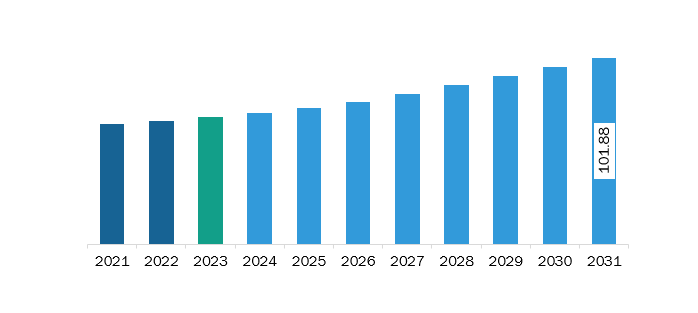

The South & Central America flame retardants market was valued at US$ 78.26 million in 2023 and is expected to reach US$ 101.88 million by 2031; it is estimated to register a CAGR of 3.4% from 2023 to 2031.

Advancements in flame retardant technologies are poised to provide significant growth opportunities for the market by addressing safety concerns and meeting stringent regulatory standards. In addition, nanomaterials offer significant improvements in fire resistance and safety. Incorporating nanoparticles such as nano clays, carbon nanotubes, and graphene into traditional flame retardant formulations can enhance the material's ability to withstand high temperatures and prevent the spread of flames. These advanced nanomaterials can create a protective barrier when exposed to heat, thereby improving the overall effectiveness of flame retardants without the need for higher loading levels of potentially harmful chemicals. In addition, the benefits of nanomaterials extend beyond just enhancing fire resistance. They can also improve the mechanicals, making them more suitable for various applications across different industries. For instance, in the electronics industry, nanomaterial-based flame retardants can be used to develop lighter and more efficient components that are better at dissipating heat and less prone to fire hazards. This is particularly crucial owing to the growing traction of compact and powerful electronic devices.

Nanomaterials can also be integrated into building materials such as insulation, coatings, and structural components for enhancing fire safety while improving strength and energy efficiency. Additionally, the environmental advantages of nanomaterial-based flame retardants are significant. These materials often require lower quantities to achieve the same or better fire-resistance properties compared to traditional flame retardants, reducing the overall environmental impact. The advancements in flame retardant technologies through the use of nanomaterials not only address the safety and regulatory challenges associated with conventional flame retardants but also enhance the performance and sustainability of flame-resistant products. This creates significant growth opportunities for the flame retardants market as industries seek to adopt these cutting-edge solutions to meet evolving safety standards and consumer expectations.

According to the report by the Brazilian Association of Automotive Vehicle Manufacturers, in Brazil, the production of automobiles grew by 11.4%, and the sales increased by 10.9% from February to March 2022. In 2022, Audi AG invested US$ 19.2 million to restart production at its plant in Parana, Brazil, registering a capacity of 4,000 vehicles per year. Several economies in the region are focused on the development of electric vehicle infrastructure. In February 2023, Argentina's Federal Energy Department issued a resolution designed to support the growth of the low-emission vehicle industry. According to the Association of Automotive Manufacturers, 7,846 units of vehicles powered by alternative energies were patented in Argentina in 2022. Flame-retardant polymer compounds are used in the manufacturing of electric vehicles. Flame-retardant plastics are also used in cable-sheathings, connectors, electric switches, and battery components. Thus, the growing automotive industry in South & Central America propels the demand for automotive components and materials, which drives the flame retardants market growth in the region.

Strategic insights for the South & Central America Flame Retardants provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Flame Retardants refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Flame Retardants Strategic Insights

South & Central America Flame Retardants Report Scope

Report Attribute

Details

Market size in 2023

US$ 78.26 Million

Market Size by 2031

US$ 101.88 Million

CAGR (2023 - 2031) 3.4%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Type

By End-Use Industry

Regions and Countries Covered

South & Central America

Market leaders and key company profiles

South & Central America Flame Retardants Regional Insights

The South & Central America flame retardants market is categorized into type, end-use industry, and country.

By type, the South & Central America flame retardants market is bifurcated into halogenated and halogen-free. In addition, halogenated is sub segmented into bromine-based and chlorine-based, and halogen-free is sub segmented into phosphorus-based, aluminum hydroxide, magnesium hydroxide, and others. The halogenated segment held a larger share of the South & Central America flame retardants market share in 2023.

In terms of end-use industry, the South & Central America flame retardants market is segmented into building and construction, automotive and transportation, electrical and electronics, textiles, and others. The building and construction segment held the largest share of the South & Central America flame retardants market share in 2023.

Based on country, the South & Central America flame retardants market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil segment held the largest share of South & Central America flame retardants market in 2023.

ADEKA CORPORATION; AIR WATER INC; Albemarle Corp; Alpha Calcit Füllstoff GmbH & Co. KG; Avient Corp; BASF SE; Celanese Corp; Clariant AG; Domo Chemicals GmbH; Georg Nordmann.’; Greenchemicals S.r.l; ICL Group Ltd’ Italmatch Chemicals S.p.A; J.M. Huber Corporation’ Konoshima Chemical Co., Ltd.; Lanxess AG; Marubeni Corp; Nabaltec AG; RTP Company; and THOR Group Ltd are among the leading companies operating in the South & Central America flame retardants market.

The South & Central America Flame Retardants Market is valued at US$ 78.26 Million in 2023, it is projected to reach US$ 101.88 Million by 2031.

As per our report South & Central America Flame Retardants Market, the market size is valued at US$ 78.26 Million in 2023, projecting it to reach US$ 101.88 Million by 2031. This translates to a CAGR of approximately 3.4% during the forecast period.

The South & Central America Flame Retardants Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Flame Retardants Market report:

The South & Central America Flame Retardants Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Flame Retardants Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Flame Retardants Market value chain can benefit from the information contained in a comprehensive market report.