North America Naval System Surveillance Radar Market Forecast to 2028– COVID-19 Impact and Regional Analysis– by Type (X-band and Ku-band, L-Band and S-band, and Others) and Application (Weapon Guidance System and Surveillance)

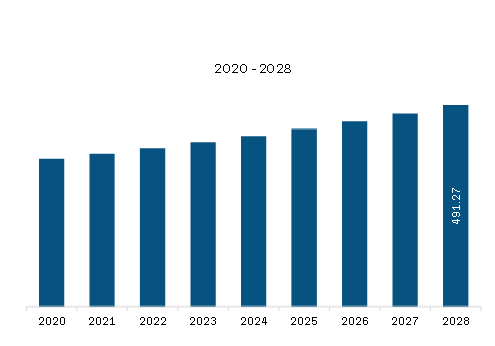

The naval system surveillance radar market in North America is expected to grow from US$ 1719.60 million in 2022 to US$ 2,574.95 million by 2028. It is estimated to grow at a CAGR of 7.0% from 2022 to 2028.

Rise in Procurement of Naval System Surveillance Radar

The concerns regarding security in naval ships, naval boats, and naval ports are increasing continuously. In order to effectively manage and control naval threats with the help of radar systems have become an important paradigm for the navy and security authorities. In that case navy take a help of naval system surveillance radar in national security, navigation and detection of incoming ships or land obstacles to avoid a collision. The increase in military expenditure across various countries is influencing the growth of the naval system surveillance radar market. Radar systems for surveillance are increasingly gaining adoption traction to ensure the safety of naval operations and personnel and efficient training for radar operators. Naval system surveillance radars are being procured by many countries to strengthen their respective navy forces to train operators to combat the threats from advanced naval strikes that occur frequently. Naval system surveillance radar further helps the Navy officials devise navigation counter plans and detect incoming ships and land obstacles to avoid collision and attacks from unidentified threats. Naval system surveillance radar procurement is increasing in the defense sectors across various countries. Governments in several countries across the region are proposing higher naval spending budgets to help the naval and defense sectors procure more advanced radar systems for surveillance. Thus, the increasing procurement of naval system surveillance radar is driving the market growth.

Market Overview

US, Canada, Mexico are the key contributors to the naval system surveillance radar market in the North America. North America has the largest aerospace and defense market globally due to the various military, naval, and air forces. Over the years, the US increased its military spending on acquiring advanced and updated vessels, equipment, and communication. According to the data published by Stockholm International Peace Research Institute (SIPRI), the US recorded an increase in military expenses by 1.5% in 2020 compared to 2019. The increase in military expenditure by North American countries influences the growth of the naval system surveillance radar market. Further, according to Global Fire, the US has 68 submarine fleets, and Canada has 4 submarine fleets. The region leads in technological advancements and expenditure toward navy technologies that primarily drive the North America naval system surveillance radar market growth. Moreover, the region continuously witnesses the increase of radar systems for naval purposes. Further, the rising applications relevant to surveillance and analysis of radar systems for the navy and naval vehicles industry in the US, Canada, and Mexico are boosting this region's naval system surveillance market growth. For instance, in March 2020, Raytheon Missiles & Defense and the US Navy completed EASR engineering and production developmental testing. The Navy awarded the firm a US$ 126 million contract in July 2020 to manufacture four rotators and two fixed-faced radars. The growing demand for advanced and reliable radar systems is one of the major factors contributing to the growth of the naval system surveillance market. The rising trend for using surveillance radar applications to target radar cross-sections (RCS) with the help of radar systems across North America is also driving the North America naval system surveillance radar market growth.

North America Naval System Surveillance Radar Market Revenue and Forecast to 2028 (US$ Million)

North America Naval System Surveillance Radar Market Segmentation

The North America naval system surveillance radar market is segmented into type, application, and country.

- Based on type, the market is segmented into x-band and ku-band, l-band and s-band, and others. The x-band and ku-band segment registered the largest market share in 2022.

- Based on application, the market is bifurcated into weapon guidance system and surveillance. The surveillance segment held a larger market share in 2022.

- Based on country, the market is segmented into US, Canada, Mexico. US dominated the market share in 2022.

Lockheed Martin Corporation; Northrop Grumman Corporation; Raytheon Technologies Corporation; Saab AB; Thales Group; BAE Systems; Israel Aerospace Industries Ltd; Leonardo S.p.a; Ultra; and HENSOLDT. are the leading companies operating in the North America naval system surveillance radar market in the region.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Naval System Surveillance Radar Market Landscape

4.1 Market Overview

4.2 Porter’s Five Force Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

5. North America Naval System Surveillance Radar Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Growing Importance of Naval Surveillance Systems

5.1.2 Rise in Procurement of Naval System Surveillance Radar

5.2 Market Restraints

5.2.1 Design Constraints and Component Failure Due to Environment Conditions

5.3 Market Opportunities

5.3.1 Modernization of Conventional Naval System Surveillance Radar

5.4 Trends

5.4.1 Integration of Advanced Technology with Naval Radars

5.5 Impact Analysis of Drivers and Restraints

6. Naval System Surveillance Radar Market – North America Market Analysis

6.1 Naval System Surveillance Radar Market Forecast and Analysis

7. North America Naval System Surveillance Radar Market Analysis – by Type

7.1 Overview

7.2 Naval System Surveillance Radar Market, By Type (2021 and 2028)

7.3 X-band and Ku-band

7.3.1 Overview

7.3.2 X-Band and Ku-Band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

7.4 L-band and S-band

7.4.1 Overview

7.4.2 L-band and S-band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

8. North America Naval System Surveillance Radar Market Analysis – by Application

8.1 Overview

8.2 Naval System Surveillance Radar Market, By Application (2021 and 2028)

8.3 Weapon Guidance System

8.3.1 Overview

8.3.2 Weapon Guidance System: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Surveillance

8.4.1 Overview

8.4.2 Surveillance: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9. North America Naval System Surveillance Radar Market – Country Analysis

9.1 North America: Naval System Surveillance Radar Market

9.1.1 North America: Naval System Surveillance Radar Market, by Key Country

9.1.2 North America: Naval System Surveillance Radar Market, by Key Country

9.1.2.1 US: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.1.1 US: Naval System Surveillance Radar Market, by Type

9.1.2.1.2 US: Naval System Surveillance Radar Market, by Application

9.1.2.2 Canada: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.2.1 Canada: Naval System Surveillance Radar Market, by Type

9.1.2.2.2 Canada: Naval System Surveillance Radar Market, by Application

9.1.2.3 Mexico: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

9.1.2.3.1 Mexico: Naval System Surveillance Radar Market, by Type

9.1.2.3.2 Mexico: Naval System Surveillance Radar Market, by Application

10. Industry Landscape

10.1 Overview

10.2 Market Initiative

10.3 New Product Development

11. Company Profiles

11.1 Lockheed Martin Corporation

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Northrop Grumman Corporation

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Raytheon Technologies Corporation

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Saab AB

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Thales Group

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 BAE Systems

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Israel Aerospace Industries Ltd.

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Leonardo S.p.A.

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Ultra

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 HENSOLDT

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Word Index

LIST OF TABLES

Table 1. Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. US: Naval System Surveillance Radar Market, by Type–Revenue and Forecast to 2028 (US$ Million)

Table 3. US: Naval System Surveillance Radar Market, by Application –Revenue and Forecast to 2028 (US$ Million)

Table 4. Canada: Naval System Surveillance Radar Market, by Type– Revenue and Forecast to 2028 (US$ Million)

Table 5. Canada: Naval System Surveillance Radar Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 6. Mexico: Naval System Surveillance Radar Market, by Type– Revenue and Forecast to 2028 (US$ Million)

Table 7. Mexico: Naval System Surveillance Radar Market, by Application– Revenue and Forecast to 2028 (US$ Million)

Table 8. List of Abbreviation

LIST OF FIGURES

Figure 1. North America Naval System Surveillance Radar Market Segmentation

Figure 2. North America Naval System Surveillance Radar Segmentation, By Country

Figure 3. North America Naval System Surveillance Radar Market Overview

Figure 4. North America Naval System Surveillance Radar Market, By Type

Figure 5. North America Naval System Surveillance Radar Market, By Application

Figure 6. North America Naval System Surveillance Radar Market, By Country

Figure 7. North America Naval System Surveillance Radar Market: Porter’s Five Forces Analysis

Figure 8. North America Ecosystem Analysis

Figure 9. North America Naval System Surveillance Radar Market: Impact Analysis of Drivers and Restraints

Figure 10. North America Naval System Surveillance Radar Market Forecast and Analysis (US$ Million)

Figure 11. North America Naval System Surveillance Radar Market Revenue Share, by Type (2021 and 2028)

Figure 12. North America X-band and Ku-band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 13. North America L-band and S-band: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. North America Others: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. North America Naval System Surveillance Radar Market Revenue Share, by Application (2021 and 2028)

Figure 16. North America Weapon Guidance System: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. North America Surveillance: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. North America: Naval System Surveillance Radar Market Revenue Share, by Key Country (2021 and 2028)

Figure 19. North America: Naval System Surveillance Radar Market Revenue Share, by Key Country (2021 and 2028)

Figure 20. US: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. Canada: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. Mexico: Naval System Surveillance Radar Market – Revenue and Forecast to 2028 (US$ Million)

- BAE Systems.

- HENSOLDT.

- Israel Aerospace Industries Ltd.

- Leonardo S.p.a.

- Lockheed Martin Corporation.

- Northrop Grumman Corporation.

- Raytheon Technologies Corporation.

- Saab AB.

- Thales Group.

- Ultra.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America naval system surveillance radar market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America naval system surveillance radar market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the naval system surveillance radar market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution