Surgical Staplers Market Outlook (2022-2033)

No. of Pages: 200 | Report Code: BMIPUB00031769 | Category: Life Sciences

No. of Pages: 200 | Report Code: BMIPUB00031769 | Category: Life Sciences

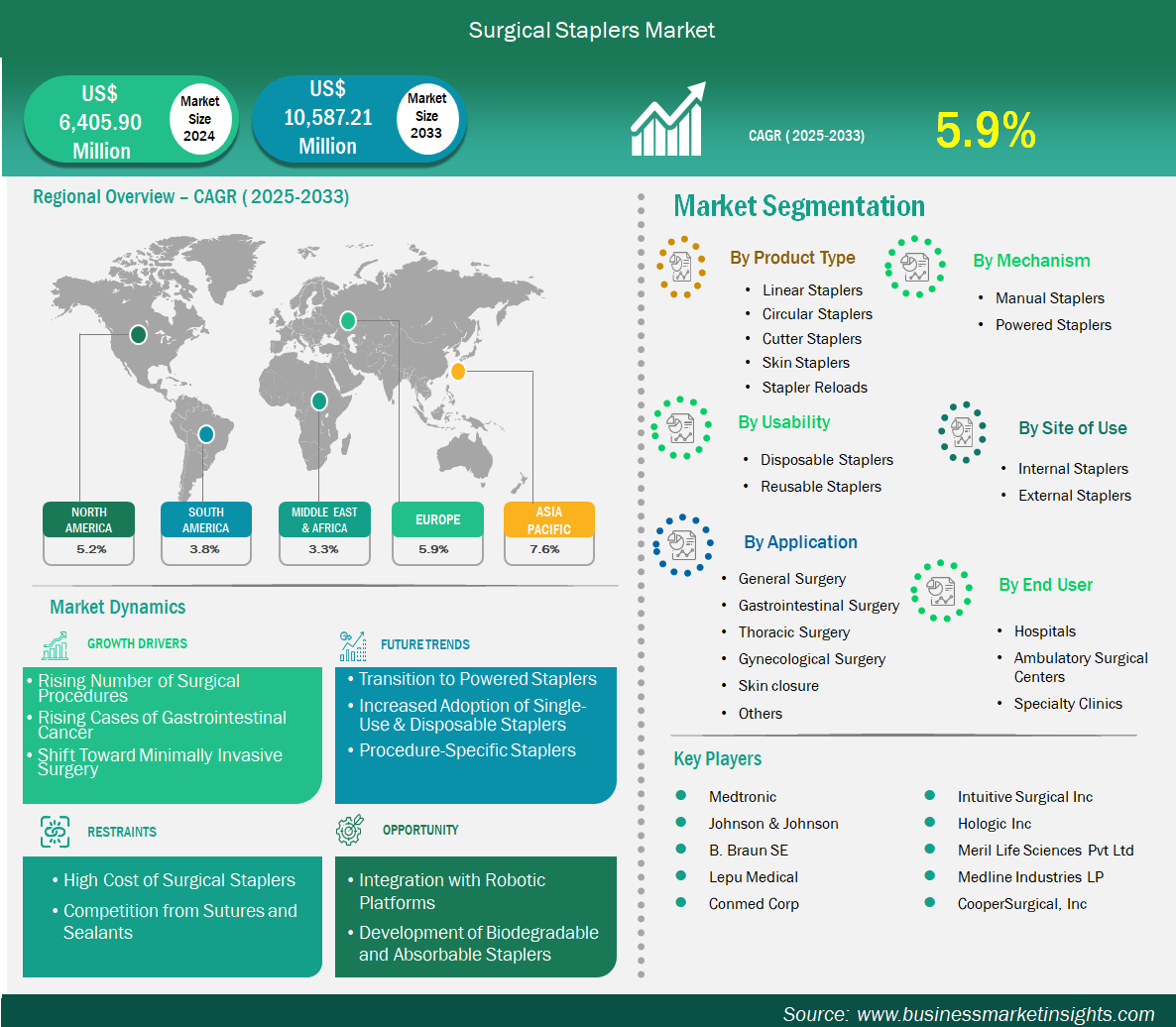

The surgical staplers market size is expected to reach US$ 10,587.21 million by 2033 from US$ 6,405.90 million in 2024. The market is estimated to record a CAGR of 5.9% from 2025 to 2033.

Surgical staplers are used to close incisions, excise tissue, and join organs during surgery. They are beneficial in various procedures, such as general surgery, stomach surgery, chest procedures, women's health, and weight loss surgeries. The surgical stapler has many advantages such as they can make surgery quicker, close wounds firmly, and reduce infection as compared to conventional stitches. The rising number of surgical procedures globally, and improved stapler technology are driving the market. Also, the growing number of elderly people and surging chronic diseases such as obesity and cancer also result in more procedures.

In line with the adoption rate, the global surgical staplers market stood at US$ 6,405.90 million in 2024 and is expected to reach US$ 10,587.21 million by 2033. However, there are various factors that can limit market growth such as high cost of advanced surgical stapler, and the risk of malfunctioning. In addition, regulations around these staplers are stringent. Moreover, limited affordability in low-income regions can restrict their adoption. But, expanding healthcare infrastructure such as new clinics and hospitals in emerging nations, and innovation in surgical staplers can further provide opportunities for the market to expand.

Key segments that contributed to the derivation of the surgical staplers market analysis are product type, mechanism, usability, site of use, application, and end user.

The number of surgical procedures performed globally is rising steadily due to a combination of factors including the growing burden of chronic diseases, better healthcare accessibility, and advancements in medical diagnostics. Conditions such as cancer, cardiovascular disease, obesity, and gastrointestinal disorders often require surgical intervention at various stages of treatment. In many cases, surgery has become the preferred or only viable therapeutic option when conservative treatments fail to provide relief.

For instance, according to American Society for Metabolic & Bariatric Surgery’s estimates, there were around 270,089 number of bariatric surgical procedure performed in the U.S. in 2023. Whereas, in 2021 there were 262,893 number of bariatric surgical procedures, which indicates a 2.73% increase.

This steady increase in surgical volume is especially evident in areas, including gastrointestinal surgery, bariatric procedures, thoracic operations, and gynecology, where timely and efficient tissue closure is critical. Surgical staplers are increasingly relied upon for their speed, consistency, and ability to reduce intraoperative complications such as bleeding or leakage. As surgeons adopt more minimally invasive and laparoscopic techniques, the role of staplers becomes even more prominent due to their compatibility with constrained surgical environments.

The rise in incidence rates of gastrointestinal (Gl) cancers is a strong driver for the surgical stapler market. Colon, rectal, stomach, esophageal, pancreatic, and liver cancers are usually treated by surgical methods, particularly in the early to mid-stages when resection of the tumor is possible. Surgery is the most efficient curative method for most Gl malignancies, and stapling devices are at the core of the surgery by enabling accurate resection of tissue and anastomosis.

With changing oncologic surgical techniques, there is an increasing trend towards minimally invasive methods, such as laparoscopic and robotic-assisted resections, especially in colorectal and gastric cancer resections. These methods require surgical techniques that can function within limited anatomical spaces with absolute closure guarantees to minimize postoperative complications such as leakage or bleeding

For instance, according to the report of Global Cancer Observatory, globally there were around 1,926,425 new cases of Colorectum cancer, and 968,784 new cases of stomach cancer in 2022.

The safety and efficacy provided by current stapling instruments are in line with the principles of mechanical reduction in operative time and patient recovery in oncologic surgery. Because the incidence of Gl cancer is increasing worldwide and a greater number of patients are being treated, including with surgery, as part of multidisciplinary schemes, the need for surgical approaches is anticipated to increase markedly, further justifying their role in cancer care protocols.

By product type, the surgical staplers market is segmented into linear staplers, circular staplers, cutter staplers, skin staplers, stapler reloads. The linear staplers segment dominated the market in 2024. Linear staplers dominate due to their versatility and precision in various surgeries, including gastrointestinal, thoracic, and bariatric procedures. They offer reliable tissue transection and closure, reduce operative time, and minimize complications, especially in minimally invasive settings.

By mechanism, the surgical staplers market is segmented into manual staplers and powered staplers. The manual staplers segment dominated the market in 2024. Manual staplers remain dominant due to their widespread accessibility and lower cost compared to powered alternatives, making them ideal for diverse healthcare settings, especially in developing regions. Surgeons appreciate the direct tactile feedback, allowing for precise control over tissue compression and staple formation, crucial for optimal surgical outcomes and minimizing complications across various procedures.

By usability, the market is segmented into disposable staplers and reusable staplers. The disposable staplers held a larger share of the market in 2024. Disposable staplers hold dominance due to their paramount advantage of ensuring complete sterility, eliminating cross-contamination risks inherent with reusable instruments. This single-use design streamlines surgical workflows by negating reprocessing and sterilization steps, enhancing efficiency and patient safety. Their pre-sterilized, ready-to-use nature is highly valued in modern operating rooms.

By site of use, the market is segmented into internal staplers and external staplers. The internal staplers segment held a larger share of the market in 2024. Dominant for their ability to precisely resect, transect, and anastomose internal tissues and organs, especially crucial in minimally invasive and laparoscopic surgeries where manual suturing is challenging. They enable faster procedures and reduce complications like leaks.

By application, the market is segmented into general surgery, gastrointestinal surgery, thoracic surgery, gynecological surgery, skin closure and others. The gastrointestinal surgery segment held the largest share of the market in 2024. Gastrointestinal surgery is dominant application due to the frequent need for tissue resection, transection, and anastomosis in complex GI procedures (e.g., resections for cancer, bariatric surgery). Staplers offer consistent, secure closures, reducing operative time and improving patient outcomes compared to hand-sewing.

By end user, the market is segmented into hospitals, ambulatory surgical centers, and specialty clinics. The hospitals segment held the largest share of the market in 2024. Hospitals dominate due to the high volume and complexity of surgical procedures performed, including major operations requiring staplers. They possess the necessary infrastructure, advanced equipment, and specialized surgical teams for diverse cases, unlike smaller clinics or ambulatory surgical centers.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 6,405.90 Million |

| Market Size by 2033 | US$ 10,587.21 Million |

| Global CAGR (2025 - 2033) | 5.9% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2033 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The "Surgical Staplers Market Size and Forecast (2022–2033)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the surgical staplers market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The surgical staplers market in Asia Pacific is expected to grow significantly during the forecast period.

The Asia Pacific surgical staplers market is segmented into China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Taiwan, Bangladesh and Rest of Asia. The Asia Pacific surgical market is experiencing robust growth, driven by increasing healthcare expenditure, improving medical infrastructure, and a rising prevalence of chronic diseases necessitating surgical interventions. China and India are leading the way, driven by high patient volumes, rising knowledge of sophisticated surgical methods, and increasing utilization of less invasive procedures. Advances in technology, most notably in powered and robotic staplers, are increasing accuracy and efficacy, fueling further market growth. The rising surge in medical tourism and local manufacturing capacity also plays a key role in the region's dominant market position.

The surgical staplers market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the surgical staplers market are:

The Surgical Staplers Market is valued at US$ 6,405.90 Million in 2024, it is projected to reach US$ 10,587.21 Million by 2033.

As per our report Surgical Staplers Market, the market size is valued at US$ 6,405.90 Million in 2024, projecting it to reach US$ 10,587.21 Million by 2033. This translates to a CAGR of approximately 5.9% during the forecast period.

The Surgical Staplers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Surgical Staplers Market report:

The Surgical Staplers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Surgical Staplers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Surgical Staplers Market value chain can benefit from the information contained in a comprehensive market report.