North America Dental Implants Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 121 | Report Code: TIPRE00008107 | Category: Life Sciences

No. of Pages: 121 | Report Code: TIPRE00008107 | Category: Life Sciences

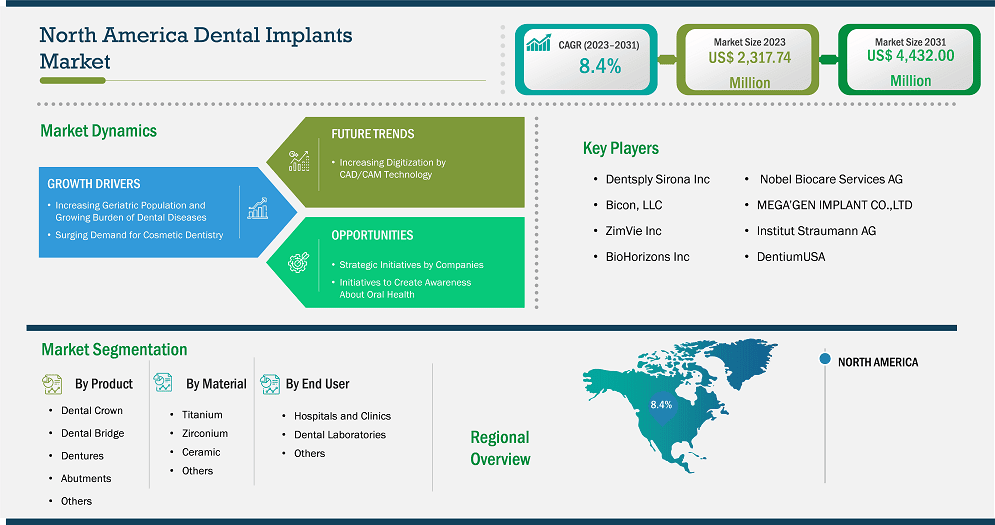

The North America dental implants market size is expected to reach US$ 4,432.00 million by 2031 from US$ 2,317.74 million in 2023. The market is estimated to record a CAGR of 8.4% from 2023 to 2031.

North America region includes countries such as the US, Canada, and Mexico. increasing prevalence of dental diseases, wide acceptance of technological advancements in dental implants, and an increasing number of dental visits are propelling the growth of the dental implant market. In addition, rising government support regarding dental coverage for dental services across the countries also favors the growth of the dental implant market in the forecast period.

Key segments that contributed to the derivation of the dental implants market analysis are product, material, and end user.

Neglecting dental health can lead to numerous dental issues, including cavities and gum disease. It is crucial to educate and spread knowledge on correct dental care and the prevention of dental diseases through dental professionals, community outreach initiatives, and appropriate public health awareness initiatives to foster individual and societal well-being. By increasing awareness, promoting learning, and enhancing the availability of dental care, a healthier future with improved oral health can be attained. Dental and oral health awareness has increased worldwide through various initiatives. For instance, World Oral Health Day is celebrated on March 20 every year. It highlights the advantages of good oral health and the importance of dental health and its impact on overall health and well-being, spreads awareness about oral diseases, and promotes oral hygiene maintenance. The 2019 World Oral Health Day theme was "Say Ahh: Act on Mouth Health." This campaign helped raise awareness among people about taking concrete actions to prevent oral disease and safeguard their entire health. The theme focused on individuals and oral health professionals, as they are also stakeholders in educating and protecting patients from oral diseases. Policymakers are also aiming to address the burden of oral diseases and integrate oral health into policies that address other diseases.

The governments of various countries are also focusing on promoting oral health among their people. In addition, the Department of Health and Human Services (HHS), the US, supports a broad spectrum of oral health activities that significantly aid the nation's oral health through oral health financing, research, workforce development, public health action, quality initiatives, and technology. These initiatives by the government and institutions to create awareness about dental health among the people are expected to support the growth of the dental implants market.

Based on geography, the North America dental implants market comprises the US, Canada, and Mexico. The US held the largest share in 2023.

Dental diseases are one of the most preventable public health challenges in the US. According to the World Health Organization cites ‘alarming’ dental statistics published in November 2022, more than 1 in 4 (26%) adults in the US have untreated tooth cavities. Additionally, nearly half (46%) of all adults aged 30 years or over show signs of gum disease. Millions of people in the country have some form of periodontal disease. As per the US Gum Disease & Gingivitis Statistics, published in January 2024, about 30% of adults have moderate gum disease, 9% of adults in the country have severe gum disease, and 8.52% have some concerns with their gums. As per the American Dental Association (2020), ~5 million people aged 65–74 are edentulous in the country. Therefore, the high prevalence of dental diseases fuels the demand for dental implants in the country.

As per the American Academy of Cosmetic Dentistry, about US$ 2.75 billion is spent annually on cosmetic dentistry in the US. Moreover, numerous private and government organizations provide reimbursement policies to raise awareness of oral and dental care in the country. For instance, in 2017, the American Academy of Pediatric Dentistry, an authority on children’s oral health, provides a policy on third-party reimbursement to enhance medical care and manage patients with special healthcare needs. In addition, the CDC provides a Dental Public Health Residency Program to develop skilled specialists in dental public health. This residency program offers lucrative opportunities for dental participants to achieve improved oral health and guided practice in collaboration with public health.

Furthermore, several market players focus on implementing organic and inorganic strategies for market development. For instance, Straumann Group entered into a strategic partnership with Aspen Dental Management, Inc. (ADMI) in September 2021 to provide dental implant solutions, abutments, and CAD/CAM options to more than 1,000 ADMI and affiliated workplaces throughout 45 US states. Additionally, in January 2021, by introducing the Xeal and TiUltra surfaces in the country, Nobel Biocare encouraged dental practitioners to join the Mucointegration era. These innovative surfaces are used on implants and abutments to improve tissue integration at each level.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,317.74 Million |

| Market Size by 2031 | US$ 4,432.00 Million |

| CAGR (2023 - 2031) | 8.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include DentiumUSA; Dentsply Sirona Inc; Bicon, LLC; ZimVie Inc; BioHorizons Inc; Nobel Biocare Services AG; MEGA’GEN IMPLANT CO.,LTD; and Institut Straumann AG among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The North America Dental Implants Market is valued at US$ 2,317.74 Million in 2023, it is projected to reach US$ 4,432.00 Million by 2031.

As per our report North America Dental Implants Market, the market size is valued at US$ 2,317.74 Million in 2023, projecting it to reach US$ 4,432.00 Million by 2031. This translates to a CAGR of approximately 8.4% during the forecast period.

The North America Dental Implants Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Dental Implants Market report:

The North America Dental Implants Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Dental Implants Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Dental Implants Market value chain can benefit from the information contained in a comprehensive market report.