North America Mobile ECG Devices Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Monitoring ECG Systems and Diagnostic ECG Systems), Modality (Handheld, Pen, Band, and Others), and End User (Personal Users, Hospitals and Clinics, and Ambulatory Services)

Market Introduction

ECG devices monitors and record electrical activity of the heart and the device detects and picks up electrical impulses generated by the polarization and depolarization of cardiac tissue and translate them into waveform. A mobile ECG monitoring device is the complete diagnostic solution for diagnosis of arrhythmia and provides full disclosure ECG signal, data, analysis, reporting, and allows monitoring of heart at anyplace at any time, such as, home. It consists of two divisions, including, the analog signal receiver that reads, amplifies and convert the signal to digital form and the other part is a wireless transmitter that sends the data to storage devices so that it can be analyzed by physicians and medical personnel. It connect with Wi-Fi, Bluetooth, or the internet to mobiles, tablets, among others.

Get more information on this report :

Market Overview and Dynamics

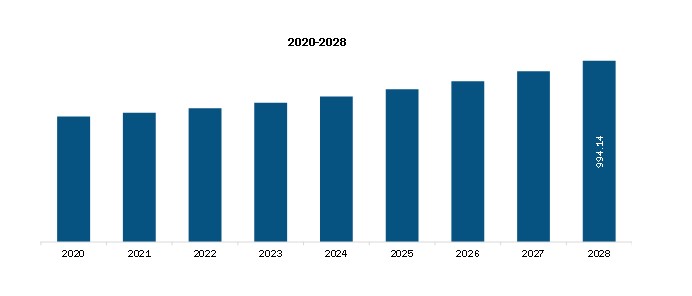

The North America mobile ECG devices market is expected to reach US$ 994.14 million by 2028 from US$ 712.04 million in 2021; it is estimated to grow at a CAGR of 4.9% from 2021 to 2028. The market growth is attributed to technological advancements in portable and handheld ECG devices, rise in the incidence of cardiovascular diseases, increase in geriatric population, and favorable government regulations regarding monitoring devices. However, aspects such as unfavorable reimbursement policies and market saturation restrict the mobile ECG devices market growth in North America.

ECG monitoring is an essential part of the healthcare services for older adults due to which the elderly population is a primary target of mobile ECG monitoring system providers. According to the US Census Bureau, the number of Americans with age 65 and above is anticipated to double from 46 million in 2016 to more than 98 million by 2060, and the share of elderly population in the total population will increase to ~24% from ~15% during this period. With a significant rise in the number of people aged 65 and above, the number of people suffering from CVDs is likely to increase in the coming years as the prevalence of these diseases is associated with aging due to weak immunity among these people. Thus, the demand for mobile and wireless devices, and other technological advancements to ensure improved CVD prevention and control is likely to rise in the future. Therefore, the geriatric population is also prone to arrhythmia, among other aging-related diseases, which is likely to boost the demand for mobile ECG devices for diagnosis and treatment during the forecast period. The ECG systems are the most effective instruments for detecting arrhythmias (abnormal heart rhythm), coronary artery disease, atrial fibrillation, previous heart attack, and other conditions. According to the World Health Organization (WHO), CVDs are the leading cause of death worldwide, which cause 17.9 million deaths in the world each year; moreover, 30 million people suffer from stroke every year. According to the WHO factsheets, ~17.7 million people died due to CVDs in 2017, of which ~7.4 million mortalities were due to coronary heart disease and 6.7 million were due to stroke. Therefore, the rise in the incidence of cardiovascular diseases and other heart-related conditions is driving mobile ECG device market growth.

The onset of COVID-19 in North America led to the overburdening of healthcare systems, and the delivery of medical care to all patients became a critical challenge in the region. Moreover, a sudden surge in number of infections led to the shortage of emergency health supplies such as ventilators, beds, and oxygen cylinders. To manage the outbreak, governments took preventive measures including total lockdowns and social distancing policies. As the COVID-19 pandemic continues to unfold, medical device companies started facing difficulties in managing their operations. Many companies offering products for cardiac monitoring have their business operations in the US, and the pandemic adversely affected these businesses due to the temporary shutdown of facilities and disturbed operations of suppliers or customers. Moreover, since March 2020, US healthcare authorities framed policies about elective cardiac surgeries. To free up hospital beds for COVID patients, hospitals had to postpone or cancel their fewer essential operations. However, demand for vital sign monitoring devices in the region had substantial impact on the adoption of ECG devices.

Key Market Segments

The North America mobile ECG devices market, based on type, has been segmented into monitoring ECG systems and diagnostic ECG systems. The monitoring ECG systems segment held a larger share of the market in 2021. Moreover, the monitoring ECG systems segment is anticipated to register a higher CAGR in the market during the forecast period due to product innovation, and incumbent usage and high-volume consumption of these products.

The North America mobile ECG devices market, based on application, is segmented into handheld, band, pen, and others. In 2021, the handheld segment held the largest share of the market. Moreover, the segment is also expected register the fastest CAGR in the market during 2021–2028.

The North America mobile ECG devices market, based on end user, is segmented into personal users, hospitals and clinics, and ambulatory services. In 2021, the personal users segment accounted for the largest share of the market. Moreover, the segment is expected to witness the highest CAGR in the market during 2021–2028.

Major Sources and Companies Listed

A few of the primary and secondary sources associated with this report on the North America mobile ECG devices market are the Centers for Disease Control and Prevention (CDC), CDC’s Division for Heart Disease and Stroke Prevention (DHDSP), and US Food and Drug Administration.

Reasons to buy the report

- Determine prospective investment areas based on a detailed trend analysis of North America mobile ECG devices market over the next years.

- Gain an in-depth understanding of the underlying factors driving demand for different addictions therapeutics segments in the top spending countries and identify the opportunities offered by each of them.

- Strengthen your knowledge of the market in terms of demand drivers, industry trends, and the latest technological developments, among others.

- Identify the major channels driving the North America mobile ECG devices market, providing a clear picture of future opportunities that will help analyze, resulting in revenue expansion.

- Channelize resources by focusing on the ongoing programs undertaken by the different countries within the North America mobile ECG devices market.

NORTH AMERICA MOBILE ECG DEVICES MARKET SEGMENTATION

- Monitoring ECG Systems

- Diagnostics ECG Systems

By Modality

By End Use

By Country

- US

- Canada

- Mexico

Company Profiles

- CardioComm Solutions Inc.

- Koninklijke Philips N.V.

- Bittium Biosignals LTD. (Subsidiary of Bittium Corporation)

- Medtronic

- AliveCor, Inc

- Nihon Kohden Corporation

- EB Neuro S.P.A

- Preventice Solutions

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Mobile ECG Devices Market – By Modality

1.3.2 North America Mobile ECG Devices Market – By Type

1.3.3 North America Mobile ECG Devices Market – By End User

1.3.4 North America Mobile ECG Devices Market – By Country

2. Mobile ECG Devices Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Mobile ECG Devices – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 North America PEST Analysis

4.3 Experts Opinion

5. Mobile ECG Devices Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Increase in Geriatric Population

5.1.2 Rise in Incidence of Cardiovascular Diseases and Heart-Related Conditions

5.1 Market Restraints

5.1.1 Stringent Regulatory Requirements and Technical Issues

5.2 Market Opportunities

5.2.1 Increasing Potential in the Developing Nations

5.3 Future Trends

5.3.1 Technological Advancements by Market Players

5.4 Impact Analysis

6. Growth Opportunities Mobile ECG Devices Market–Regional Analysis

6.1 Mobile ECG Devices Market Revenue Forecast and Analysis

7. North America Mobile ECG Devices Market Revenue and Forecasts To 2028– by Type

7.1 Overview

7.2 North America Mobile ECG Devices Market, By Type, 2021 & 2028 (%)

7.3 Monitoring ECG Systems

7.3.1 Overview

7.3.2 Monitoring ECG Systems: Mobile ECG Devices Market Revenue and Forecasts to 2028 (US$ Million)

7.4 Diagnostics ECG Systems

7.4.1 Overview

7.4.2 Diagnostics ECG Systems: Mobile ECG Devices Market Revenue and Forecasts to 2028 (US$ Million)

8. Mobile ECG Devices Market Revenue and Forecasts To 2028 – Modality

8.1 Overview

8.2 Mobile ECG Devices Market Share by Segment - 2021 & 2028 (%)

8.3 Handheld

8.3.1 Overview

8.3.2 Handheld: Mobile ECG Devices Market Revenue and Forecast to 2028 (US$ Million)

8.4 Band

8.4.1 Overview

8.4.2 Band: Mobile ECG Devices Market Revenue and Forecast to 2028 (US$ Million)

8.5 Pen

8.5.1 Overview

8.5.2 Pen: Mobile ECG Devices Market Revenue and Forecast to 2028 (US$ Million)

8.6 Others

8.6.1 Overview

8.6.2 Others: Mobile ECG Devices Market Revenue and Forecast to 2028 (US$ Million)

9. Mobile ECG Devices Market Revenue and Forecasts To 2028 – End User

9.1 Overview

9.2 Mobile ECG Devices Market Share by Segment - 2021 & 2028 (%)

9.3 Personal users

9.3.1 Overview

9.3.2 Personal users: Mobile ECG Devices Market Revenue and Forecast to 2028 (US$ Million)

9.4 Hospitals and Clinics

9.4.1 Overview

9.4.2 Hospitals and Clinics: Mobile ECG Devices Market Revenue and Forecast to 2028 (US$ Million)

9.5 Ambulatory Services

9.5.1 Overview

9.5.2 Ambulatory Services: Mobile ECG Devices Market Revenue and Forecast to 2028 (US$ Million)

10. Mobile ECG Devices Market Revenue and Forecasts to 2028 – North America Analysis

10.1 North America: Mobile ECG Devices Market

10.1.1 Overview

10.1.2 North America: Mobile ECG Devices Market – Revenue and Forecast to 2028 (US$ Million)

10.1.3 North America: Mobile ECG Devices Market, by Modality, 2019–2028 (US$ Million)

10.1.4 North America: Mobile ECG Devices Market, by Type, 2019–2028 (US$ Million)

10.1.5 North America: Mobile ECG Devices Market, by End User, 2019–2028 (US$ Million)

10.1.6 North America: Mobile ECG Devices Market, by Country, 2021 & 2028 (%)

10.1.6.1 US: Mobile ECG Devices Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.1.1 Overview

10.1.6.1.2 US: Mobile ECG Devices Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.1.3 US: Mobile ECG Devices Market, by Modality, 2019–2028 (US$ Million)

10.1.6.1.4 US: Mobile ECG Devices Market, by Type, 2019–2028 (US$ Million)

10.1.6.1.5 US: Mobile ECG Devices Market, by End User, 2019–2028 (US$ Million)

10.1.6.2 Canada: Mobile ECG Devices Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.2.1 Overview

10.1.6.2.2 Canada: Mobile ECG Devices Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.2.3 Canada: Mobile ECG Devices Market, by Modality, 2019–2028 (US$ Million)

10.1.6.2.4 Canada: Mobile ECG Devices Market, by Type, 2019–2028 (US$ Million)

10.1.6.2.5 Canada: Mobile ECG Devices Market, by End User, 2019–2028 (US$ Million)

10.1.6.3 Mexico: Mobile ECG Devices Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.3.1 Overview

10.1.6.3.2 Mexico: Mobile ECG Devices Market – Revenue and Forecast to 2028 (US$ Million)

10.1.6.3.3 Mexico: Mobile ECG Devices Market, by Modality, 2019–2028 (US$ Million)

10.1.6.3.4 Mexico: Mobile ECG Devices Market, by Type, 2019–2028 (US$ Million)

10.1.6.3.5 Mexico: Mobile ECG Devices Market, by End User, 2019–2028 (US$ Million)

11. Impact Of COVID-19 Pandemic on Mobile ECG Devices Market

11.1 North America: Impact Assessment of COVID-19 Pandemic

12. Mobile ECG Devices Market–Industry Landscape

12.1 Overview

12.2 Organic Developments

12.2.1 Overview

12.3 Inorganic Developments

12.3.1 Overview

13. Company Profiles

13.1 CardioComm Solutions Inc.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Koninklijke Philips N.V.

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Bittium Biosignals LTD. (Subsidiary of Bittium Corporation)

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Medtronic

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 AliveCor, Inc

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Nihon Kohden Corporation

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 EB Neuro S.P.A

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Preventice Solutions

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Mobile ECG Devices Market, by Modality – Revenue and Forecast to 2028 (US$ Million)

Table 2. North America Mobile ECG Devices Market, by Type– Revenue and Forecast to 2028 (US$ Million)

Table 3. North America Mobile ECG Devices Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 4. US Mobile ECG Devices Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 5. US Mobile ECG Devices Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 6. US Mobile ECG Devices Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 7. Canada Mobile ECG Devices Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 8. Canada: Mobile ECG Devices Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 9. Canada Mobile ECG Devices Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 10. Mexico Mobile ECG Devices Market, by Modality– Revenue and Forecast to 2028 (US$ Million)

Table 11. Mexico: Mobile ECG Devices Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 12. Mexico Mobile ECG Devices Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 13. Organic Developments in the Mobile ECG devices Market

Table 14. Inorganic Developments in the Mobile ECG Devices Market

Table 15. Glossary of Terms

LIST OF FIGURES

Figure 1. Mobile ECG Devices Market Segmentation

Figure 2. Mobile ECG Devices Market Segmentation, By Country

Figure 3. Mobile ECG Devices Market Overview

Figure 4. Handheld by Modality Segment Held Largest Share of Mobile ECG Devices Market

Figure 5. North America Mobile ECG Devices Market – Leading Country Markets (US$ Million)

Figure 6. North America: PEST Analysis

Figure 7. Experts Opinion

Figure 8. Mobile ECG Devices Market Impact Analysis of Driver and Restraints

Figure 9. Mobile ECG Devices Market– Revenue Forecast and Analysis – 2021 - 2028

Figure 10. North America Mobile ECG Devices Market, by Type, 2021 & 2028 (%)

Figure 11. Monitoring ECG Systems: Mobile ECG Devices Market Revenue and Forecasts to 2028 (US$ Million)

Figure 12. Diagnostics ECG Systems: Mobile ECG Devices Market Revenue and Forecasts to 2028 (US$ Million)

Figure 13. Mobile ECG Devices Market Share by Segment - 2021 & 2028 (%)

Figure 14. Handheld: Mobile ECG Devices Market Revenue and Forecasts To 2028 (US$ Million)

Figure 15. Band: Mobile ECG Devices Market Revenue and Forecasts To 2028 (US$ Million)

Figure 16. Pen: Mobile ECG Devices Market Revenue and Forecasts To 2028 (US$ Million)

Figure 17. Others: Mobile ECG Devices Market Revenue and Forecasts To 2028 (US$ Million)

Figure 18. Mobile ECG Devices Market Share by Segment - 2021 & 2028 (%)

Figure 19. Personal users: Mobile ECG Devices Market Revenue and Forecasts To 2028 (US$ Million)

Figure 20. Hospitals and Clinics: Mobile ECG Devices Market Revenue and Forecasts To 2028 (US$ Million)

Figure 21. Ambulatory Services: Mobile ECG Devices Market Revenue and Forecasts To 2028 (US$ Million)

Figure 22. North America: Mobile ECG Devices Market, by Key Country – Revenue (2021) (US$ Million)

Figure 23. North America Mobile ECG Devices Market Revenue and Forecast to 2028 (US$ Million)

Figure 24. North America: Mobile ECG Devices Market, by Country, 2021 & 2028 (%)

Figure 25. US: Mobile ECG Devices Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Canada: Mobile ECG Devices Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. Mexico: Mobile ECG Devices Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. Impact of COVID-19 Pandemic in North American Country Markets

- American Elements

- BASF SE

- Burgess Pigment Company

- Imerys S.A.

- Sibelco

- Thiele Kaolin Company

- I-Minerals Inc.

- KaMin LLC

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America mobile ECG devices market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America mobile ECG devices market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.