The market's growth is attributed to advancements in sutures and an increase in cases of chronic wounds and surgeries. However, noninvasive alternatives to stitches are likely to hinder the market's growth during the forecast period.

Sutures are used to stabilize the wound and promote natural healing. Therefore, they are widely required for post-operative wound closure. Sutures are also used to treat other deep wounds, including wounds caused due to road and occupational accidents, orthopedic injuries, and injuries caused due to sports. Wound healing is an unmet therapeutic challenge faced by healthcare providers worldwide. Wound care management is a complex procedure as several factors play a role in the healing; however, suturing has transformed the wound closure process, which is followed by faster healing. For instance, in September 2021, Winter Innovations Inc. announced the US Food and Drug Administration (FDA) 510(k) clearance for its EasyWhip. The EasyWhip is a patented two-part needle featuring a needle tip and a connectable rod. EasyWhip helps create a continuous suture loop and creates a straight length of suture patterns, allowing fast and easy stitching to heal orthopedic injuries, which cannot be done with traditional needles.

The development of absorbable and biodegradable sutures offering faster healing has led to evolutions in suturing techniques. These sutures eliminate the need for suture or stitch removal, which proves specifically helpful for treating pediatric and geriatric patients. Such developments boost the adoption of automated suturing devices by reducing complications caused by traditional suturing. Automated suturing devices are safer, quicker, and more accurate than manual suturing. It also reduces the risk of subsequent tissue trauma and scarring by optimizing the needle force and size required for safe and efficient suturing. Moreover, automated suturing devices reduce the risk of needle stick injuries and the combined-risk of infections such as HIV and Hepatitis B among healthcare practitioners.

Further developments have led to robotic suture/endoscopic suturing devices that are suitable for robotically aided surgeries. These techniques reduce the need for open operations, increase the speed of suturing, and ensure better access to hard-to-reach areas in the subject body. Robotic suturing has also increased the accuracy of suturing in cosmetic and internal surgeries, wherein a limited movement is permitted by reducing human errors. Thus, the developments in sutures are leading to the growth of the hospital suture market.

Based on product, the North America hospital suture market is divided into sutures, automated suturing devices, and others. In terms of nature, the market is segmented into absorbable sutures and non-absorbable sutures. Based on type, the market is divided into monofilament and braided. In terms of application, the market is categorized into general surgery, cardiovascular surgery, orthopedic surgery, and others. Geographically, the North America hospital suture market is divided into the US, Canada, and Mexico.

Assut Medical Sarl, Péters Surgical, SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang, DemeTECH Corporation, Teleflex Incorporated, Smith & Nephew, B. Braun Melsungen AG, Johnson and Johnson Services, Inc., Medtronic; and W. L. Gore and Associates, Inc. are among the leading companies operating in the North America hospital suture market.

| Report Attribute | Details |

|---|---|

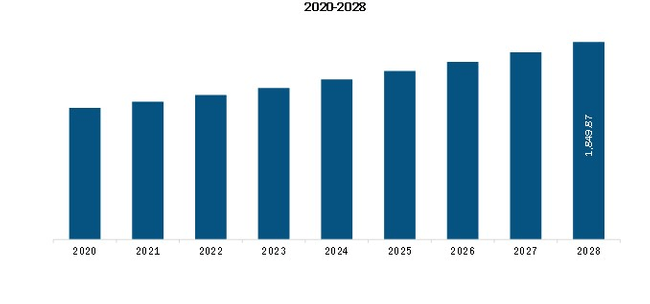

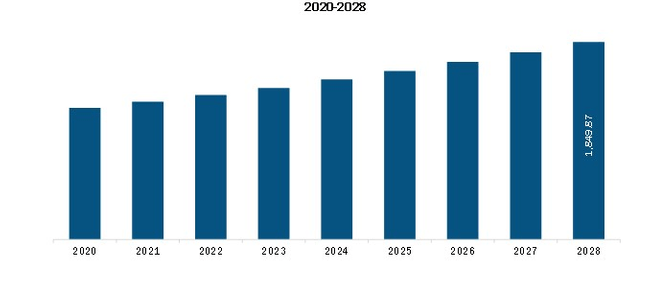

| Market size in 2021 | US$ 1,251.61 Million |

| Market Size by 2028 | US$ 1,849.87 Million |

| CAGR (2021 - 2028) | 5.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The North America Hospital Suture Market is valued at US$ 1,251.61 Million in 2021, it is projected to reach US$ 1,849.87 Million by 2028.

As per our report North America Hospital Suture Market, the market size is valued at US$ 1,251.61 Million in 2021, projecting it to reach US$ 1,849.87 Million by 2028. This translates to a CAGR of approximately 5.7% during the forecast period.

The North America Hospital Suture Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Hospital Suture Market report:

The North America Hospital Suture Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Hospital Suture Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Hospital Suture Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)