Due to escalated usage of chopper pumps in wastewater applications, the demand for these pumps is increasing across the wastewater industry in the US Wastewater treatment facilities in the US process approximately 34 billion gallons of wastewater every day. Nearly one in four households in the US depends on an individual decentralized system to treat its wastewater. The nation's more than 16,000 centralized wastewater treatment plants are also functioning, at over 80% of their design capacities, while 15% have reached or exceeded it. Growing urban environments signal a trend that these facilities will increasingly accommodate a larger portion of the nation's wastewater demand. They find applications in various areas such as biological treatment and severe clogging, to break down solids especially in municipal water and wastewater treatment. The pumps can effectively pump heavily polluted wastewater having dry matter. Companies are developing broad variety of products and solutions that address customer needs in the wastewater industry. With rapid urbanization, the need for chopper pumps will increase significantly. The escalated usage of chopper pumps in wastewater applications is one of the major drivers for market growth in the US.

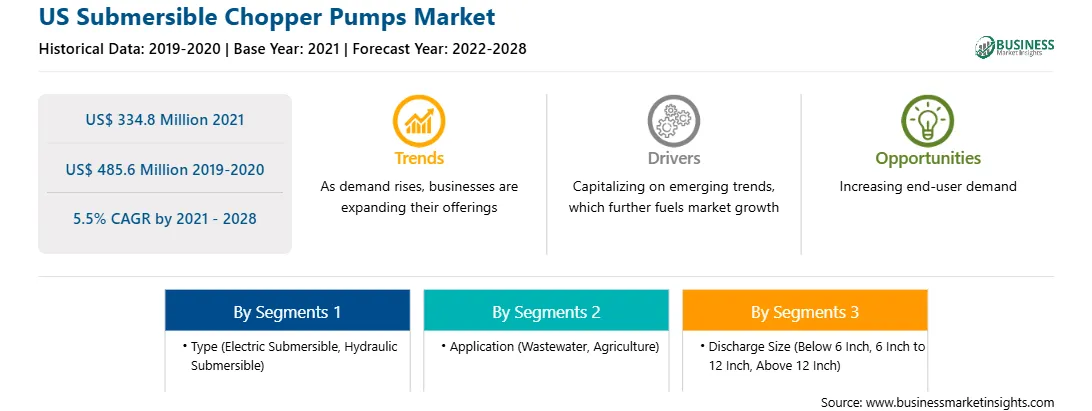

The US submersible chopper pumps market is analyzed on the basis of type, application, and discharge size. By type, the electric segment is expected to dominate the US market with high growth and greater revenue share. By application, wastewater holds a higher revenue share in the US market, followed by the agriculture application segment. By discharge size, medium discharge size, i.e., 6 inches to 12 inches, is estimated to hold a higher market value share. However, the high discharge size segment, i.e., above 12 inches, is expected to dominate the market growth during the forecast period.

The downturn in the global economy due to the impact of COVID-19 has led to adverse effect on businesses and their operations. The COVID-19 pandemic came to effect in the US during the spring and affected the pump industry in varied ways. With severe industries halted, the pump industry also faced material adverse effects. Supply chain issues, shipping delays, border disputes and currency fluctuations were some of the effects of the pandemic. Volatility in the foreign currencies and raw material prices led to negative performance of the pump industry and other industries in general.

Pump manufactures witnessed declined sales compared to previous financial years ranging from 5 to 7% decline. They also experienced reductions in the customer demand from various end-user markets. However, amidst the pandemic, the water and wastewater treatment industry seeks growth as developed and emerging regions increase their access to clean water and effective water treatment to supply their populations.

In the US, opportunities remain concentrated in the agriculture and wastewater sectors. However, wastewater applications are expected to drive market growth in the US. This is because the category has had strong sales in recent years, manufacturers are continuing to focus on growing production of chopper pumps for water and wastewater treatment. In comparison to other pumps, chopper pumps have extremely high flow rates and cover a wide range of liquid pumping applications. As a result, chopper pumps continue to see increased innovation and investment. New trends have resulted in tectonic shifts in a variety of industries.

Wastewater treatment has become an essential aspect of the sustainable development goals as numerous groups bring attention to the problem of water scarcity. Pump manufacturers are focusing on and exploring the possibilities of their products in these applications, recognizing the growing importance of water and wastewater treatment around the world. Pump makers are also projected to benefit from increased government spending in water and wastewater treatment activities.

These factors are expected to create lucrative opportunities for players operating in the submersible chopper pumps market over the next few years.

Type-Based Submersible Chopper Pumps Market Insights

On the basis of type, the submersible chopper pumps market is divided into electric submersible and hydraulic submersible. The electric submersible segment accounts for the largest revenue share in the overall market. This is due to rapid adoption of electric pumps across various end use applications such as wastewater and agriculture. With ongoing trends such as multistage pumps, self-priming pumps and heavy duty pumps, demand for energy-efficient and high performance electric submersible pumps is fast gaining traction. Especially in the US, increasing energy costs and rising environmental awareness among end users is expected to drive demand for energy-efficient and cost-effective submersible chopper pumps over the forecast period.

On the basis of discharge, the submersible chopper pumps market is segmented into below 6 inch, 6 inch to 12 inch, and above 12 inch. Below 6 inch Submersible Chopper pumps are low discharge sizes which are considered in this segment. They are also referred as light duty chopper pumps. Submersible Chopper pumps with medium discharge sizes are considered in this segment. It includes all discharge sizes from 6 inch to 12 inch especially for pumping long fiber components. These pumps are used extensively in agriculture and wastewater applications. Above 12 inch discharge sized pumps are Submersible Chopper pumps with high discharge sizes which are considered in this segment. They are also referred as heavy duty chopper pumps and extensively pump thick materials like slurries.

Based on application, the US submersible chopper pumps market is segmented into wastewater, agriculture, and others. The wastewater segment holds a significant amount of revenue share in the market. Today's wastewater industry professionals are facing varied challenges, but the challenge of handling unwanted sewage is made easier by chopper pumps. Similarly, submersible chopper pumps in agriculture are used in specific agricultural applications for pumping manure, dairy manure handling, and separating sand-laden manure through solid separators.

Chopper pumps are also exclusively used in livestock, slurry, and biogas in discharge heads, ranging from medium to high. Other applications of submersible chopper pumps include oil & gas, chemical, medical, and electronics. In the oil & gas industry, electric submersible pumps are an effective artificial lift method of pumping production fluids to the surface.

Players operating in the market mainly focus on developing advanced and efficient products.

Strategic insights for the US Submersible Chopper Pumps provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 334.8 Million |

| Market Size by 2028 | US$ 485.6 Million |

| CAGR (2021 - 2028) | 5.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

|

The geographic scope of the US Submersible Chopper Pumps refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The US Submersible Chopper Pumps Market is valued at US$ 334.8 Million in 2021, it is projected to reach US$ 485.6 Million by 2028.

As per our report US Submersible Chopper Pumps Market, the market size is valued at US$ 334.8 Million in 2021, projecting it to reach US$ 485.6 Million by 2028. This translates to a CAGR of approximately 5.5% during the forecast period.

The US Submersible Chopper Pumps Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Submersible Chopper Pumps Market report:

The US Submersible Chopper Pumps Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Submersible Chopper Pumps Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Submersible Chopper Pumps Market value chain can benefit from the information contained in a comprehensive market report.