According to an article by BMC Public Health, the most typical conditions across the UK were chronic kidney disease (7.2%), diabetes mellitus (7.1%), asthma (6.5%), and chronic heart disease (4.5%). The prevalence of each condition varied nationally. Multimorbidity was common, ranging from 6.2% in England to 7.9% in Northern Ireland: 7.1% across the UK. Also, as per the July 2021 report of the British Heart Foundation, about 7.6 million people in the UK were suffering from cardiovascular diseases, of which 4 million were males and 3.6 million were females. Also, the rising diabetic population of the country will have a positive impact on the market. As per the report of Diabetes UK, published in February 2020, about 3.9 million people in the UK were diagnosed with diabetes in 2019, with 3.3 million people in England, of these, 90% had type 2 diabetes. According to the stats by the Royal College of Pathologists Registered Charity in England and Wales, it is estimated that 5 million people in the UK will have diabetes by 2025.

Thus, the increasing cases of diabetes and other chronic diseases in the UK is simultaneously propelling the demand for insulin and other medical supplies and positively influencing the UK medical courier market growth.

Several giants operating in the industry are taking strategic initiatives such as mergers and acquisitions, partnerships and collaborations, as well as unveiling new products to expand their foothold, support the end users in faster delivery of medical supplies, offer value-based care, and maintain a competitive edge in the market.

For instance, a consortium led by AGS Airports launched its next phase—Care and Equity – Healthcare Logistics UAS Scotland (CAELUS)—in partnership with NHS Scotland in September 2022. It secured US$ 12.56 million in funding from the Future Flight Challenge at UK Research and Innovation in August 2022. CAELUS brings together 16 partners, including Atkins, the University of Strathclyde, NATS, and NHS Scotland. Together they are work to deliver essential medicines, blood, and other medical supplies throughout Scotland, including remote communities, through the first national drone network to transport. By securing US$ 1.86 million in January 2020, the CAELUS consortium designed drone landing stations for NHS sites across Scotland and developed a virtual model (digital twin) of the proposed delivery network, which connects hospitals, pathology laboratories, distribution centers, and GP surgeries across Scotland. NHS Scotland has said it will bring its "Once for Scotland" approach to the project. Further, the second phase will involve live flight trials and remove remaining barriers to safely use drones at scale within Scotland's airspace.

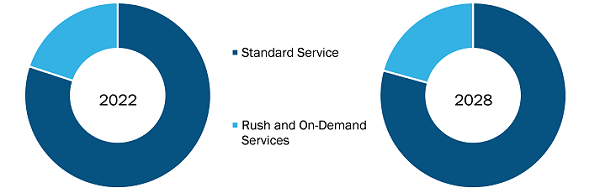

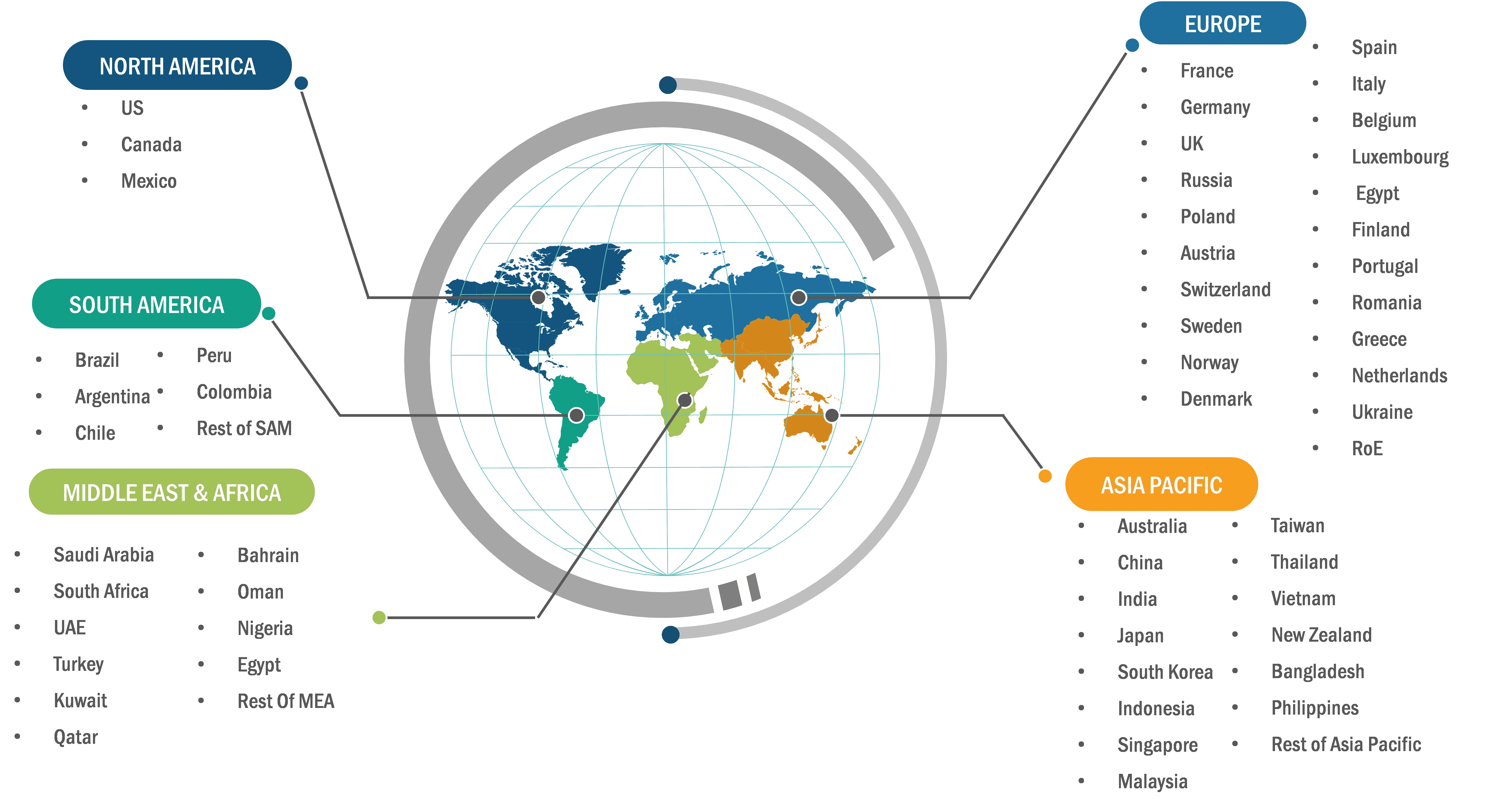

The UK medical courier market, based on product type, is segmented into lab specimens, medical supplies and equipment, blood and organs, medical notes, and others. The UK medical courier market, in terms of destination, is fragmented into domestic and international. On the basis of service type, is bifurcated into standard services and rush and on-demand services. The UK medical courier market, based on end user, is segmented into hospitals and clinics, diagnostic labs, pharmaceutical and biotechnology companies, blood and tissue banks, in-home support, and others.

Key players in the medical courier market secure growth through various strategies. In October 2022, Med Logistics Group Ltd partnered with Skyfarer and University Hospitals Coventry and Warwickshire (UHCW) NHS Trust to conduct a trial for Beyond Visual Line of Sight (BVLOS) drone in the UK. The drone is first-of-its-kind, and the trial was completed under secure CAA-approved airspace called "The Medical Logistics UK Corridor".

The National Health Service, National Health Services Blood and Transplant, Essex Partnership University NHS Foundation Trust, British Medical Association, and Department of Health and Social Care are a few key primary and secondary sources referred to while preparing the report on the medical courier market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 373.92 Million |

| Market Size by 2028 | US$ 505.27 Million |

| CAGR (2023 - 2028) | 5.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

UK

|

| Market leaders and key company profiles |

|

The UK Medical Courier Market is valued at US$ 373.92 Million in 2022, it is projected to reach US$ 505.27 Million by 2028.

As per our report UK Medical Courier Market, the market size is valued at US$ 373.92 Million in 2022, projecting it to reach US$ 505.27 Million by 2028. This translates to a CAGR of approximately 5.2% during the forecast period.

The UK Medical Courier Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the UK Medical Courier Market report:

The UK Medical Courier Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The UK Medical Courier Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the UK Medical Courier Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)