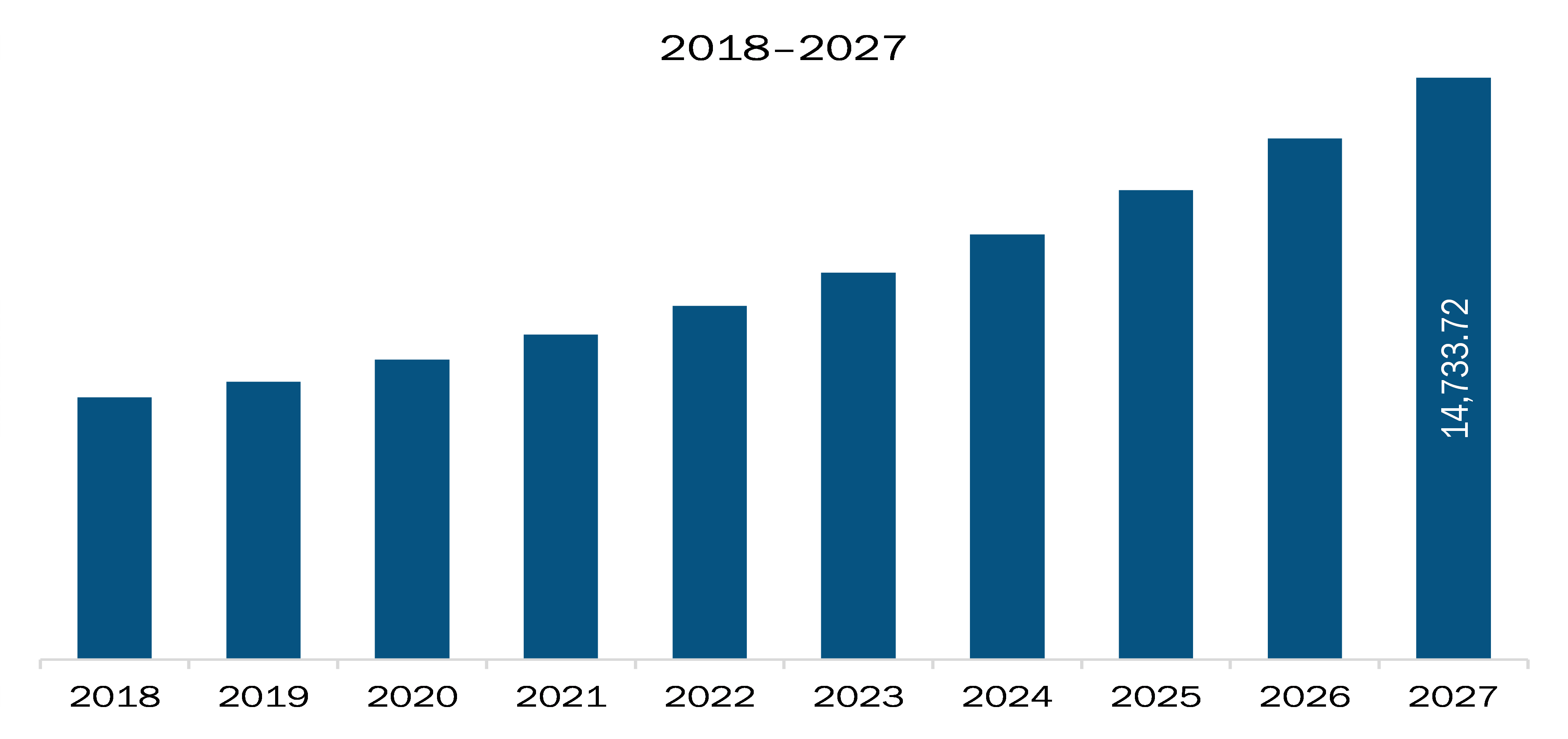

The North America USB device market is expected to grow from US$ 8229.89 million in 2021 to US$ 16530.68 million by 2028; it is estimated to grow at a CAGR of 10.5% from 2021 to 2028.

The US, Canada, and Mexico are the economies considered in North America. Growing demand for consumer electronics is expected to escalate the North America USB device market. The increasing use of consumer electronics such as smartphones and laptops in North American countries is mainly attributed to rising disposable income, increasing population, and growing Internet penetration. The ongoing significant technological developments have led to rise in the penetration of these devices across several economies. In 2019, as per the Consumer Technology Association (CTA), smartphone revenue reached US$ 80 billion in the US, while the unit shipments grew to 170.7 million in the country. USB devices have become a dominant interface to address growing requirements for swift data transfer between end devices, such as laptops, smartphones, PCs, and digital cameras. Thus, with the escalating demand for consumer electronics and data transmission products, the North America USB devices market players highly focus on launching new products to achieve sustainable growth and distinguish themselves from their competitors, thereby contributing to the North America USB device market growth.

Further, in case of COVID-19, North America is highly affected specially the US. North America is one of the most important regions for adopting and developing new digital systems due to favorable government policies to boost innovation, a huge industrial base, and high purchasing power, especially in developed countries such as the US and Canada. Hence, any negative impact on the growth of industries is expected to affect the economic development of the region. The US is a prominent market for USB device, especially consumer electronics, IT and telecommunication, and automotive industries. The huge increase in the number of confirmed cases and rising reported deaths in the country affects both manufacturing and sales of USB devices. The factory and business shutdowns across the US, Canada, and Mexico impact the adoption of the USB device market. The COVID-19 adversely affected the future business operations and financial performance of various market players in the region. However, implementation of work-from-home policy benefited the market, leading to more sales. North America is home to many manufacturing and technology companies, and thus the impact of coronavirus outbreak is anticipated to be quite severe till Mid-2021.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America USB device market. The North America USB device market is expected to grow at a good CAGR during the forecast period.

North America USB Device Market Segmentation

North America USB Device Market – By Device Standard Type

North America USB Device Market – By Product

North America USB Device Market – By Connector Type

North America USB Device Market – By Applications

North America USB Device Market, by Country

North America USB Device Market -Companies Mentioned

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 8229.89 million |

| Market Size by 2028 | US$ 16530.68 million |

| CAGR (2021 - 2028) | 10.5% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Device Standard Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The North America USB Device Market is valued at US$ 8229.89 million in 2021, it is projected to reach US$ 16530.68 million by 2028.

As per our report North America USB Device Market, the market size is valued at US$ 8229.89 million in 2021, projecting it to reach US$ 16530.68 million by 2028. This translates to a CAGR of approximately 10.5% during the forecast period.

The North America USB Device Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America USB Device Market report:

The North America USB Device Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America USB Device Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America USB Device Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)