Fuelling Services Contribute Significantly to Fixed-Base Operator Service Business is Driving the North America Fixed-Base Operator Market

The fixed-base operators offer a diversified range of services such as hangaring, fuelling, flight instructions, aircraft maintenance, and aircraft rental. Of these, fuelling is the highest revenue generating segments. FBOs across the world offer fuelling services of AVGAS to the piston engine aircraft and/or Jet Fuel to the turbine-powered aircraft. The fuelling services involve selling fuel to plane owners as well as offering them places to park their planes. Since, the business aviation sector has been growing strongly over the past few years (pre-COVID), the demand for fuelling service provider also surged. In addition, several FBOs in the current scenario are offering Sustainable Aviation Fuel (SAF) as a strategy to help the general aviation jet operators to reduce carbon footprint. The distribution of SAF among the FBOs is also aimed at improving their services and attract customers. Signature Aviation and Atlantic Aviation are among the leading FBOs offering SAF to their customers. The growing attraction towards SAF among the FBOs is analyzed to understand the future scenario of the market and has been considered to be one of the crucial driving parameters for the North America fixed-base operator market. Moreover, several airport authorities are continuously investing in the deployment of fixed-based operators to provide different services to travelers availing general aviation for enhancing their travelling experience. For instance, in February 2021, a mainland aircraft services announced its partnership by investing ~US$ 12 million for a luxury "fixed-base operation" and fuel farm at Kalaeloa Airport. The Freeman Holdings Group (Kansas) and Million Air (Texas) together operate as an FBO in the US and offer services such as fuelling, repair, and pilot lounges. -North America. Therefore, such investments in FBO operation in the airport supports the growth of fuelling services among the aircraft owners.

North America Fixed-Base Operator Market Overview

North America is known to have the largest fleet of general aviation aircraft globally, and these aircraft require regular FBO services for operational availability. These economies are characterized by high disposable individual incomes, higher standards of living, and rapid technological advancements in the arena of general aviation and general aviation airport infrastructure. North America comprises the largest fleet of business and personal jets aircraft in the world. Huge volumes of business and personal fleets in operations in the domestic as well as international arena, coupled with the rise in number of FBOs present in the region, propel the North America fixed-base operator market. The general aviation industry in the region is matured and has the presence of several aircraft OEMs. Also, there is an increase in government investments in R&D and the procurement of advanced helicopters, private jets, and trainer aircraft from the regional general aviation service players. The growing focus on enhancing the infrastructure of private airports, along with favorable changes in regulations, is also supporting the North America fixed-base operator market in North America. Furthermore, the presence of large number of FBOs in the region such as Pentastar Aviation, Xjet, AirFlite, JA Air Center, Tampa International Jet Center, Wilson Air Center, Global Select, Jet Aviation Palm Beach, Meridian Teterboro, and Banyan Air Service, is positively influencing the growth of the market. The FBOs in the region offer diversified general aviation services such as storage, fueling, catering, concierge services, meeting rooms, and maintenance services. The region consists of maximum number of public use and private use airports with one or more than one FBOs present at the airports.

Moreover, some of the recent developments across the North America FBO market include:

• In June 2022, a new fixed-base operator (FBO) providing aeronautical services officially opened at the Wilmington International Airport.

• In November 2022, Texas’s Perot Field Fort Worth Alliance Airport announced the opening of a new FBO terminal across its airport premises.

• In September 2022, Modern Aviation announced that it has closed the acquisition of the FBO assets and operations at Des Moines International Airport from Elliott Aviation, bringing its total number of locations to 13.

However, the COVID-19 pandemic has significantly affected the aviation sector in this region due to various containment measures imposed by the governments such as travel restrictions, shutdowns of businesses, and lockdowns. With the economies reopening in this region and travel industry pacing up, the demand for private jets for traveling with enhanced safety is also upscaling. This is showcasing a rise in demand for fixed-based operator services, thereby boosting the fixed-based operator market. Also, key market players such as Signature Aviation, Jet Aviation (a subsidiary of General Dynamics Corporation), and Universal Aviation among others, operate in the region, which is a key driving factor for the North America fixed-based operator market.

Strategic insights for the North America Fixed-Base Operator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Fixed-Base Operator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Fixed-Base Operator Strategic Insights

North America Fixed-Base Operator Report Scope

Report Attribute

Details

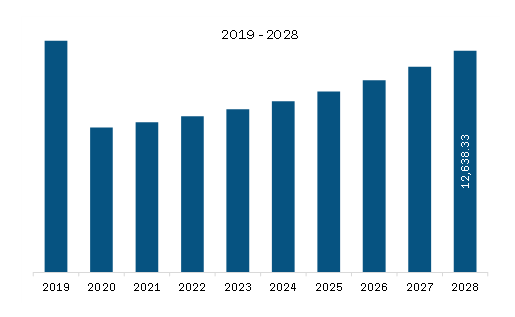

Market size in 2022

US$ 8,897.06 Million

Market Size by 2028

US$ 12,638.33 Million

CAGR (2022 - 2028) 6.0%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Services Offered

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Fixed-Base Operator Regional Insights

North America Fixed-Base Operator Market Segmentation

The North America fixed-base operator market is segmented into services offered, application, and country.

Based on services offered, the North America fixed-base operator market is segmented into hangaring, fuelling, flight training, aircraft maintenance, aircraft rental. In 2022, the fuelling segment registered a largest share in the North America fixed-base operator market.

Based on application, the North America fixed-base operator market is bifurcated into Business aviation and leisure aviation. In 2022, the Business aviation segment registered a larger share in the North America fixed-base operator market.

Based on country, the North America fixed-base operator market is segmented into the US, Canada, and Mexico. In 2022, the US segment registered a largest share in the North America fixed-base operator market.

Abilene Aero; Atlantic Aviation FBO Inc.; Avemex SA De CV; DEER JET CO. LTD.; dnata Corporation; ExecuJet Aviation Group AG; General Dynamics Corporation; Jetex; Luxaviation; Signature Aviation; Swissport; and Universal Weather and Aviation, Inc. are the leading companies operating in the North America fixed-base operator market.

The North America Fixed-Base Operator Market is valued at US$ 8,897.06 Million in 2022, it is projected to reach US$ 12,638.33 Million by 2028.

As per our report North America Fixed-Base Operator Market, the market size is valued at US$ 8,897.06 Million in 2022, projecting it to reach US$ 12,638.33 Million by 2028. This translates to a CAGR of approximately 6.0% during the forecast period.

The North America Fixed-Base Operator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Fixed-Base Operator Market report:

The North America Fixed-Base Operator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Fixed-Base Operator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Fixed-Base Operator Market value chain can benefit from the information contained in a comprehensive market report.