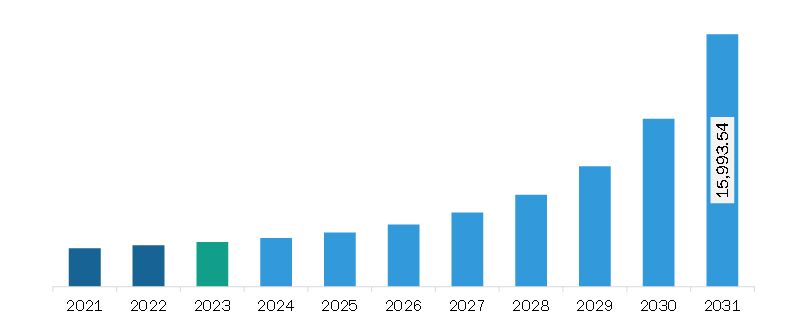

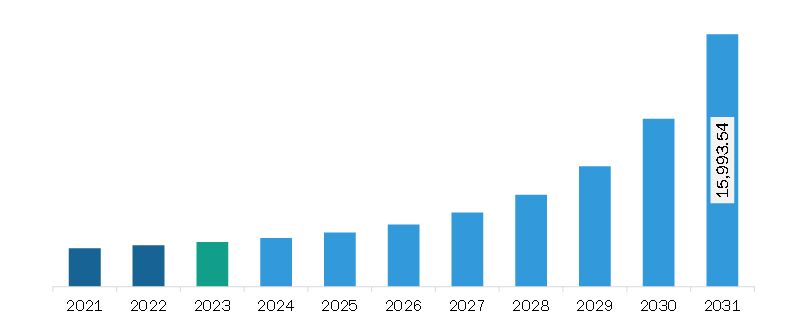

The North America regtech market was valued at US$ 2,795.17 million in 2023 and is expected to reach US$ 15,993.54 million by 2031; it is estimated to register a CAGR of 24.4% from 2023 to 2031.

According to a study by "eftsure" on payment fraud investigations, nearly one in every five organizations (~20%) said that the most disruptive incidence they faced incurred the cost of more than US$ 50 million to their businesses. Large organizations usually deal with significant financial transactions and handle crucial data, rendering them susceptible to cybercrimes. Regtech solutions come with advanced technologies and tools to detect and prevent financial crimes. These solutions leverage technologies such as Big Data analytics, machine learning, and artificial intelligence to enhance compliance processes and improve the effectiveness of anti-money laundering (AML) and know-your-customer (KYC) operations.

Regtech tools can identify suspicious transactions, detect patterns of fraudulent behavior, and provide timely alerts to financial institutions. Regtech tools, such as advanced transaction monitoring systems, help financial institutions identify money laundering attempts by analyzing transaction data and detecting irregularities or patterns that may indicate fraudulent behavior. Further, the integration of technologies such as machine learning and artificial intelligence enables Regtech solutions to process large volumes of data and identify suspicious activities in real time.

The financial service industry in the US is saturated with regulations. In an attempt to reduce the vast and ever-increasing burden of these regulatory terms, financial institutions have started adopting new technology solutions, including regtech. Various companies are launching regtech solutions in the country. In April 2024, Wolters Kluwer Compliance Solutions launched OneSumX Reg Manager to help US community banks and credit unions enhance their regulatory change management process. This AI-powered solution is the latest addition to the OneSumX Compliance Solutions portfolio suite, a trusted product line designed to help financial institutions across the US more effectively navigate regulatory change. In January 2022, Fidelity Investments launched an innovative new regtech business to help financial institutions create compliant public communications.

The North America regtech market is categorized component, deployment type, enterprise size, application, industry vertical, and country.

By component, the North America regtech market is bifurcated into solutions and services. The solutions segment held a larger share of the North America regtech market share in 2023.

In terms of deployment type, the North America regtech market is segmented into on-premise and cloud. The cloud segment held a larger share of the North America regtech market share in 2023.

Based on enterprise size, the North America regtech market is bifurcated into SMEs and large enterprises. The large enterprises segment held a larger share of the North America regtech market share in 2023.

By application, the North America regtech market is segmented into risk and compliance management, AML and fraud management, and identity management. The risk and compliance management segment held the largest share of the North America regtech market share in 2023.

By industry vertical, the North America regtech market is segmented into banks, insurance, and others. The banks segment held the largest share of the North America regtech market share in 2023.

Based on country, the North America regtech market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America regtech market in 2023.

Ascent Regtech; Broadridge Financial Solutions Inc; Deloitte Touche Tohmatsu Ltd; International Business Machines Corp; Jumio Corporation; MetricStream, Inc.; PricewaterhouseCoopers International Ltd; and Thomson Reuters Corp are some of the leading companies operating in the North America regtech market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,795.17 Million |

| Market Size by 2031 | US$ 15,993.54 Million |

| CAGR (2023 - 2031) | 24.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The North America Regtech Market is valued at US$ 2,795.17 Million in 2023, it is projected to reach US$ 15,993.54 Million by 2031.

As per our report North America Regtech Market, the market size is valued at US$ 2,795.17 Million in 2023, projecting it to reach US$ 15,993.54 Million by 2031. This translates to a CAGR of approximately 24.4% during the forecast period.

The North America Regtech Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Regtech Market report:

The North America Regtech Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Regtech Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Regtech Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)