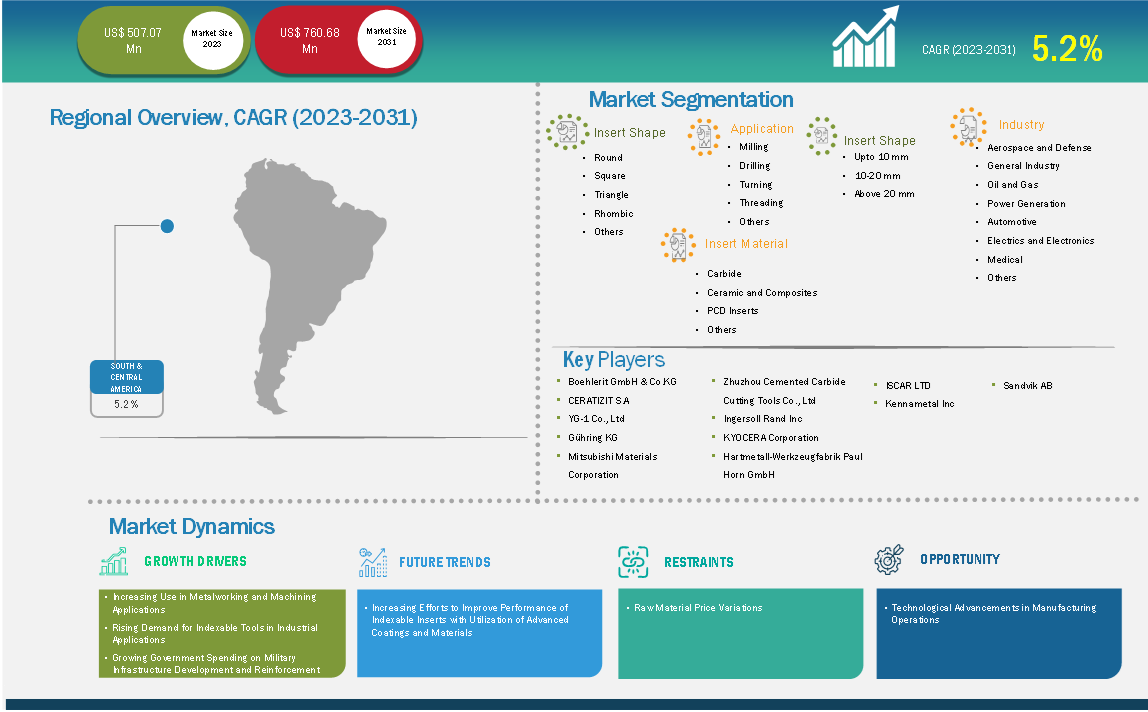

The Indexable Insert Market size is expected to reach US$ 760.68 million by 2031 from US$ 507.07 million in 2023. The market is estimated to record a CAGR of 5.2% from 2023-2031.

Brazil and Argentina are among the major countries in the indexable inserts market in South America. The market growth is attributed to rising industrialization, along with a surge in government investments in the energy and oil and gas industries. Rapid industrialization and urban population growth boost the demand for various goods and services. This has increased the establishment of manufacturing facilities, positively influencing the use of indexable inserts in various metalworking operations in the region. Several companies are investing in countries in South America to promote industrial development.

In March 2024, Stellantis, a multinational automotive manufacturing corporation, announced an investment of US$ 6.08 billion for the expansion and development of automotive products from 2025 to 2030 in South America. This long-term strategic investment was made to develop the automotive industry in Brazil and South America. The investment was made to support and launch more than 40 new products in the future. Similar investments in the region are expected to fuel the demand for metalworking machinery and cutting tools, driving the indexable inserts market growth from 2023 to 2031.

South & Central America Indexable Insert Market Segmentation Analysis:

Key segments that contributed to the derivation of the Indexable Insert Market analysis are insert shape, application, size, insert material, and industry.

The importance of efficient and cost-effective manufacturing operations is increasing with the growing demand for process automation across the manufacturing sector. Automated manufacturing processes and high-end technologies such as computer numerical control (CNC) offer several advantages over traditional manual manufacturing techniques. By integrating computer-aided design (CAD) and computer-aided manufacturing (CAM) systems with automated manufacturing processes, tasks such as cutting, drilling, milling, welding, and bending can be streamlined and automated while reducing the need for manual labor and improving overall efficiency. Automated processes can also enhance the quality of products by minimizing errors and differences associated with manual production.

The increasing need for automation in the manufacturing industry is driving the expansion of the indexable inserts market. Milling machines can perform multiple tasks simultaneously, reducing the need for a manual workforce and increasing overall productivity. Furthermore, technological advancements have contributed significantly to the growth of the indexable insert market. By integrating CNC technology, precise cuts and shapes can be easily produced, increasing the popularity of indexable inserts in the metalworking and machining industry.

CNC technology has also helped automate the milling process, increasing overall efficiency. Companies such as Boeing, Ford, Airbus, Caterpillar, Toyota, Apple, and Samsung have managed to increase their productivity through such advancements in their manufacturing processes. For example, the Boeing company has been using the CNC machining technology for several years in reducing the production time and cost significantly. Moreover, the integration of the Internet of Things and artificial intelligence is changing the utilization of indexable inserts in milling, drilling, grooving, and threading. Smart indexable inserts with sensors can monitor tool wear in real time and provide data-driven insights for predictive maintenance and optimization of cutting parameters. Therefore, the adoption of automated manufacturing processes and advanced technology is expected to provide significant opportunities for the growth of the indexable inserts market during the forecast period.

Based on Geography, the South & Central America indexable insert market comprises Brazil, Argentina, and the Rest of South & Central America. Brazil held the largest share in 2023.

Major industrial sectors in Brazil, including food and beverages, chemicals, energy and power, and manufacturing, demonstrate prime scope for metalworking operations. In addition, investments made by the Brazilian government in infrastructure development result in demand for indexable inserts in the country for the assembly of cutting and metal processing machines that are employed in the manufacturing of heavy structures. With elevated investments in oil and gas activities over the years, South America has positioned itself as one of the vital suppliers of oil and gas. Brazil has one of the largest offshore oil rigs in South America. Oil production activities continue to witness growth with the rapid industrialization in the country. The government of Brazil is investing significantly in its oil and gas industry to boost production outcomes. The country is projected to record an addition of 1.8 million barrels per day (Mb/d) in oil production by 2035, a ~70% growth compared to current levels in 2023. The rising focus on clean energy and significant investments in the energy and power sector support the growth of the indexable inserts market in Brazil. Such a rise in investments to promote industrialization and infrastructure development is expected to drive the demand for metalworking machines in various industries, in turn bolstering the indexable inserts market growth.

South & Central America Indexable Insert Market Company Profiles

Some of the key players operating in the market include Sandvik AB; Kennametal Inc; ISCAR LTD; Hartmetall-Werkzeugfabrik Paul Horn GmbH; Kyocera Corporation; Ingersoll Rand Inc; Zhuzhou Cemented Carbide Cutting Tools Co., Ltd; Mitsubishi Materials Corporation; Gühring KG; YG-1 Co., Ltd; CERATIZIT S.A; and Boehlerit GmbH & Co.KG, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 507.07 Million |

| Market Size by 2031 | US$ 760.68 Million |

| CAGR (2023 - 2031) | 5.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Insert Shape

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Indexable Insert Market is valued at US$ 507.07 Million in 2023, it is projected to reach US$ 760.68 Million by 2031.

As per our report South & Central America Indexable Insert Market, the market size is valued at US$ 507.07 Million in 2023, projecting it to reach US$ 760.68 Million by 2031. This translates to a CAGR of approximately 5.2% during the forecast period.

The South & Central America Indexable Insert Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Indexable Insert Market report:

The South & Central America Indexable Insert Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Indexable Insert Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Indexable Insert Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)