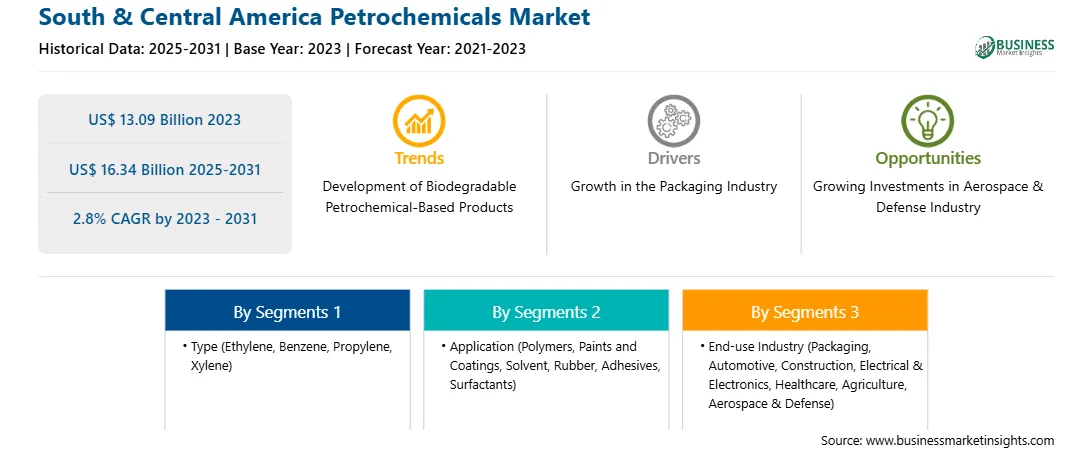

The South & Central America petrochemicals market was valued at US$ 13.09 billion in 2023 and is expected to reach US$ 16.34 billion by 2031; it is estimated to record a CAGR of 2.8% from 2023 to 2031.

Governments of various countries have increased investments in aerospace-related research, including defense and ballistic protection, owing to a rise in security risks and the need to enhance national border security. In May 2023, the Brazilian government announced an investment program aimed at advancing innovation and technology in the aerospace sector. This initiative focuses on developing a new satellite designed to enhance the monitoring of environmental crimes in the Amazon rainforest. Luciana Santos, Brazil’s Minister of Science, Technology, and Innovation, stated that the government plans to invest US$ 72 million in this project to bolster the aerospace sector as well as innovation and technology. Also, in April 2024, Embraer and ENAER (National Aeronautical Company of Chile) announced two agreements for industrial and service cooperation, focusing on the A-29 Super Tucano and C-390 Millennium defense aircraft, as well as commercial aircraft. This collaboration will enhance Embraer's network of suppliers and services in Chile and foster the integration of the aerospace industries in both Brazil and Chile. The cooperation is the result of an agreement between Embraer, ENAER, and the Chilean Air Force. ENAER will begin manufacturing components and will serve as a designated maintenance center for the Chilean Air Force's fleet of 22 A-29 Super Tucano aircraft. This agreement is connected to the planned expansion of the A-29 Super Tucano fleet in the country. Additionally, the collaboration aims to enhance ENAER's role as a supplier and to increase Embraer's presence in Chile. Thus, the rising investments in the aerospace & defense industry are expected to create lucrative opportunities for the petrochemicals market growth during the forecast period.

Governments of various countries have increased investments in aerospace-related research, including defense and ballistic protection, owing to a rise in security risks and the need to enhance national border security. In May 2023, the Brazilian government announced an investment program aimed at advancing innovation and technology in the aerospace sector. This initiative focuses on developing a new satellite designed to enhance the monitoring of environmental crimes in the Amazon rainforest. Luciana Santos, Brazil’s Minister of Science, Technology, and Innovation, stated that the government plans to invest US$ 72 million in this project to bolster the aerospace sector as well as innovation and technology. Also, in April 2024, Embraer and ENAER (National Aeronautical Company of Chile) announced two agreements for industrial and service cooperation, focusing on the A-29 Super Tucano and C-390 Millennium defense aircraft, as well as commercial aircraft. This collaboration will enhance Embraer's network of suppliers and services in Chile and foster the integration of the aerospace industries in both Brazil and Chile. The cooperation is the result of an agreement between Embraer, ENAER, and the Chilean Air Force. ENAER will begin manufacturing components and will serve as a designated maintenance center for the Chilean Air Force's fleet of 22 A-29 Super Tucano aircraft. This agreement is connected to the planned expansion of the A-29 Super Tucano fleet in the country. Additionally, the collaboration aims to enhance ENAER's role as a supplier and to increase Embraer's presence in Chile. Thus, the rising investments in the aerospace & defense industry are expected to create lucrative opportunities for the petrochemicals market growth during the forecast period.

Strategic insights for the South & Central America Petrochemicals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Petrochemicals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Petrochemicals Strategic Insights

South & Central America Petrochemicals Report Scope

Report Attribute

Details

Market size in 2023

US$ 13.09 Billion

Market Size by 2031

US$ 16.34 Billion

CAGR (2023 - 2031) 2.8%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Type

By Application

By End-use Industry

Regions and Countries Covered

South & Central America

Market leaders and key company profiles

South & Central America Petrochemicals Regional Insights

The South & Central America petrochemicals market is segmented based on type, application, end-use industry, and country. Based on type, the South & Central America petrochemicals market is segmented into ethylene, benzene, propylene, xylene, and others. The ethylene segment held the largest market share in 2023.

In terms of application, the South & Central America petrochemicals market is segmented into polymers, paints and coatings, solvent, rubber, adhesives, surfactants, and others. The polymers segment held the largest market share in 2023.

By end-use industry, the South & Central America petrochemicals market is categorized into packaging, automotive, construction, electrical & electronics, healthcare, agriculture, aerospace & defense, and others. The packaging segment held the largest market share in 2023.

Based on country, the South & Central America petrochemicals market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of South & Central America. China dominated the South & Central America petrochemicals market share in 2023.

Shell Plc, LyondellBasell Industries NV, INEOS Group Holdings SA, Saudi Basic Industries Corp, BASF SE, Dow Inc, Chevron Phillips Chemical Company LLC, China Petroleum & Chemical Corp, Mitsubishi Chemical Group Corp, and Exxon Mobil Corp are some of the leading players operating in the South & Central America petrochemicals market.

The South & Central America Petrochemicals Market is valued at US$ 13.09 Billion in 2023, it is projected to reach US$ 16.34 Billion by 2031.

As per our report South & Central America Petrochemicals Market, the market size is valued at US$ 13.09 Billion in 2023, projecting it to reach US$ 16.34 Billion by 2031. This translates to a CAGR of approximately 2.8% during the forecast period.

The South & Central America Petrochemicals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Petrochemicals Market report:

The South & Central America Petrochemicals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Petrochemicals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Petrochemicals Market value chain can benefit from the information contained in a comprehensive market report.