The market's growth is attributed to the rise in the usage of smart sutures and the wide availability of health insurance. However, noninvasive alternatives to stitches are likely to hinder the market's growth during the forecast period.

The growing awareness about the availability of insurance for most surgical treatments is accelerating the number of surgeries in developed and developing countries. Similarly, under private insurance, ~34% of the total hospital care expenses are paid by insurance companies, while patients bear 11% of the cost. Other sources that include public health insurance programs—such as the Children's Health Insurance Program (CHIP), programs of the Department of Veterans Affairs (VA) and the Department of Defense (DoD)—and other third-party payers—such as workers' compensation, and other state and local programs—cover 18% of the cost of surgeries. Therefore, the availability of insurance cover and increase in healthcare expenditure by public organizations allow people to opt for surgeries for improved outcomes, increased patient satisfaction, and greater yields in clinical effectiveness, which is creating significant opportunities for hospital suture providers to scale up their production levels for addressing the growing demands for sutures.

According to the American College of Surgeons, globally, 1–2% of people are likely to suffer from a chronic wound once in their lifetime. Apart from sharp injuries, the cases of work-related injuries or occupational injuries are rising worldwide. These wounds affect patients' health and quality of life. The burden of chronic wounds eventually underlines the need for advanced wound care management to reduce the financial burden from national healthcare systems substantially. Various countries spend significant amounts on treating injuries and avoiding associated risks. Therefore, with a surge in the occurrence of chronic wounds, the demand for hospital sutures is also increasing worldwide.

Further, the number of cardiovascular, general, orthopedic, gynecological, and cancer surgeries performed in hospitals is increasing tremendously worldwide. Moreover, the growing geriatric population is primarily responsible for severe health conditions requiring surgeries as the treatment option. Surgeries for hernias and cataracts are more common among older adults. Further, the rise in aesthetic surgery is more common among people working in the entertainment industry. These surgeries are performed on patients who require the replacement of a body part due to an injury or a deformity. Therefore, a rise in the number of surgeries being performed at hospitals or similar healthcare centers is driving the demand for sutures.

Based on product, the Middle East & Africa suture market is divided into sutures, automated suturing devices, and others. In terms of nature, the market is segmented into absorbable sutures and non-absorbable sutures. Based on type, the market is divided into monofilament and braided. In terms of application, the market is categorized into general surgery, cardiovascular surgery, orthopedic surgery, and others. Geographically, the Middle East & Africa hospital suture market is divided into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa.

Assut Medical Sarl, Péters Surgical., SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang, DemeTECH Corporation, Teleflex Incorporated, Smith & Nephew, B. Braun Melsungen AG, Johnson and Johnson Services, Inc., Medtronic; and W. L. Gore and Associates, Inc. are among the leading companies operating in the Middle East & Africa hospital suture market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 318.19 Million |

| Market Size by 2028 | US$ 447.35 Million |

| CAGR (2021 - 2028) | 5.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

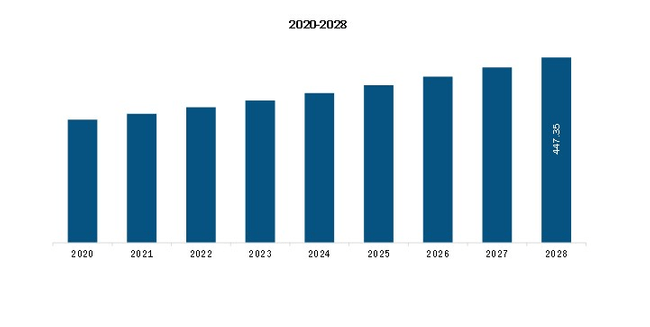

The Middle East & Africa Hospital Suture Market is valued at US$ 318.19 Million in 2021, it is projected to reach US$ 447.35 Million by 2028.

As per our report Middle East & Africa Hospital Suture Market, the market size is valued at US$ 318.19 Million in 2021, projecting it to reach US$ 447.35 Million by 2028. This translates to a CAGR of approximately 5.0% during the forecast period.

The Middle East & Africa Hospital Suture Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Hospital Suture Market report:

The Middle East & Africa Hospital Suture Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Hospital Suture Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Hospital Suture Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)