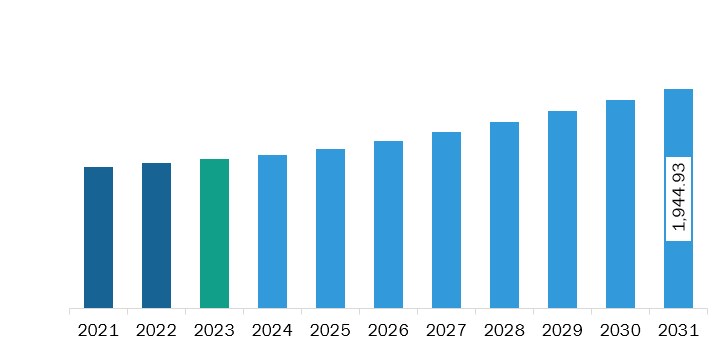

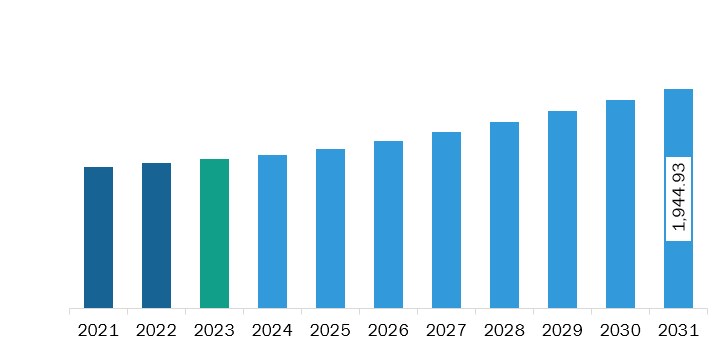

The North America flame retardants market was valued at US$ 1,321.62 million in 2023 and is expected to reach US$ 1,944.93 million by 2031; it is estimated to register a CAGR of 4.9% from 2023 to 2031.

Rapid Growth of Construction Industry Fuel North America Flame Retardants Market

As urbanization and infrastructure development surge, the construction sector requires a variety of materials such as insulation, wiring, and furnishings, all of which need to meet stringent fire safety standards. Flame retardants comply with safety regulations, thereby reducing the risk of fires in residential, commercial, and industrial buildings. The heightened focus on fire safety in construction projects amplifies the necessity for flame-retardant products, directly boosting their market demand. Several government bodies across different countries support the development of the residential construction sector. For instance, according to the Associated General Contractors of America (AGC), the construction industry has more than 745,000 employers with over 7.6 million employees and creates nearly US$ 1.4 trillion worth of structures each year. The government spending from the National Housing Strategy (NHS) earmarks to encourage energy-efficient construction is powering additional demand for residential projects. The government has announced funding for the NHS over the 2018-19 to 2028-29 period of more than US$ 82 billion.

As modern construction increasingly emphasizes sustainable and high-performance buildings, the role of advanced materials becomes more pronounced. Therefore, various government-supportive measures for the development of the construction industry are leading to an increase in construction activities. This is creating demand for different construction materials, thereby driving the North America flame retardants market growth.

North America Flame Retardants Market Overview

Flame retardants are used in automotive components and mass transportation vehicle applications. Flame retardants demonstrate improved processing characteristics in plastics such as acrylonitrile butadiene styrene and high-impact polystyrene. According to the International Organization of Motor Vehicle Manufacturers, North America registered an increase in the production of motor vehicles from 14.79 million vehicles in 2022 to 16.16 million vehicles in 2023. As per a report by the American Automotive Policy Council, car sales are expected to exceed 17.7 million vehicles per year by 2025. According to the International Trade Administration data released in 2022, the automotive industry of Mexico accounts for 3.5% of the country's GDP and 20% of the manufacturing gross domestic production. Flame retardants are used as additives in paints and coatings used in residential, commercial, and industrial buildings. According to the American Coatings Association, in the US, architectural coatings are the largest segment of the paint industry, accounting for more than 50% of the total volume of coatings produced yearly. According to the US Department of Transportation Federal Highway Administration, in 2021, the US Government signed the Infrastructure Investment and Jobs Act, encompassing long-term infrastructure investments, providing US$ 550 billion over fiscal years 2022–2026 for the construction of bridges, roads, and mass transit and water infrastructure. Thus, the factors mentioned above drive the flame retardants market in North America.

North America Flame Retardants Market Revenue and Forecast to 2031 (US$ Million)

North America Flame Retardants Market Segmentation

The North America flame retardants market is categorized into type, end-use industry, and country.

By type, the North America flame retardants market is bifurcated into halogenated and halogen-free. In addition, halogenated is sub segmented into bromine-based and chlorine-based, and halogen-free is sub segmented into phosphorus-based, aluminum hydroxide, magnesium hydroxide, and others. The halogenated segment held a larger share of the North America flame retardants market share in 2023.

In terms of end-use industry, the North America flame retardants market is segmented into building and construction, automotive and transportation, electrical and electronics, textiles, and others. The building and construction segment held the largest share of the North America flame retardants market share in 2023.

Based on country, the North America flame retardants market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America flame retardants market in 2023.

ADEKA CORPORATION; AIR WATER INC; Albemarle Corp; Alpha Calcit Füllstoff GmbH & Co. KG; Avient Corp; BASF SE; Celanese Corp; Clariant AG; Domo Chemicals GmbH; Georg Nordmann; Greenchemicals S.r.l; ICL Group Ltd; Italmatch Chemicals S.p.A; J.M. Huber Corporation; Konoshima Chemical Co., Ltd.; Lanxess AG; Marubeni Corp; Nabaltec AG; RTP Company; and THOR Group Ltd are some of the leading companies operating in the North America flame retardants market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,321.62 Million |

| Market Size by 2031 | US$ 1,944.93 Million |

| CAGR (2023 - 2031) | 4.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The North America Flame Retardants Market is valued at US$ 1,321.62 Million in 2023, it is projected to reach US$ 1,944.93 Million by 2031.

As per our report North America Flame Retardants Market, the market size is valued at US$ 1,321.62 Million in 2023, projecting it to reach US$ 1,944.93 Million by 2031. This translates to a CAGR of approximately 4.9% during the forecast period.

The North America Flame Retardants Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Flame Retardants Market report:

The North America Flame Retardants Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Flame Retardants Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Flame Retardants Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)