North America Workwear Market to 2028 – COVID-19 Impact and Regional Analysis – by Product Type (Topwear, Bottomwear, and Coveralls), Category (Men, Women, and Unisex), End Use (Construction, Oil and Gas, Chemicals, Healthcare, and Others), and Distribution Channel (Wholesalers, Supermarkets and Hypermarkets, Specialty Stores, and Online Platforms)

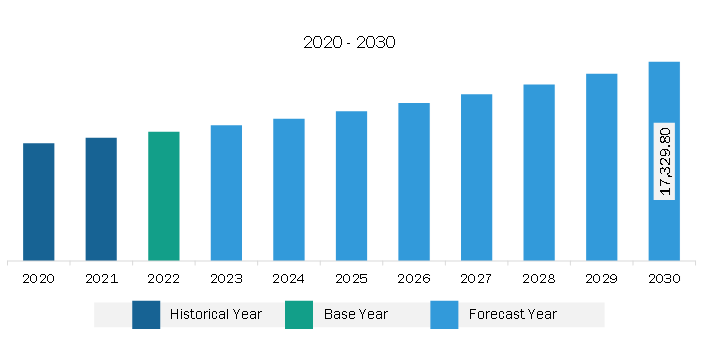

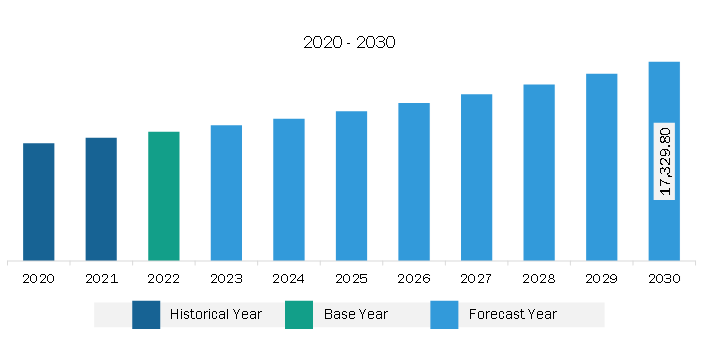

North America workwear market forecast is expected to grow from US$ 11,240.40 million in 2022 to US$ 15,347.10 million by 2028. It is estimated to grow at a CAGR of 5.3% from 2022 to 2028.

Increase in Number of Industrial Accidents Fuel North America Workwear Market

Industrial accidents are one of the major concerns across various industrial sectors. These accidents have severe consequences on human health. There have been numerous cases of accidents at work globally in various industries such as construction, oil & gas, and mining. Further, International Labour Organization (ILO) stated that work-related diseases caused the most deaths among workers. Various industries such as construction, mining, oil & gas, automotive, and healthcare record numerous work-related deaths and injuries. The construction industry has a disproportionately high rate of recorded accidents. According to the International Journal for Research in Applied Science & Engineering Technology, construction-related deaths accounted for around 18.17% of fatalities across the US from 2009 to 2018. The rising rate of accidents at work has shifted the focus toward employee safety, which is increasing the demand for industrial workwear.

Owing to the increasing number of industrial accidents, employers are adopting several standards defined by national and international organizations to ensure the well-being and safety of their employees at the workplace. Industrial workwear is designed to provide protection and comfort to users and help them avoid severe fatalities at the workplace, thereby improving the working efficiency of the workers. The functional workwear provides safety and durability while working across diversified industrial bases. Thus, an increase in industrial accidents and work-related mortality has surged the demand for the use of workwear to ensure the workers’ safety, which, in turn, is contributing to the market's growth.

North America Workwear Market Overview

Increasing cases of occupational injuries, an increase in the number of surgeries and occupational deaths, high demand for safety apparel, growing expenditure on work safety by the end users such as oil and gas, food, automotive, and the presence of major market players are some of the prominent factors propelling the workwear market growth in North America. In addition, stringent government regulations in the region regarding the safety of working professionals in factories and on-site workers, coupled with penalties for non-compliance with the standards, augmented the adoption of workwear. The rise in demand for industrial workwear, mainly from oil & gas, chemical, construction, healthcare, and other industries, is fueling the market growth in the region. Workers across these industries are exposed to various risks owing to the nature of the job or task. Therefore, these industries require functional and high-performance workwear, which endure such extremities at the workplace.

North America Workwear Market Revenue and Forecast to 2028 (US$ Million)

North America Workwear Market Segmentation

North America Workwear Market Segmentation

North America workwear market is segmented into product type, category, end use, distribution channel, and country.

Based on product type, the North America workwear market is segmented into top wear, bottom wear, and coveralls. The top wear segment held the largest share of the North America workwear market in 2022.

Based on category, the North America workwear market is segmented into men, women, and unisex. The men segment held the largest share of the North America workwear market in 2022.

Based on end use, the North America workwear market is segmented into construction, oil and gas, chemicals, healthcare, and others. The others held the largest share of the North America workwear market in 2022.

Based on distribution channel, the North America workwear market is segmented into the wholesalers, supermarkets and hypermarkets, specialty stores, and online platforms. The supermarkets and hypermarkets held the largest share of the North America workwear market in 2022.

Based on country, the North America workwear market is segmented into the US, Canada, and Mexico. The US dominated the share of the North America workwear market in 2022.

3M; Alexandra; Alisco Group; ARAMARK; Carhartt, Inc.; Honeywell International Inc.; and Lakeland Industries Inc. are the leading companies operating in the North America workwear market.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis Formulation:

3.2.4 Macro-economic Factor Analysis:

3.2.5 Developing Base Number:

3.2.6 Data Triangulation:

3.2.7 Country Level Data:

4. North America Workwear Market Landscape

4.1 Market Overview

4.2 North America PEST Analysis

4.3 Expert Opinion

5. North America Workwear Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increase in Number of Industrial Accidents

5.1.2 Introduction of Stringent Government Regulations

5.2 Market Restraints

5.2.1 Increased Adoption of Industrial Automation

5.3 Market Opportunities

5.3.1 Increasing Demand from Emerging Economies

5.4 Future Trends

5.4.1 Increasing Product Innovation with Latest Technologies

5.5 Impact Analysis of Drivers and Restraints

6. Workwear – North America Market Analysis

6.1 North America Workwear Market Overview

6.2 North America Workwear Market –Revenue and Forecast to 2028 (US$ Mn)

7. North America Workwear Market Analysis – By Product Type

7.1 Overview

7.2 North America Workwear Market, By Product Type (2021 and 2028)

7.3 Topwear

7.3.1 Overview

7.3.2 Topwear: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

7.4 Bottomwear

7.4.1 Overview

7.4.2 Bottomwear: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

7.5 Coveralls

7.5.1 Overview

7.5.2 Coveralls: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

8. North America Workwear Market Analysis – By Category

8.1 Overview

8.2 North America Workwear Market, By Category (2021 and 2028)

8.3 Men

8.3.1 Overview

8.3.2 Men: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

8.4 Women

8.4.1 Overview

8.4.2 Women: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

8.5 Unisex

8.5.1 Overview

8.5.2 Unisex: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

9. North America Workwear Market Analysis – By End Use

9.1 Overview

9.2 North America Workwear Market, By End Use (2021 and 2028)

9.3 Construction

9.3.1 Overview

9.3.2 Construction: North America Workwear Market– Revenue and Forecast to 2028 (US$ Mn)

9.4 Oil and Gas

9.4.1 Overview

9.4.2 Oil and Gas: North America Workwear Market– Revenue and Forecast to 2028 (US$ Mn)

9.5 Chemicals

9.5.1 Overview

9.5.2 Chemicals: North America Workwear Market– Revenue and Forecast to 2028 (US$ Mn)

9.6 Healthcare

9.6.1 Overview

9.6.2 Healthcare: North America Workwear Market– Revenue and Forecast to 2028 (US$ Mn)

9.7 Others

9.7.1 Overview

9.7.2 Others: North America Workwear Market– Revenue and Forecast to 2028 (US$ Mn)

10. North America Workwear Market Analysis – By Distribution Channel

10.1 Overview

10.2 North America Workwear Market, By End Use (2021 and 2028)

10.3 Wholesalers

10.3.1 Overview

10.3.2 Wholesalers: North America Workwear Market– Revenue and Forecast to 2028 (US$ Mn)

10.4 Supermarkets and Hypermarkets

10.4.1 Overview

10.4.2 Supermarkets and Hypermarkets: North America Workwear Market– Revenue and Forecast to 2028 (US$ Mn)

10.5 Specialty Stores

10.5.1 Overview

10.5.2 Speciality Stores: North America Workwear Market– Revenue and Forecast to 2028 (US$ Mn)

10.6 Online Platforms

10.6.1 Overview

10.6.2 Online Platforms: North America Workwear Market– Revenue and Forecast to 2028 (US$ Mn)

11. North America Workwear Market – Country Analysis

11.1 Overview

11.1.1 North America Workwear Market, by Key Country

11.1.1.1 US: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

11.1.1.1.1 US: North America Workwear Market, By Product Type

11.1.1.1.2 US: North America Workwear Market, by Category

11.1.1.1.3 US: North America Workwear Market, by End Use

11.1.1.1.4 US: North America Workwear Market, by Distribution Channel

11.1.1.2 Canada: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

11.1.1.2.1 Canada: North America Workwear Market, By Product Type

11.1.1.2.2 Canada: North America Workwear Market, by Category

11.1.1.2.3 Canada: North America Workwear Market, by End Use

11.1.1.2.4 Canada: North America Workwear Market, by Distribution Channel

11.1.1.3 Mexico: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

11.1.1.3.1 Mexico: North America Workwear Market, By Product Type

11.1.1.3.2 Mexico: North America Workwear Market, by Category

11.1.1.3.3 Mexico: North America Workwear Market, by End Use

11.1.1.3.4 Mexico: North America Workwear Market, by Distribution Channel

12. Industry Landscape

12.1 Overview

12.2 Business Planning and Strategy

12.3 Product News

13. Company Profiles

13.1 Carhartt, Inc.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 ARAMARK

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Alisco Group

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Alexandra

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 3M

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Honeywell International Inc.

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Lakeland Industries Inc.

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. North America Workwear Market –Revenue and Forecast to 2028 (US$ Mn)

Table 2. US: North America Workwear Market, Product Type – Revenue and Forecast to 2028 (US$ Mn)

Table 3. US: North America Workwear Market, by Category – Revenue and Forecast to 2028 (US$ Mn)

Table 4. US: North America Workwear Market, by End Use – Revenue and Forecast to 2028 (US$ Mn)

Table 5. US: North America Workwear Market, by Distribution Channel – Revenue and Forecast to 2028 (US$ Mn)

Table 6. Canada: North America Workwear Market, By Product Type – Revenue and Forecast to 2028 (US$ Mn)

Table 7. Canada: North America Workwear Market, by Category – Revenue and Forecast to 2028 (US$ Mn)

Table 8. Canada: North America Workwear Market, by End Use – Revenue and Forecast to 2028 (US$ Mn)

Table 9. Canada: North America Workwear Market, by Distribution Channel – Revenue and Forecast to 2028 (US$ Mn)

Table 10. Mexico: North America Workwear Market, By Product Type – Revenue and Forecast to 2028 (US$ Mn)

Table 11. Mexico: North America Workwear Market, by Category – Revenue and Forecast to 2028 (US$ Mn)

Table 12. Mexico: North America Workwear Market, by End Use – Revenue and Forecast to 2028 (US$ Mn)

Table 13. Mexico: North America Workwear Market, by Distribution Channel – Revenue and Forecast to 2028 (US$ Mn)

Table 14. List of Abbreviation

LIST OF FIGURES

Figure 1. North America Workwear Market Segmentation

Figure 2. North America Workwear Market Segmentation – By Country

Figure 3. North America Workwear Market Overview

Figure 4. North America Workwear Market: By Category

Figure 5. North America Workwear Market: By Country

Figure 6. PEST Analysis

Figure 7. Expert Opinion

Figure 8. North America Workwear Market Impact Analysis of Drivers and Restraints

Figure 9. North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 10. North America Workwear Market Revenue Share, By Product Type (2021 and 2028)

Figure 11. Topwear: North America Workwear Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 12. Bottomwear: North America Workwear Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 13. Coveralls: North America Workwear Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 14. North America Workwear Market Revenue Share, By Category (2021 and 2028)

Figure 15. Men: North America Workwear Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 16. Women: North America Workwear Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 17. Unisex: North America Workwear Market – Revenue and Forecast To 2028 (US$ Mn)

Figure 18. North America Workwear Market Revenue Share, By End Use (2021 and 2028)

Figure 19. Construction: North America Workwear Market– Revenue and Forecast To 2028 (US$ Mn)

Figure 20. Oil and Gas: North America Workwear Market– Revenue and Forecast To 2028 (US$ Mn)

Figure 21. Chemicals: North America Workwear Market– Revenue and Forecast To 2028 (US$ Mn)

Figure 22. Healthcare: North America Workwear Market– Revenue and Forecast To 2028 (US$ Mn)

Figure 23. Others: North America Workwear Market– Revenue and Forecast To 2028 (US$ Mn)

Figure 24. North America Workwear Market Revenue Share, By Distribution Channel (2021 and 2028)

Figure 25. Wholesalers: North America Workwear Market– Revenue and Forecast To 2028 (US$ Mn)

Figure 26. Supermarkets and Hypermarkets: North America Workwear Market– Revenue and Forecast To 2028 (US$ Mn)

Figure 27. Specialty Stores: North America Workwear Market– Revenue and Forecast To 2028 (US$ Mn)

Figure 28. Online Platforms: North America Workwear Market– Revenue and Forecast To 2028 (US$ Mn)

Figure 29. North America Workwear Market, by Key Country– Revenue (2021) (US$ Mn)

Figure 30. North America Workwear Market Revenue Share, by Key Country (2021 and 2028)

Figure 31. US: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 32. Canada: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

Figure 33. Mexico: North America Workwear Market – Revenue and Forecast to 2028 (US$ Mn)

- 3M

- Alexandra

- Alisco Group

- ARAMARK

- Carhartt, Inc.

- Honeywell International Inc.

- Lakeland Industries Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America workwear market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America workwear market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the workwear market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution