The FAO of the United Nations published an article on the ASF situation update in Asia & Pacific in July 2023. As per this article, ASF is a growing disease that affects pigs with up to 100% fatality rate. Since the first case reported on January 15, 2019, Mongolia has reported 11 outbreaks in 6 provinces and in Ulaanbaatar. Nearly 3,000 pigs have died due to ASF as of April 2019. On September 17, 2019, the Ministry of Agriculture, Food and Rural Affairs (MAFRA) of the Republic of Korea confirmed the first ASF outbreak. The disease was detected in 36 domestic pig farms in Gyeonggi-do (17), Incheon City (5), and Gangwon-do (14), of which 8 of these farms have started reporting ASF cases again since January 2023. In Indonesia, after the Ministry of Agriculture and Fisheries announced the confirmation of the ASF outbreak on 27 September 2019, ASF spread to almost all villages within a year. At least 129,000 pigs, 28% of the total pig population, have died due to ASF. In China, ASF has been detected in 32 provinces/autonomous regions/municipalities/special administrative regions since the confirmation of the first outbreak in Liaoning Province by the Ministry of Agriculture and Rural Affairs (MARA) on August 3, 2018. The recent outbreak was reported on February 11, 2023, in Sheung Shui, Hong Kong SAR, located close to the border with Guangdong Province. According to the World Organization for Animal Health (OIE), over 100 million cases of pig diseases were reported worldwide in 2021. The most common pig diseases were African swine fever, swine influenza, porcine reproductive and respiratory syndrome (PRRS), pseudorabies, and enzootic pneumonia of pigs. The disease is also common in other parts of the world, including, Asia. Thus, the rising prevalence of various swine diseases boosts the swine diagnostic market.

China is among the world's largest markets for swine diagnostics. Swine production in the country has continued to grow in the last couple of years, with stable swine production capacity and prices, despite the onset of the COVID-19 pandemic and the prevalence of ASF. In August 2020, the Ministry of Agriculture and Rural Affairs in China proposed new rules to standardize the use of diagnostic kits for ASF. The ministry aims to have better control over this disease and limit the devastation caused by the same in Chinese pig farms. From January 2021, the Ministry of Agriculture and Rural Affairs mandated issuing animal health certificates for disease monitoring purpose s, and the ministry should provide an approval number to ensure the accuracy of diagnostics results. These compulsions were made to the farmers, players and authorities working in swine industry. Such regulations help increase the sales of advanced and efficient swine diagnostics products in the country. China has recently witnessed the outbreak of ASF. According to MARA, Sheung Shui (Hong Kong SAR), located close to the border with Guangdong Province, witnessed the latest outbreak of ASF in February 2023. Thus, the growing incidence of ASF in the country results in a spurred demand for diagnostic products, benefitting the Asia Pacific swine diagnostics market in China.

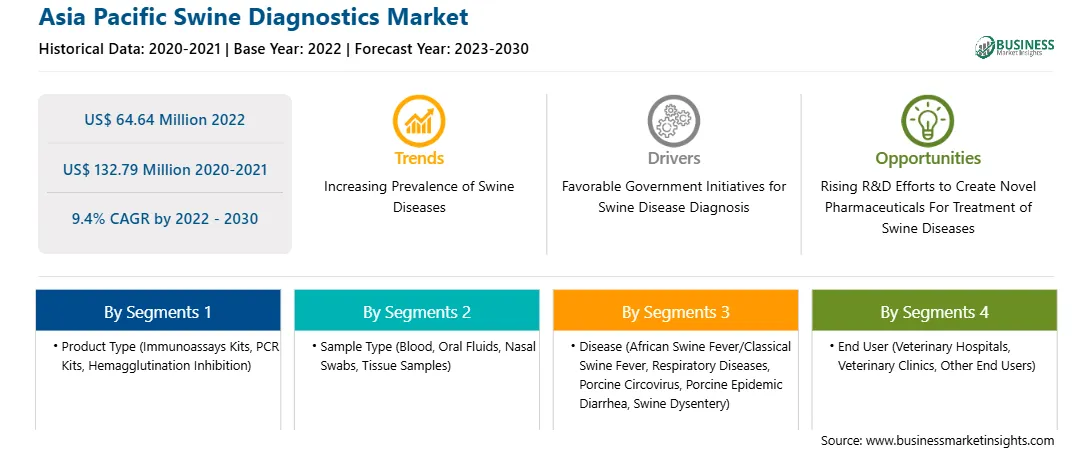

The Asia Pacific swine diagnostics market is segmented into product type, sample type, disease, end user, and country.

Based on product type, the Asia Pacific swine diagnostics market is segmented into immunoassays kits, PCR kits, hemagglutination inhibition (HI), and others. In 2022, the immunoassays kits segment registered the largest share in the Asia Pacific swine diagnostics market.

Based on sample type, the Asia Pacific swine diagnostics market is segmented into blood, oral fluids, nasal swabs, tissue samples, and others. In 2022, the blood segment registered the largest share in the Asia Pacific swine diagnostics market.

Based on disease, the Asia Pacific swine diagnostics market is segmented into African swine fever (ASF)/classical swine fever (CSF), respiratory diseases, porcine circovirus, porcine epidemic diarrhea, swine dysentery, and others. In 2022, the African swine fever (ASF)/classical swine fever (CSF) segment registered the largest share in the Asia Pacific swine diagnostics market.

Based on end user, the Asia Pacific swine diagnostics market is segmented into veterinary hospitals, veterinary clinics, and other end users. In 2022, the veterinary hospitals segment registered the largest share in the Asia Pacific swine diagnostics market.

Based on country, the Asia Pacific swine diagnostics market is segmented into China, South Korea, Japan, India, Australia, and the Rest of Asia Pacific. In 2022, China registered the largest share in the Asia Pacific swine diagnostics market.

BioCheck BV, Bionote Inc, Idexx Laboratories Inc, Innovative Diagnostics SAS, Neogen Corp, Ring Biotechnology Co Ltd, SAN Group GmbH, Thermo Fisher Scientific Inc, and Zoetis Inc are some of the leading companies operating in the Asia Pacific swine diagnostics market.

Strategic insights for the Asia Pacific Swine Diagnostics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 64.64 Million |

| Market Size by 2030 | US$ 132.79 Million |

| CAGR (2022 - 2030) | 9.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

|

The geographic scope of the Asia Pacific Swine Diagnostics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific Swine Diagnostics Market is valued at US$ 64.64 Million in 2022, it is projected to reach US$ 132.79 Million by 2030.

As per our report Asia Pacific Swine Diagnostics Market, the market size is valued at US$ 64.64 Million in 2022, projecting it to reach US$ 132.79 Million by 2030. This translates to a CAGR of approximately 9.4% during the forecast period.

The Asia Pacific Swine Diagnostics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Swine Diagnostics Market report:

The Asia Pacific Swine Diagnostics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Swine Diagnostics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Swine Diagnostics Market value chain can benefit from the information contained in a comprehensive market report.