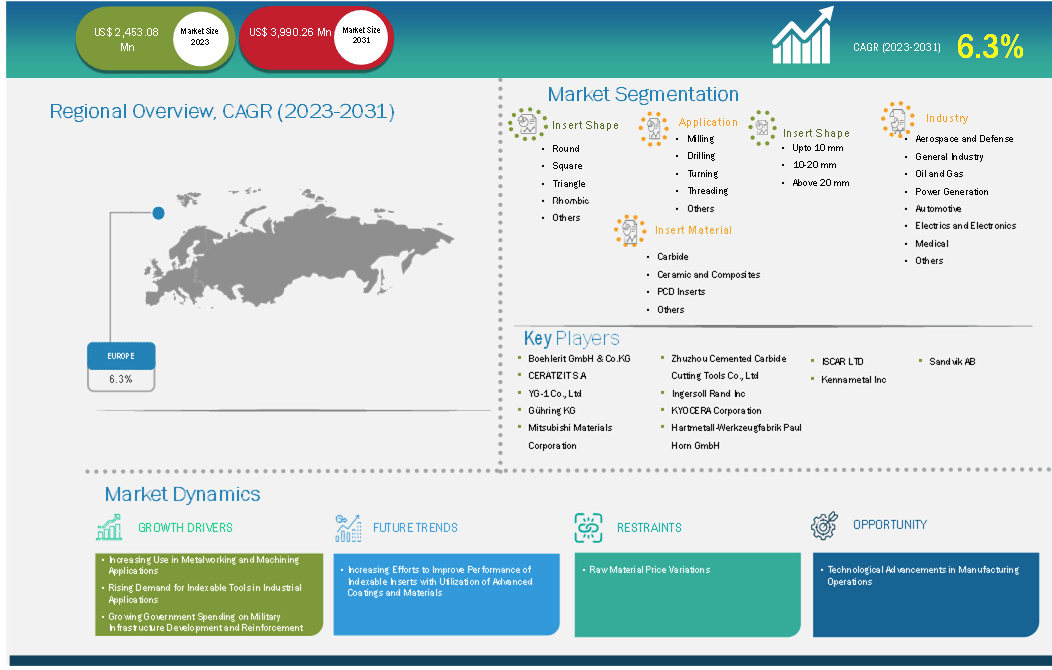

The Europe Indexable Insert Market size is expected to reach US$ 3,990.26 million by 2031 from US$ 2,453.08 million in 2023. The market is estimated to record a CAGR of 6.3% from 2023-2031.

The indexable inserts market in Europe is segmented into France, Germany, Italy, Russia, the UK, and the Rest of Europe. Western Europe is a highly developed region with different types of companies. Europe has a well-established manufacturing industry that uses cutting-edge technologies, such as automation, robotics, the Industrial Internet of Things (IoT), and Industry 4.0. Across Europe, technological advancements have created a highly competitive market for indexable inserts. Europe is one of the most important automobile manufacturers in the world. The presence of world-leading automobile manufacturers such as Volkswagen AG, Stellantis NV, Mercedes-Benz Group AG, Bayerische Motoren Werke AG, and Renault SA is driving the industry's growth. As per the European Automobile Manufacturers Association (ACEA), new car registrations in Europe increased by 18.6% from 12.93 million units in 2022 to 15.33 million units in 2023. Germany accounted for the highest share in new car registration in the region, followed by the UK, France, and Italy. Such a rise in car and other vehicle sales in the region is expected to fuel the demand for cutting tools, such as indexable inserts, in metalworking operations in the region. In addition, the presence of various leading automobile and aircraft manufacturers also contributes to the fierce competition in this region. These players focus on delivering high-quality products in large quantities without any defects. The metalworking machines with advanced cutting tools such as indexable inserts offer speed and precision, contributing to less waste and faster production, thereby creating a cost-effective manufacturing process. Due to these advantages, these cutting tools are becoming increasingly popular in the automotive manufacturing process. Therefore, the growing automotive industry in Europe is expected to provide promising opportunities for metalworking machinery and cutting tools, driving the indexable inserts market growth in the near future.

Key segments that contributed to the derivation of the Indexable Insert Market analysis are insert shape, application, size, insert material, and industry.

Indexable inserts are increasingly used in industries such as automotive, aerospace, medical, and general manufacturing in various applications, including milling, drilling, grooving, and threading. Indexable inserts represent a significant advancement in cutting tool technology and offer numerous advantages over traditional tooling methods. Easy interchangeability, high performance, and versatility of cutting edges make indexable inserts indispensable in modern machining. Manufacturers can optimize their machining processes, improve productivity, and reduce costs by understanding the operating principles, benefits, and applications of indexable inserts. Automobile production is steadily increasing worldwide, especially in Asian and European countries, increasing the demand for indexable inserts. In the industry, indexable inserts are widely used in the metal machining of crankshafts, face milling and hole drilling, and other machining operations in producing auto parts.

The automotive industry achieves excellent results with the use of indexable inserts in ball joints, brakes, crankshafts in high-performance vehicles, and other mechanical parts of vehicles that are subjected to heavy use and extreme temperatures. Automotive giants such as Audi, BMW, Ford Motor Company, and Range Rover are contributing significantly to the growth of the indexable inserts market.

Indexable inserts are used for a variety of purposes in the aerospace industry. They are particularly used in milling operations that require high precision and smooth surfaces. Indexable inserts are commonly employed in this industry as they can cut through materials such as titanium, aluminum, steel alloy, and plastics. They are crucial in manufacturing aircraft components such as engines, wings, fuselage structures, and landing gears. The aerospace industry increasingly emphasizes lightweight materials and high-end manufacturing techniques to enhance the fuel efficiency and performance of aircraft. In July 2023, Airbus—a European plane manufacturer—inaugurated a production facility in Tianjin, China, for the A-320 narrow bodies as a part of its initiative to expand its production capabilities in the country. With this development, Airbus would be able to fabricate ~75 new A-320 neo-family jets every month by 2026. The increasing demand for indexable tools in industrial applications is anticipated to fuel the demand for indexable inserts in the coming years.

Based on country, the Europe indexable insert market comprises Germany, France, Italy, the UK, Russia, and the Rest of Europe. Germany held the largest share in 2023.

Germany is the biggest economy in Europe and houses several leading industry verticals, including automotive, aviation, electronics, chemical, and food processing. According to the European Automobile Manufacturers Association (ACEA), new car registrations in Germany increased by ~7% to reach nearly 2.84 million units in 2023 from 2.65 million units in 2022. It is the largest automotive hub in Europe, accounting for over 25% of all passenger car production and ~20% of all new vehicle registrations in 2023. In 2023, Germany was Europe's leading passenger vehicle producer; manufacturing plants in the country recorded the manufacturing of nearly 3.10 million units at a ~17% annual increase. Thus, data shows that Germany has a well-established ecosystem for automobile manufacturing, which in turn is expected to fuel the demand for automotive components, which in turn is anticipated to fuel the indexable inserts market growth in the coming years. Cutting tools offer precise cuts and shapes in metal, plastic, and wood, among other materials, which can be used in various industrial applications. Indexable inserts represent a significant upgrade of the cutting tool technology, as they offer numerous advantages over traditional tooling methods. Their easy interchangeability, and the high performance and versatility of their cutting edges make them indispensable in modern machining. By understanding the operating principles, benefits, and applications of indexable inserts, manufacturers can optimize their machining processes, such as drilling, cutting, milling, grooving, threading, and others, to improve productivity and reduce costs.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,453.08 Million |

| Market Size by 2031 | US$ 3,990.26 Million |

| CAGR (2023 - 2031) | 6.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Insert Shape

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Sandvik AB; Kennametal Inc; ISCAR LTD; Hartmetall-Werkzeugfabrik Paul Horn GmbH; Kyocera Corporation; Ingersoll Rand Inc; Zhuzhou Cemented Carbide Cutting Tools Co., Ltd; Mitsubishi Materials Corporation; Gühring KG; YG-1 Co., Ltd; CERATIZIT S.A; and Boehlerit GmbH & Co.KG among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Europe Indexable Insert Market is valued at US$ 2,453.08 Million in 2023, it is projected to reach US$ 3,990.26 Million by 2031.

As per our report Europe Indexable Insert Market, the market size is valued at US$ 2,453.08 Million in 2023, projecting it to reach US$ 3,990.26 Million by 2031. This translates to a CAGR of approximately 6.3% during the forecast period.

The Europe Indexable Insert Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Indexable Insert Market report:

The Europe Indexable Insert Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Indexable Insert Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Indexable Insert Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)