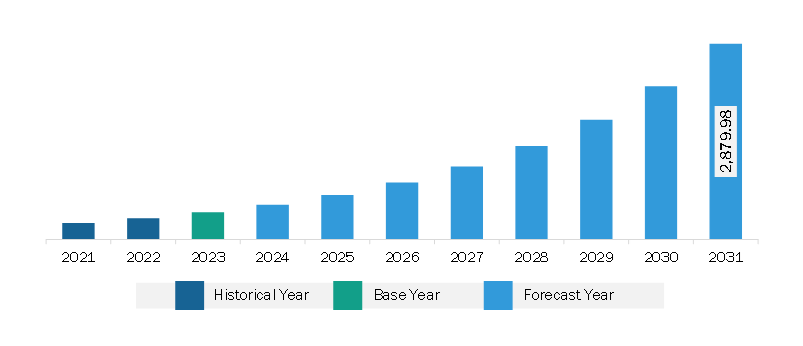

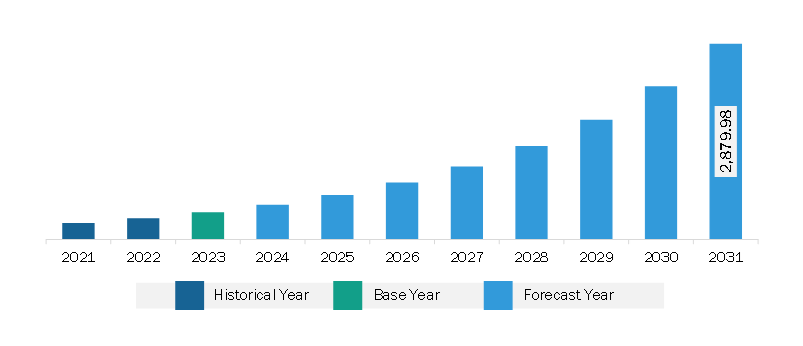

The South & Central America unified endpoint management market was valued at US$ 397.94 million in 2023 and is expected to reach US$ 2,879.98 million by 2031; it is anticipated to reach a CAGR of 28.1% from 2023 to 2031.

Small and medium-sized enterprises (SMEs) are still in the growth stage of adopting advanced technology solutions such as unified endpoint management by replacing traditional endpoint management solutions. The lack of resources and awareness about the potential cost and productivity benefits of unified endpoint management solutions have impacted the adoption of these solutions among SMEs. However, with the growing popularity of cloud-based unified endpoint management, SMEs are increasingly investing in such solutions. Key companies such as Citrix Systems, Inc.; VMware, Inc.; and Microsoft Corporation are offering cloud-based UEM solutions/subscriptions at competitive prices for SMEs to increase their revenue and market share. The rising trend of digital transformation among these enterprises to improve business processes, enhance productivity, and reduce costs will boost the adoption of unified endpoint management solutions and services among SMEs. Thus, the wide application scope of unified endpoint management solutions is expected to create growth opportunities for the market players over the forecast period.

The South & Central America unified endpoint management market is segmented into Brazil, Argentina, and the Rest of South & Central America. The region is witnessing a significant increase in the demand for unified endpoint management solutions. The increasing usage of mobile devices among the workforce in South & Central America has contributed to the demand for unified endpoint management solutions. For instance, as per the GSMA The Mobile Economy Latin America 2024 report, in 2023, mobile technology and services contributed 8% of the region’s GDP, totaling US$ 520 billion in economic value added. Also, 418 million individuals in South & Central America (65% of the population) utilized mobile internet, recording 75 million increases in the past five years. By April of 2023, 29 operators in 10 countries have launched commercial 5G services, accounting for 5% of connections, and predicted to reach 55% by the end of the decade, with 5G displacing 4G as the primary technology. Organizations need a comprehensive solution to manage and secure a wide range of devices, including smartphones and tablets, while ensuring productivity and data protection. Therefore, the firms in the region recognize the importance of unified endpoint management solutions in managing and securing their endpoints, enabling efficient remote work, and ensuring compliance with data protection regulations.

The South & Central America unified endpoint management market is categorized into component, deployment type, platform, organization size, end user, and country.

Based on component, the South & Central America unified endpoint management market is bifurcated into solutions and services. The solutions segment held a larger market share in 2023.

By deployment type, the South & Central America unified endpoint management market is segmented into cloud based and on-premise. The cloud-based segment held a larger market share in 2023.

In the terms of platform, the South & Central America unified endpoint management market is divided into desktop and mobile. The desktop segment held a larger market share in 2023.

By organization size, the South & Central America unified endpoint management market is segmented into large enterprises and SMEs. The large enterprises segment held a larger market share in 2023.

Based on end user, the South & Central America unified endpoint management market is segmented into BFSI, government and defense, healthcare, IT and telecom, automotive and transportation, retail, manufacturing, and others. The IT and telecom segment held the largest market share in 2023.

By country, the South & Central America unified endpoint management market is segmented Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America unified endpoint management market share in 2023.

BlackBerry Ltd; HCL Technologies Ltd; Mitsogo Inc; Sophos Ltd.; SOTI Inc.; STEFANINI; TANGOE; Zoho Corp Pvt Ltd; Ivanti; Citrix Systems Inc; International Business Machines Corp; Microsoft Corp; and Open Text Corp are some of the leading companies operating in the South & Central America unified endpoint management market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 397.94 Million |

| Market Size by 2031 | US$ 2,879.98 Million |

| CAGR (2023 - 2031) | 28.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

South & Central America

|

| Market leaders and key company profiles |

|

The South & Central America Unified Endpoint Management Market is valued at US$ 397.94 Million in 2023, it is projected to reach US$ 2,879.98 Million by 2031.

As per our report South & Central America Unified Endpoint Management Market, the market size is valued at US$ 397.94 Million in 2023, projecting it to reach US$ 2,879.98 Million by 2031. This translates to a CAGR of approximately 28.1% during the forecast period.

The South & Central America Unified Endpoint Management Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Unified Endpoint Management Market report:

The South & Central America Unified Endpoint Management Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Unified Endpoint Management Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Unified Endpoint Management Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)