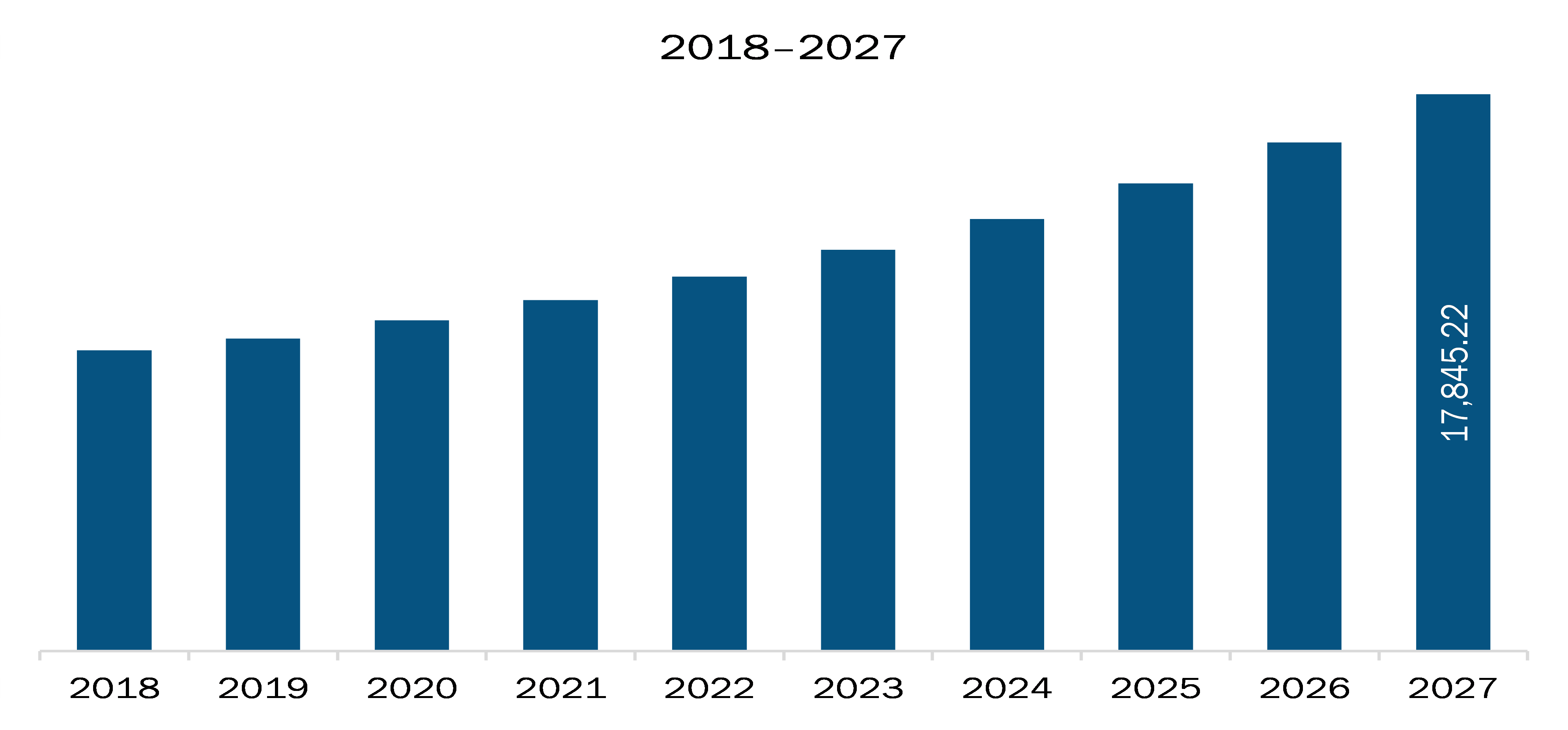

The APAC USB device market is expected to grow from US$ 11,253.88 million in 2021 to US$ 19,625.70 million by 2028; it is estimated to grow at a CAGR of 8.3 % from 2021 to 2028.

Australia, China, India, Japan, and South Korea are major economies across APAC region. Growing popularity of smart homes is expected to escalate the APAC USB device market. The demand for smart homes has increased substantially across the APAC region over the past few years due to the rising penetration of smartphones and other smart devices. Smart homes are gaining huge popularity due to the development of the residential sector in different countries. The building owners and homeowners are more aware of the effectiveness of automated controls in their premises, which make them more inclined toward the integration of smart devices. Growing number of internet users, increasing consumer disposable income in developing countries, and rising significance of home monitoring are also propelling the demand for smart homes. The smart home industry is dominated by offerings such as security cameras, smart TV, and smart speakers. There has been huge adoption of smart TVs in APAC region, with the escalating popularity of the streaming media options. With the surge in manufacturing of smart TVs by consumer electronics giants across the APAC, the demand for USB devices is also soaring. Therefore, with the growing inclination toward smart home technologies, USB device vendors are further striving to meet the dynamic demands of users, which, in turn, would boost the growth of the APAC USB device market in the coming years.

Further, in case of COVID-19, APAC is highly affected specially India. A large number of electronic components and various sectors such as consumer electronics and automotive in this region present a huge opportunity for the growth of the USB device market. In addition to this, APAC is also a global manufacturing hub with countries. The ongoing COVID-19 is anticipated to cause huge disruptions in the growth of various industries in the region. For instance, China is the global hub of manufacturing and the largest raw material supplier for various industries, and it is one of the worst affected COVID-19 countries. The lockdown of various plants and factories in China affects the global supply chains and negatively impacts manufacturing, delivery schedules, and sales of various products. APAC is a crucial region in manufacturing and industrial growth, and any disruptions may negatively impact the growth of various industries dependent on the region for business growth revenues. The governments of various countries of this region are taking drastic measures to reduce coronavirus outbreak effects by announcing lockdowns, travel, and trade bans. All these measures are expected to have a negative impact on the adoption and growth of USB devices, especially in the electronics and semiconductor sector till Mid-2021.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the APAC USB device market. The APAC USB device market is expected to grow at a good CAGR during the forecast period.

APAC USB Device Market Segmentation

APAC USB Device Market – By Device Standard Type

APAC USB Device Market – By Product

APAC USB Device Market – By Connector Type

APAC USB Device Market – By Applications

APAC USB Device Market, by Country

APAC USB Device Market -Companies Mentioned

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 11,253.88 million |

| Market Size by 2028 | US$ 19,625.70 million |

| CAGR (2021 - 2028) | 8.3% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Device Standard Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

The Asia Pacific USB Device Market is valued at US$ 11,253.88 million in 2021, it is projected to reach US$ 19,625.70 million by 2028.

As per our report Asia Pacific USB Device Market, the market size is valued at US$ 11,253.88 million in 2021, projecting it to reach US$ 19,625.70 million by 2028. This translates to a CAGR of approximately 8.3% during the forecast period.

The Asia Pacific USB Device Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific USB Device Market report:

The Asia Pacific USB Device Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific USB Device Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific USB Device Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)