US Ground Support Equipment Market Forecast to 2027 - COVID-19 Impact and Country Analysis by Equipment (Tugs and Tractors, Ground Power Unit, Hydraulic Power Unit, Aircraft Jacks, Belt Loader, De-Iceing Vehicles, and Others), Power Source (Electric and Non-Electric), and Application (Business Aviation and Military Aviation)

Market Introduction

The US ground support equipment market for military and business aviation is expected to witness growth during the forecast period. The growth in the business aviation sector is propelling the demand for ground support equipment. According to data by Cirium, in 2019, the US had an installed fleet of ~19,000 business jets and turboprops. The figure signifies that the country comprises over 60% of the total inventory of business jets worldwide. The company further stated that the US constantly accounts for over half of new business jet deliveries every year, with small and midsize aircraft category models contributing the majority of the output. Further, growing procurement of military aircraft fleet is driving the demand for ground support equipment (GSE). The US Department of Defense has numerous air bases across the world, and it continues to procure modern technologies to maintain the fleet. Ground support equipment is one of the key systems deployed by the US Department of Defense at various air bases worldwide.

Get more information on this report :

Market Overview and Dynamics

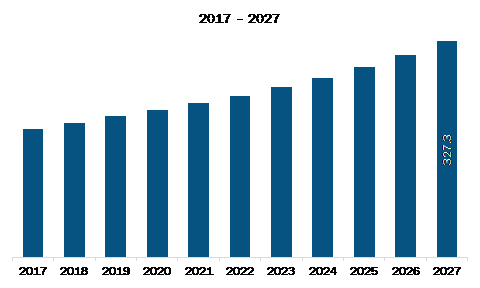

The US ground support equipment market was valued at US$ 246.2 million in 2019 and is projected to reach US$ 327.3 million by 2027; it is expected to grow at a CAGR of 4.7% from 2020 to 2027.

The availability of developed airport infrastructure significantly drives the growth of the business aviation sector. According to the President of the National Business Aviation Association, there are around 5,000 public service airports and additional 13,000 airfields, landing strips, and private sites situated across the US and serving businesses, including private owners and fly-in-fly-out mining companies. Another key factor driving the growth of the business aviation industry is the favorable tax legislation. According to legislation introduced in the Trump administration in 2017, a company can write off 100% of tax against capital expenditure, including a new or used business aircraft, in the first year of acquisition. Moreover, as per the Cirium fleets data published in September 2019, the US had 19,137 operational business jets and turboprops, signifying 61% of the total global share. The presence of the highly-developed business aviation sector in the US is boosting the demand for GSE.

The US is the worst-hit country due to the COVID-19 outbreak in North America. Thousands of infected individuals are facing severe health conditions across the country as well as continuous growth in the number of confirmed cases had led the government to impose lockdown across the nation’s borders in last few months. The airports across the country are experiencing deflation in revenue owing to the restrictions on air travelling for regular passengers. The adoption rate of technologies and equipment among airports is decent in the US, and its demand has shrunken to a drastic level owing to the closure of airports. This scenario is hindering the business aviation US ground support equipment market. The US military supply chain is also disrupted due to the COVID-19 pandemic. On the production end, ground support equipment manufacturing activities are slowed down.

Key Market Segments

In terms of equipment, the ground power unit segment accounted for the largest share of the US ground support equipment market in 2019. By power source, the non-electric segment held a larger market share in 2019. Based on application, the military aviation segment held a larger share of the market in 2019.

Major Sources and Companies Listed

A few major primary and secondary sources referred to while preparing the report on the US ground support equipment market are company websites, annual reports, financial reports, national government documents, and statistical database. Mallaghan; AERO Specialties, Inc.; AGSE LLC; Aviation Ground Equipment Corp.; ITW GSE ApS.; JBT Corporation; Meyer Hydraulics Corporation; Textron Ground Support Equipment Inc.; Towflexx GmbH; and Tronair Inc. are among the major companies listed in the market report.

Reasons to Buy Report

- To understand the US ground support equipment market landscape and identify market segments that are most likely to guarantee a strong return

- To stay ahead of the race by comprehending the ever-changing competitive landscape for the market

- To efficiently plan M&A and partnership deals in the market by identifying market segments with the most promising probable sales

- To make knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segments in the US ground support equipment market

- To obtain US ground support equipment market revenue forecast by various segments from 2020–2027 in the US.

US Ground Support Equipment Market Segmentation

US Ground Support Equipment Market – by Equipment

- Tugs and Tractors

- Ground Power Unit

- Hydraulic Power Unit

- Aircraft Jacks

- Belt Loader

- De-Iceing Vehicles

- Others

US Ground Support Equipment Market – by Power Source

- Electric

- Non-Electric

US Ground Support Equipment Market– by Application

- Business Aviation

- Military Aviation

US Ground Support Equipment Market-Companies

- Mallaghan

- AERO Specialties, Inc.

- AGSE LLC

- Aviation Ground Equipment Corp.

- ITW GSE ApS.

- JBT Corporation

- Meyer Hydraulics Corporation

- Textron Ground Support Equipment Inc.

- Towflexx GmbH

- Tronair Inc.

TABLE OF CONTENTS

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 US Ground Support Equipment Market – By Equipment

1.3.2 US Ground Support Equipment Market – By Power Source

1.3.3 US Ground Support Equipment Market – By Application

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. US Ground Support Equipment Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Ground Support Equipment Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Enhancement of Operational Efficiency

5.1.2 Growing Business Aviation Sector

5.2 Market Restraints

5.2.1 Long Service Life of Ground Support Equipment

5.3 Market Opportunities

5.3.1 Procurement of Greener Ground Support Equipment

5.4 Future Trends

5.4.1 Increased Adoption of Wireless Technology

5.5 Impact Analysis of Drivers and Restraints

6. Ground Support Equipment Market – US Analysis

6.1 Ground Support Equipment Market US Overview

6.2 US Ground Support Equipment Market – Revenue and Forecast to 2027 (US$ Million)

6.3 Market Positioning – Key Players

7. Ground Support Equipment Market Analysis – By Equipment

7.1 Overview

7.2 Ground Support Equipment Market Breakdown, By Equipment, 2019 & 2027

7.3 Tugs and Tractors

7.3.1 Overview

7.3.2 Tugs and Tractors Market Revenue and Forecast to 2027 (US$ Million)

7.4 Ground Power Unit

7.4.1 Overview

7.4.2 Ground Power Unit Market Revenue and Forecast to 2027 (US$ Million)

7.5 Hydraulic Power Unit

7.5.1 Overview

7.5.2 Hydraulic Power Unit Market Revenue and Forecast to 2027 (US$ Million)

7.6 Aircraft Jacks

7.6.1 Overview

7.6.2 Aircraft Jacks Market Revenue and Forecast to 2027 (US$ Million)

7.7 Belt Loader

7.7.1 Overview

7.7.2 Belt Loader Market Revenue and Forecast to 2027 (US$ Million)

7.8 De-iceing Vehicles

7.8.1 Overview

7.8.2 De-iceing Vehicles Market Revenue and Forecast to 2027 (US$ Million)

7.9 Others

7.9.1 Overview

7.9.2 Others Market Revenue and Forecast to 2027 (US$ Million)

8. Ground Support Equipment Market Analysis – By Power Source

8.1 Overview

8.2 Ground Support Equipment Market Breakdown, By Power Source, 2019 & 2027

8.3 Electric

8.3.1 Overview

8.3.2 Electric Market Revenue and Forecast to 2027 (US$ Million)

8.4 Non-Electric

8.4.1 Overview

8.4.2 Non-Electric Market Revenue and Forecast to 2027 (US$ Million)

9. Ground Support Equipment Market Analysis – By Application

9.1 Overview

9.2 Ground Support Equipment Market Breakdown, By Power Source, 2019 & 2027

9.3 Business Aviation

9.3.1 Overview

9.3.2 Business Aviation Market Revenue and Forecast to 2027 (US$ Million)

9.4 Military

9.4.1 Overview

9.4.2 Non-Electric Market Revenue and Forecast to 2027 (US$ Million)

10. Impact of COVID-19 on US Ground Support Equipment Market

10.1 Impact of COVID-19 Pandemic on US Ground Support Equipment Market

10.1.1 US: Impact Assessment of COVID-19 Pandemic

11. US Ground Support Equipment Market- Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

11.4 Merger and Acquisition

12. Company Profiles

12.1 Mallaghan

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 AERO Specialties, Inc.

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 AGSE LLC

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Aviation Ground Equipment Corp.

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 ITW GSE ApS.

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 JBT CORPORATION

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Meyer Hydraulics Corporation

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Textron Ground Support Equipment Inc.

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Towflexx GmbH

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Tronair Inc.

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary of TermsLIST OF TABLES

Table 1. US Ground Support Equipment Market – Revenue and Forecast to 2027 (US$ Million)

Table 2. Word of Index: Ground Support Equipment MarketLIST OF FIGURES

Figure 1. US Ground Support Equipment Market Segmentation

Figure 2. US Ground Support Equipment Market Overview

Figure 3. US Ground Support Equipment Market, By Equipment

Figure 4. US Ground Support Equipment Market, By Power Source

Figure 5. US Ground Support Equipment Market, By Application

Figure 6. Porter’s Five Forces Analysis

Figure 7. US Ground Support Equipment Market– Ecosystem Analysis

Figure 8. Expert Opinion

Figure 9. Ground Support Equipment Market Impact Analysis of Drivers and Restraints

Figure 10. US Ground Support Equipment Market – Revenue and Forecast to 2027 (US$ Million)

Figure 11. Ground Support Equipment Market Breakdown, By Equipment (2019 and 2027)

Figure 12. Tugs and Tractors Market Revenue and Forecast to 2027 (US$ Million)

Figure 13. Ground Power Unit Market Revenue and Forecast to 2027 (US$ Million)

Figure 14. Hydraulic Power Unit Market Revenue and Forecast to 2027 (US$ Million)

Figure 15. Aircraft Jacks Market Revenue and Forecast to 2027 (US$ Million)

Figure 16. Belt Loader Market Revenue and Forecast to 2027 (US$ Million)

Figure 17. De-iceing Vehicles Market Revenue and Forecast to 2027 (US$ Million)

Figure 18. Others Market Revenue and Forecast to 2027 (US$ Million)

Figure 19. Ground Support Equipment Market Breakdown, By Power Source (2019 and 2027)

Figure 20. Electric Market Revenue and Forecast to 2027(US$ Million)

Figure 21. Non-Electric Market Revenue and Forecast to 2027(US$ Million)

Figure 22. Ground Support Equipment Market Breakdown, By Power Source (2019 and 2027)

Figure 23. Business Aviation Market Revenue and Forecast to 2027(US$ Million)

Figure 24. Non-Electric Market Revenue and Forecast to 2027(US$ Million)

Figure 25. Impact of COVID-19 Pandemic on US Ground Support Equipment Market- Mallaghan

- AERO Specialties, Inc.

- AGSE LLC

- Aviation Ground Equipment Corp.

- ITW GSE ApS.

- JBT CORPORATION

- Meyer Hydraulics Corporation

- Textron Ground Support Equipment Inc.

- Towflexx GmbH

- Tronair Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the US Ground Support Equipment market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the US Ground Support Equipment market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth US market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution.