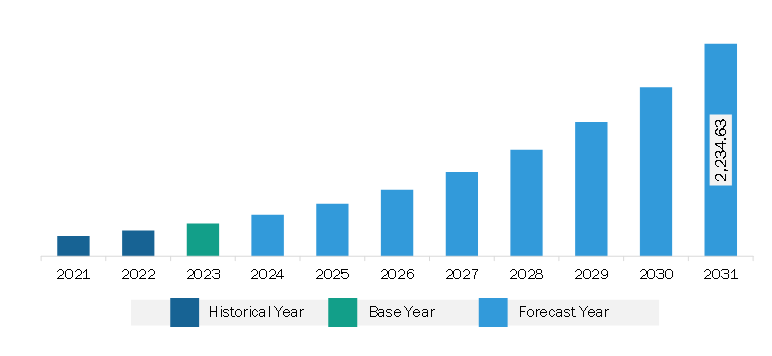

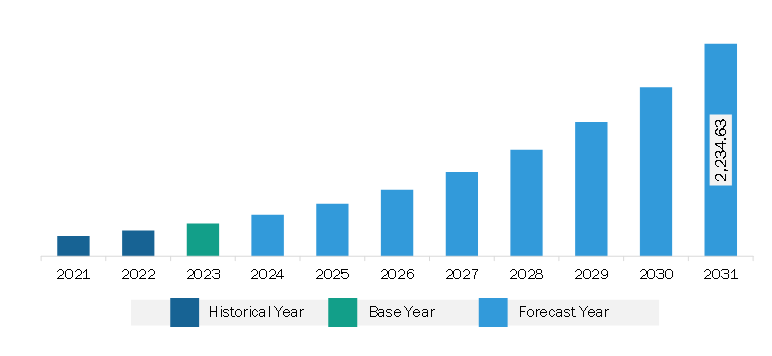

The Middle East & Africa unified endpoint management market was valued at US$ 343.47 million in 2023 and is expected to reach US$ 2,234.63 million by 2031; it is projected to reach a CAGR of 26.4% from 2023 to 2031.

Zero-touch deployment is a method of configuring employee devices with company-specific protocols, programs, and settings remotely. This hands-off approach is becoming increasingly important as organizations’ cloud-based tech stacks and the volume of tablets, laptops, and mobile phones continue to grow. The goal in implementing a zero-touch model for unified device deployment and management is to architect an automated process for new users with required settings and applications without direct involvement from IT staff. The deployment of zero-touch with unified endpoint management enables smooth device provisioning without any manual intervention. With this feature, IT admins can easily configure devices remotely and manage them from a centralized console. Also, with zero-touch, endpoint devices automatically enroll in the UEM system upon first boot, ensuring they adhere to organizational security policies from the outset. Further, various companies are providing zero-touch deployment with unified endpoint management solutions. For instance, VMware delivers zero-touch enrollment (Workspace ONE) for XR devices. With Workspace ONE, organizations do not manually set up devices. They have started shipping the XR devices to end users, and these devices are automatically enrolled into Workspace ONE Unified Endpoint Management (UEM). Therefore, zero-touch deployment is a significant trend for the Middle East & Africa unified endpoint management market.

Digital transformation is a key focus in the Middle East & Africa as countries in the region recognize the need to adapt to the digital age and leverage technology for economic diversification and sustainability. The Middle East & Africa is embracing the digital revolution. Many Gulfs Cooperation Council (GCC) nations are implementing ambitious economic diversification initiatives aimed at reducing their dependency on oil and gas. Countries such as Bahrain, Saudi Arabia, and the UAE have all articulated economic strategies that include extensive use of sophisticated technology. In the Middle East & Africa, the increasing cybersecurity risk landscape is driving the demand for unified endpoint management solutions. With the proliferation of endpoints, such as mobile devices, laptops, and IoT devices, organizations experience a higher risk of cyber threats and data breaches. The need to protect corporate data and applications has become paramount in this evolving digital landscape. According to IBM's 2023 report, cybersecurity events in the Middle East have reached a record average of US$ 8.07 million per data breach, up from US$ 7.46 million in 2022 and a significant rise over the global average of US$ 4.45 million per incident.

Middle East & Africa Unified Endpoint Management Market Segmentation

Middle East & Africa Unified Endpoint Management Market Segmentation

The Middle East & Africa unified endpoint management market is categorized into component, deployment type, platform, organization size, end user and country.

Based on component, the Middle East & Africa unified endpoint management market is bifurcated into solutions and services. The solutions segment held a larger market share in 2023.

By deployment type, the Middle East & Africa unified endpoint management market is segmented into cloud based and on-premise. The cloud-based segment held a larger market share in 2023.

In the terms of platform, the Middle East & Africa unified endpoint management market is divided into desktop and mobile. The desktop segment held a larger market share in 2023.

By organization size, the Middle East & Africa unified endpoint management market is segmented into large enterprises and SMEs. The large enterprises segment held a larger market share in 2023.

Based on end user, the Middle East & Africa unified endpoint management market is segmented into BFSI, government and defense, healthcare, IT and telecom, automotive and transportation, retail, manufacturing, and others. The IT and telecom segment held the largest market share in 2023.

By country, the Middle East & Africa unified endpoint management market is segmented Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa unified endpoint management market share in 2023.

BlackBerry Ltd; HCL Technologies Ltd; Mitsogo Inc; Sophos Ltd.; SOTI Inc.; STEFANINI; Zoho Corp Pvt Ltd; Matrix42 AG; Ivanti; Citrix Systems Inc; International Business Machines Corp; Microsoft Corp; MICROLAND LIMITED; and Open Text Corp are some of the leading companies operating in the Middle East & Africa unified endpoint management market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 343.47 Million |

| Market Size by 2031 | US$ 2,234.63 Million |

| CAGR (2023 - 2031) | 26.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Middle East & Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Unified Endpoint Management Market is valued at US$ 343.47 Million in 2023, it is projected to reach US$ 2,234.63 Million by 2031.

As per our report Middle East & Africa Unified Endpoint Management Market, the market size is valued at US$ 343.47 Million in 2023, projecting it to reach US$ 2,234.63 Million by 2031. This translates to a CAGR of approximately 26.4% during the forecast period.

The Middle East & Africa Unified Endpoint Management Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Unified Endpoint Management Market report:

The Middle East & Africa Unified Endpoint Management Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Unified Endpoint Management Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Unified Endpoint Management Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)