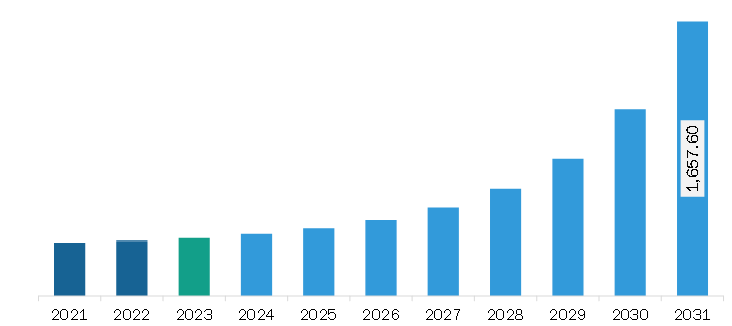

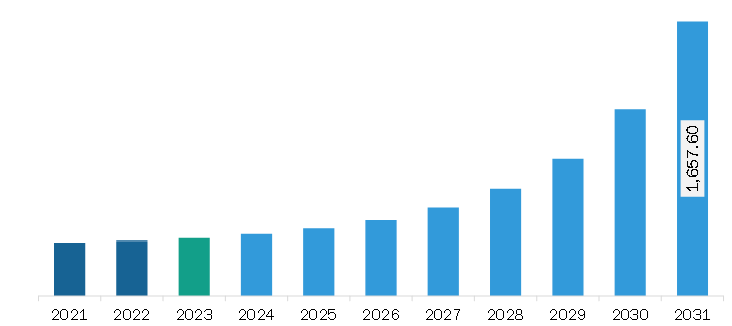

The Middle East & Africa regtech market was valued at US$ 349.40 million in 2023 and is expected to reach US$ 1,657.60 million by 2031; it is estimated to register a CAGR of 21.5% from 2023 to 2031.

Expansion of AI, Machine Learning, and Blockchain Applications Bolsters Middle East & Africa Regtech Market

AI and ML are robust technologies that are deemed necessary for the automation of business operations. These technologies are also capable of spotting industry trends and providing quick and accurate insights. AI-based systems have the potential to analyze massive amounts of data to detect trends and abnormalities, enabling regulated companies to prevent fraud. To remain relevant in an ever-changing environment, firms should constantly develop their rule-based parameters. AI-powered Regtech solutions may help regulated organizations efficiently acquire, process, and analyze data for regulatory reporting as financial transactions expand. Further, Blockchain is a decentralized, distributed digital ledger that records transactions safely and transparently. Its appeal in the Regtech business stems from its capacity to confer transparency, immutability, and record security. Creating a tamper-proof audit trail for regulatory reporting involves accurate and verifiable information. Blockchain is spread throughout a network of systems, with each machine keeping a copy of the ledger. Blockchain technology eliminates the need for central control, allowing the authentication and recording of transactions without the involvement of a trusted third party, thereby supporting the decentralization, security, and transparency features of Regtech solutions. Thus, the expansion of AI, machine learning, and Blockchain applications is emerging as a significant Middle East & Africa regtech market trend.

Middle East & Africa Regtech Market Overview

Regtech business in Saudi Arabia is still in its early stages. However, there is a growing interest in creating and implementing technological solutions for regulatory purposes. In 2019, the Saudi Arabian Monetary Authority (SAMA) established a regulatory sandbox to examine the impact of regtech on the financial sector and further promote the development of regtech solutions. The deployment of regtech solutions across industries provides significant financial, operational, and consumer safety benefits to the economies embracing them. As a result, the acceptance of these solutions is on the rise in Saudi Arabia, and players in the country are also focusing on developing their own regtech ecosystem. In March 2024, Konsentus, an open ecosystem regtech provider, opened its MENA regional center in Saudi Arabia to deliver open data infrastructure and technology services to regulators and financial services firms in the Kingdom and adjacent regions.

Middle East & Africa Regtech Market Revenue and Forecast to 2031 (US$ Million)

Middle East & Africa Regtech Market Segmentation

The Middle East & Africa regtech market is categorized component, deployment type, enterprise size, application, industry vertical, and country.

By component, the Middle East & Africa regtech market is bifurcated into solutions and services. The solutions segment held a larger share of the Middle East & Africa regtech market share in 2023.

In terms of deployment type, the Middle East & Africa regtech market is bifurcated into on-premise and cloud. The cloud segment held a larger share of the Middle East & Africa regtech market share in 2023.

Based on enterprise size, the Middle East & Africa regtech market is bifurcated into SMEs and large enterprises. The large enterprises segment held a larger share of the Middle East & Africa regtech market share in 2023.

By application, the Middle East & Africa regtech market is segmented into risk and compliance management, AML and fraud management, and identity management. The risk and compliance management segment held the largest share of the Middle East & Africa regtech market share in 2023.

By industry vertical, the Middle East & Africa regtech market is segmented into banks, insurance, and others. The banks segment held the largest share of the Middle East & Africa regtech market share in 2023.

Based on country, the Middle East & Africa regtech market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. Saudi Arabia segment held the largest share of Middle East & Africa regtech market in 2023.

Broadridge Financial Solutions Inc; Deloitte Touche Tohmatsu Ltd; International Business Machines Corp; MetricStream, Inc.; PricewaterhouseCoopers International Ltd; and Thomson Reuters Corp are some of the leading companies operating in the Middle East & Africa regtech market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 349.40 Million |

| Market Size by 2031 | US$ 1,657.60 Million |

| CAGR (2023 - 2031) | 21.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Regtech Market is valued at US$ 349.40 Million in 2023, it is projected to reach US$ 1,657.60 Million by 2031.

As per our report Middle East & Africa Regtech Market, the market size is valued at US$ 349.40 Million in 2023, projecting it to reach US$ 1,657.60 Million by 2031. This translates to a CAGR of approximately 21.5% during the forecast period.

The Middle East & Africa Regtech Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Regtech Market report:

The Middle East & Africa Regtech Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Regtech Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Regtech Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)