21.1 South: United States Pharmaceutical Fluid Handling Market, by Fluid Handling and Management, 2019–2028 (US$ Million)

12.3.22 South: United States Pharmaceutical Fluid Handling Market, by Usage, 2019–2028 (US$ Million)

12.3.22.1 South: United States Pharmaceutical Fluid Handling Market, by Complex APIs, 2019–2028 (US$ Million)

12.3.23 South: United States Pharmaceutical Fluid Handling Market, by End User, 2019–2028 (US$ Million)

12.3.24 West: United States Pharmaceutical Fluid Handling Market – Revenue and Forecast to 2028 (US$ Million)

12.3.25 West: United States Pharmaceutical Fluid Handling Market, by Offering, 2019–2028 (US$ Million)

12.3.25.1 West: United States Pharmaceutical Fluid Handling Market, by Equipment, 2019–2028 (US$ Million)

12.3.26 West United States Pharmaceutical Fluid Handling Market, by Tubing, 2019–2028 (US$ Million)

12.3.27 West: United States Pharmaceutical Fluid Handling Market, by Application, 2019–2028 (US$ Million)

12.3.27.1 West United States Pharmaceutical Fluid Handling Market, by Fluid Handling and Management, 2019–2028 (US$ Million)

12.3.28 West: United States Pharmaceutical Fluid Handling Market, by Usage, 2019–2028 (US$ Million)

12.3.28.1 West: United States Pharmaceutical Fluid Handling Market, by Complex APIs, 2019–2028 (US$ Million)

12.3.29 West: United States Pharmaceutical Fluid Handling Market, by End User, 2019–2028 (US$ Million)

13. Impact of COVID-19 Pandemic on United States Pharmaceutical Fluid Handling Market

13.1 United States: Impact Assessment of COVID-19 Pandemic

14. United States Pharmaceutical Fluid Handling Market Industry Landscape

14.1 Overview

14.2 Growth Strategies in the United States Pharmaceutical Fluid Handling Market

14.3 Inorganic Growth Strategies

14.3.1 Overview

14.4 Organic Growth Strategies

14.4.1 Overview

15. Company Profiles

15.1 Pall Corporation

15.1.1 Key Facts

15.1.2 Business Description

15.1.3 Products and Services

15.1.4 Financial Overview

15.1.5 SWOT Analysis

15.1.6 Key Developments

15.2 Watson-Marlow

15.2.1 Key Facts

15.2.2 Business Description

15.2.3 Products and Services

15.2.4 Financial Overview

15.2.5 SWOT Analysis

15.2.6 Key Developments

15.3 Merck KGaA

15.3.1 Key Facts

15.3.2 Business Description

15.3.3 Products and Services

15.3.4 Financial Overview

15.3.5 SWOT Analysis

15.3.6 Key Developments

15.4 Röchling SE & Co. KG

15.4.1 Key Facts

15.4.2 Business Description

15.4.3 Products and Services

15.4.4 Financial Overview

15.4.5 SWOT Analysis

15.4.6 Key Developments

15.5 Cytiva

15.5.1 Key Facts

15.5.2 Business Description

15.5.3 Products and Services

15.5.4 Financial Overview

15.5.5 SWOT Analysis

15.5.6 Key Developments

15.6 Tef Cap Industries Inc

15.6.1 Key Facts

15.6.2 Business Description

15.6.3 Products and Services

15.6.4 Financial Overview

As the company is privately held, we have essentially derived the information from secondary paid data sources.

15.6.5 SWOT Analysis

15.6.6 Key Developments

15.7 Flowtrend, Inc.

15.7.1 Key Facts

15.7.2 Business Description

15.7.3 Products and Services

15.7.4 Financial Overview

As the company is privately held, we have essentially derived the information from secondary paid data sources.

15.7.5 SWOT Analysis

15.7.6 Key Developments

15.8 DXP, Inc. (Quadna)

15.8.1 Key Facts

15.8.2 Business Description

15.8.3 Products and Services

15.8.4 Financial Overview

As the company is privately held, we have essentially derived the information from secondary paid data sources.

15.8.5 SWOT Analysis

15.8.6 Key Developments

16. Appendix

16.1 About The Insight Partners

16.2 Glossary of Terms

- Pall Corporation

- Watson-Marlow Fluid Technology Solutions

- MercK Global

- Rochling SE & CO KG.

- Cytiva

- Tef Cap Industries

- Flowtrend, Inc.

- DXP, Inc. (Quadna)

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the United States pharmaceutical fluid handling market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the United States pharmaceutical fluid handling market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth country market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution