Infectious diseases cause loss of production ability in farm animals. Governments across the world are emphasizing on making pig farmers aware of the most common and disastrous infectious diseases by undertaking initiatives to promote screening or mass diagnosis of these diseases. They are working with domestic and international companies to promote animal health products. These initiatives help convey the significance of livestock diagnosis to decision-makers, regulatory agencies, reference laboratories, and other end users. A few of the remarkable government initiatives undertaken with regard to livestock diagnostics are mentioned below. In December 2020, the Animal and Plant Health Inspection Service (APHIS) of the US Department of Agriculture (USDA) granted US$ 14.4 million to 76 projects focused on improving the early diagnosis of animal diseases and enhancing emergency response abilities of veterinary diagnostic laboratories from the National Animal Health Laboratory Network (NAHLN). The projects also focus on the betterment of ASF and classical swine fever diagnostic testing. In August 2022, the Ministry of Agriculture and Agri-Food of Canada invested up to US$ 33.34 million to enhance efforts to prevent the emergence of ASF in Canada and prepare for a potential outbreak. The funding is crucial for reducing the risk of the entry and spread of the ASF virus in Canada. The Canadian government invested up to US$$ 17.22 million to support prevention and mitigation efforts by the pork industry against AFS. Such government efforts are creating viable opportunities for companies in the North America swine diagnostics market and organizations conducting ASF-related research projects.

The US is the largest market for swine diagnostics at a global and regional level. The swine diagnostic market growth in this country is attributed to product developments by companies, increasing swine disease surveillance, and government investments in purchasing diagnostics kits. Swine disease surveillance in the US has evolved significantly over time. Pig populations in the country are large and complex, and government entities are focusing on conducting preventive surveillance for diseases such as classical swine fever and African swine fever. In addition, the US Department of Agriculture (USDA) focuses on preparing the pig industry in the country to respond to high-consequence, foreign animal diseases (FADs).

In February 2023, the Animal and Plant Health Inspection Service (APHIS) of the USDA announced purchasing of test kits to diagnose African swine fever (ASF) and foot-and-mouth disease (FMD) for the National Animal Vaccine and Veterinary Countermeasures Bank (NAVVCB). Thus, such measures by the US government to purchase diagnostics kits in large volumes support the North America swine diagnostics market growth.

Companies operating in the North America swine diagnostics market in the US continuously develop and introduce their products, enabling enhanced diagnostics. They are also developing products to diagnose pathogenicity in already cleaned areas wherein animal samples are handled. In April 2023, BioCheck launched VetAssure, a real-time biosecurity diagnostic tool that provides results in 10 seconds from swine or animal culture. VetAssure is a swabbing system that detects the amount of ATP (energy source of all cells) in any area where swabbing is done, allowing quick decision-making, preventing disease spread, and keeping biosecurity intact. The results of VetAssure help identify the need for disinfection of lab buildings during transports or if the staff needs to take shower before they enter the facilities. Thus, the increasing availability of such products would help maintain the good health of animals and people working in farms, labs, and other relevant places.

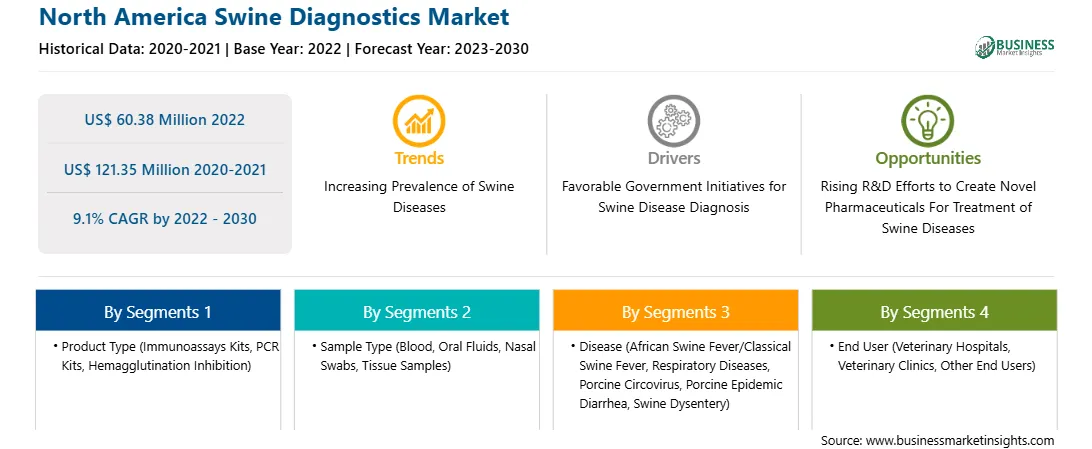

The North America swine diagnostics market is segmented into product type, sample type, disease, end user, and country.

Based on product type, the North America swine diagnostics market is segmented into immunoassays kits, PCR kits, hemagglutination inhibition (HI), and others. In 2022, the immunoassays kits segment registered the largest share in the North America swine diagnostics market.

Based on sample type, the North America swine diagnostics market is segmented into blood, oral fluids, nasal swabs, tissue samples, and others. In 2022, the blood segment registered the largest share in the North America swine diagnostics market.

Based on disease, the North America swine diagnostics market is segmented into African swine fever (ASF)/classical swine fever (CSF), respiratory diseases, porcine circovirus, porcine epidemic diarrhea, swine dysentery, and others. In 2022, the African swine fever (ASF)/classical swine fever (CSF) segment registered the largest share in the North America swine diagnostics market.

Based on end user, the North America swine diagnostics market is segmented into veterinary hospitals, veterinary clinics, and other end users. In 2022, the veterinary hospitals segment registered the largest share in the North America swine diagnostics market.

Based on country, the North America swine diagnostics market is segmented into the US, Canada, Mexico. In 2022, the US registered the largest share in the North America swine diagnostics market.

BioCheck BV, Bionote Inc, Idexx Laboratories Inc, INDICAL BIOSCIENCE GmbH, Innovative Diagnostics SAS, Neogen Corp, Ring Biotechnology Co Ltd, SAN Group GmbH, Thermo Fisher Scientific Inc, and Zoetis Inc are some of the leading companies operating in the North America swine diagnostics market.

Strategic insights for the North America Swine Diagnostics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 60.38 Million |

| Market Size by 2030 | US$ 121.35 Million |

| CAGR (2022 - 2030) | 9.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Swine Diagnostics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Swine Diagnostics Market is valued at US$ 60.38 Million in 2022, it is projected to reach US$ 121.35 Million by 2030.

As per our report North America Swine Diagnostics Market, the market size is valued at US$ 60.38 Million in 2022, projecting it to reach US$ 121.35 Million by 2030. This translates to a CAGR of approximately 9.1% during the forecast period.

The North America Swine Diagnostics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Swine Diagnostics Market report:

The North America Swine Diagnostics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Swine Diagnostics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Swine Diagnostics Market value chain can benefit from the information contained in a comprehensive market report.