North America Connected Gym Equipment Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Type (Cardiovascular Training and Strength Training) and End-Users (Residential, Gym, and Other Commercial Users)

Market Introduction

In North America, advanced technology is going to support the adoption of digitally connected gym equipment to a large extent. United States and Canada together have the largest number of fitness clubs in the world (approximately 35,000–38,000). The craze for connected fitness experience is increasing especially in youngsters and many companies are incorporating digital technologies in their machines. Developments in technologies, such as AI, cloud and wearable technology are expected to increase the implementation of modern exercise techniques which provide immersive workout experiences. In October 2019, a digital platform JRNY was launched by Nautilus which uses AI for offering customized workouts. The equipment adjusts automatically according to the user. There has been a strong demand for robust strength training equipment for enhanced joint flexibility and bone health. For better health, the American Heart Association has recommended strength training at least twice a week. In March 2018, Matrix Fitness introduced a training console which offered guided training experience for its users. It also facilitated strength training for beginners. Rising health concerns and growing technological advancement in connected gym equipment are the major factor driving the growth of the North America connected gym equipment market.

In case of COVID-19, North America is highly affected specially the US, with several thousands of infected people facing critical health problems across the entire country. Rising number of corona cases had also compelled the government to impose lockdown across the borders of the nation. Since gyms are closed, professional trainers, gym owners, and supporting staff are facing serious troubles. Owners are finding it difficult to pay rents, bank loans, salaries of employees and electricity bills. Many boutique gyms operate on small margins and hence this pandemic has posed a big question on their existence itself. The brick-and-mortar gyms in the US constitute the highest share of country’s fitness industry and has suffered the most. Since uncertainty of this virus still prevails, there has been a need for the fitness industry to restructure itself in accordance with changing times. Many have already started going creative and digital with online streaming of sessions for their users from various locations. Despite all these, there was sever impact on the growth of the connected gym equipment market in this region.

Get more information on this report :

Market Overview and Dynamics

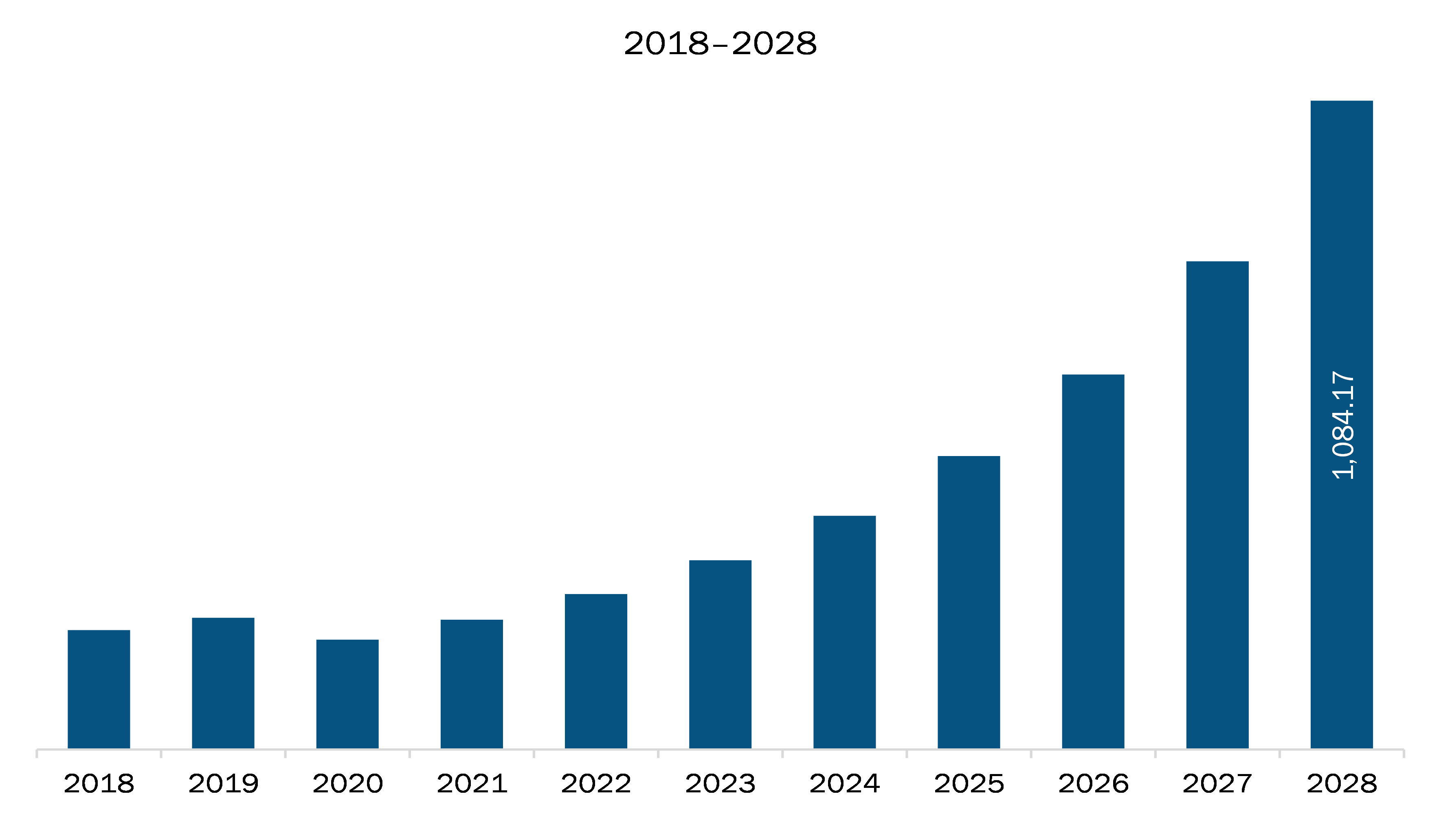

The North America connected gym equipment market is expected to grow from US$ 216.89 million in 2021 to US$ 1,084.17 million by 2028; it is estimated to grow at a CAGR of 25.8% from 2021 to 2028. Increasing demand for residential connected gym equipment is expected to escalate the market growth. Considering not only the pandemic of COVID-19, otherwise also, people have got different timing schedules according to their professions. General timings in gyms and health club may not be suitable for very customer. Also, the user’s timing and trainer’s timing should match for the workout session. There lies a great opportunity in designing and manufacturing affordable connected gym equipment for residential use as users are inclining towards privacy and convenience. Demand for smart fitness equipment is increasing across North American countries. Also, disposable house-hold incoming is increasing noticeably in many North American countries. Considering buying capacity and space available at home, manufacturers have also got an opportunity for customization of smart equipment and machines. Doing this will significantly increase the demand for mid-price segment connect gym equipment. With the use of advanced technology, various new smart fitness equipment can be introduced which provides treatment for various diseases and disorder other than cardiovascular training and strength training. Doctors, physicians, and tech-experts can work together for developing such products. With research and development, companies can identify new needs and wants of the customers, which will create a significant opportunity for launching new products that will cater to several different applications, thereby driving the North America market.

Key Market Segments

In terms of type, the cardiovascular training segment accounted for the largest share of the North America connected gym equipment market in 2020. In terms of end-users, the gym segment held a larger market share of the North America connected gym equipment market in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the North America connected gym equipment market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Cybex International, Inc.; Draper, Inc.; EGYM; Johnson Health Tech; LES MILLS INTERNATIONAL LTD; Life Fitness; Nautilus, Inc.; Precor Incorporated; Technogym S.p.A; and TRUE Fitness Technology, Inc.

Reasons to buy report

- To understand the North America connected gym equipment market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America connected gym equipment market

- Efficiently plan M&A and partnership deals in North America connected gym equipment market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form North America connected gym equipment market

- Obtain market revenue forecast for market by various segments from 2021-2028 in North America region.

North America Connected Gym Equipment Market Segmentation

North America Connected Gym Equipment Market - By Type

- Cardiovascular Training

- Strength Training

North America Connected Gym Equipment Market - By End-Users

- Residential

- Gym

- Other Commercial Users

North America Connected Gym Equipment Market - By Country

- US

- Canada

- Mexico

North America Connected Gym Equipment Market - Company Profiles

- Cybex International, Inc.

- Draper, Inc.

- EGYM

- Johnson Health Tech

- LES MILLS INTERNATIONAL LTD

- Life Fitness

- Nautilus, Inc.

- Precor Incorporated

- Technogym S.p.A

- TRUE Fitness Technology, Inc.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 North America Connected Gym Equipment Market – By Type

1.3.2 North America Connected Gym Equipment Market – By End-Users

1.3.3 North America Connected Gym Equipment Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Connected Gym Equipment Market Landscape

4.1 Market Overview

4.2 North America PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinions

5. North America Connected Gym Equipment Market – Key Industry Dynamics

5.1 Key Market Drivers

5.1.1 Rising Health Concerns

5.1.2 Growing Technological Advancement in Connected Gym Equipment

5.2 Key Market Restraints:

5.2.1 Costly Connected Gym Equipment

5.3 Key Market Opportunities:

5.3.1 Increasing Demand for Residential Connected Gym Equipment

5.4 Key Market Trends:

5.4.1 Transforming Smart Fitness Technology

5.5 Impact Analysis of Drivers and Restraints

6. Connected Gym Equipment Market – North America Analysis

6.1 North America Connected Gym Equipment Market Overview

6.2 North America Connected Gym Equipment Market- Revenue and Forecast to 2028 (US$ Million)

7. North America Connected Gym Equipment Market Analysis – By Type

7.1 Overview

7.2 North America Connected Gym Equipment Market Breakdown, By Type (2020 and 2028)

7.3 Cardiovascular Training

7.3.1 Overview

7.3.2 Cardiovascular Training: Connected Gym Equipment Market- Revenue and Forecast to 2028 (US$ Million)

7.4 Strength Training

7.4.1 Overview

7.4.2 Strength Training: Connected Gym Equipment Market- Revenue and Forecast to 2028 (US$ Million)

8. North America Connected Gym Equipment Market Analysis – By End-Users

8.1 Overview

8.2 North America Connected Gym Equipment Market, By End-Users (2020 and 2028)

8.3 Residential

8.3.1 Overview

8.3.2 Residential: Connected Gym Equipment Market- Revenue and Forecast to 2028 (US$ Million)

8.4 Gym

8.4.1 Overview

8.4.2 Gym: Connected Gym Equipment Market- Revenue and Forecast to 2028 (US$ Million)

8.5 Other Commercial Users

8.5.1 Overview

8.5.2 Other Commercial Users: Connected Gym Equipment Market- Revenue and Forecast to 2028 (US$ Million)

9. North America Connected Gym Equipment Market – Country Analysis

9.1 Overview

9.1.1 North America: Connected Gym Equipment Market, by Key Country

9.1.1.1 US: Connected Gym Equipment Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.1.1 US: Connected Gym Equipment Market, by Type

9.1.1.1.2 US: Connected Gym Equipment Market, by End-Users

9.1.1.2 Canada: Connected Gym Equipment Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.2.1 Canada: Connected Gym Equipment Market, by Type

9.1.1.2.2 Canada: Connected Gym Equipment Market, by End-Users

9.1.1.3 Mexico: Connected Gym Equipment Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.3.1 Mexico: Connected Gym Equipment Market, by Type

9.1.1.3.2 Mexico: Connected Gym Equipment Market, by End-Users

10. North America Connected Gym Equipment Market- COVID-19 Impact Analysis

10.1 North America

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

11.3 New Product Development

12. Company Profiles

12.1 EGYM

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 Life Fitness

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 LES MILLS INTERNATIONAL LTD

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Technogym S.p.A

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Precor Incorporated

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Cybex International, Inc.

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Johnson Health Tech

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Draper, Inc.

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Nautilus, Inc.

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 TRUE Fitness Technology, Inc.

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Word Index

LIST OF TABLES

Table 1. North America Connected Gym Equipment Market – Revenue and Forecast to 2028 (US$ Million)

Table 2. North America Connected Gym Equipment Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 3. US: Connected Gym Equipment Market, by Type –Revenue and Forecast to 2028 (US$ Million)

Table 4. US: Connected Gym Equipment Market, by End-Users –Revenue and Forecast to 2028 (US$ Million)

Table 5. Canada: Connected Gym Equipment Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 6. Canada: Connected Gym Equipment Market, by End-Users –Revenue and Forecast to 2028 (Canada$ Million)

Table 7. Mexico: Connected Gym Equipment Market, by Type – Revenue and Forecast to 2028 (US$ Million)

Table 8. Mexico: Connected Gym Equipment Market, by End-Users –Revenue and Forecast to 2028 (Mexico$ Million)

Table 9. List of Abbreviation

LIST OF FIGURES

Figure 1. North America Connected Gym Equipment Market Segmentation

Figure 2. North America Connected Gym Equipment Market Segmentation – By Country

Figure 3. North America Connected Gym Equipment Market Overview

Figure 4. Cardiovascular Training Segment held the Largest Share of North America Connected Gym Equipment Market

Figure 5. Gym segment held the Largest Share of North America Connected Gym Equipment Market

Figure 6. Mexico to Show Great Traction During Forecast Period

Figure 7. North America – PEST Analysis

Figure 8. North America Connected Gym Equipment Market Ecosystem

Figure 9. Expert Opinions

Figure 10. North America Connected Gym Equipment Market Impact Analysis of Drivers and Restraints

Figure 11. North America Connected Gym Equipment Market - Revenue and Forecast to 2028 (US$ Million)

Figure 12. North America Connected Gym Equipment Market Breakdown, By Type (2020 and 2028)

Figure 13. North America Cardiovascular Training: Connected Gym Equipment Market- Revenue and Forecast to 2028 (US$ Million)

Figure 14. North America Strength Training: Connected Gym Equipment Market- Revenue and Forecast to 2028 (US$ Million)

Figure 15. North America Connected Gym Equipment Market Breakdown, By End-Users (2020 and 2028)

Figure 16. North America Residential: Connected Gym Equipment Market- Revenue and Forecast to 2028 (US$ Million)

Figure 17. North America Gym: Connected Gym Equipment Market- Revenue and Forecast to 2028 (US$ Million)

Figure 18. North America Other Commercial Users: Connected Gym Equipment Market- Revenue and Forecast to 2028 (US$ Million)

Figure 19. North America: Connected Gym Equipment Market, by Key Country – Revenue (2020) (USD Million)

Figure 20. North America: Connected Gym Equipment Market Revenue Share, by Key Country (2020 and 2028)

Figure 21. US: Connected Gym Equipment Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. Canada: Connected Gym Equipment Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. Mexico: Connected Gym Equipment Market – Revenue and Forecast to 2028 (US$ Million)

Figure 24. Impact of COVID-19 Pandemic in North American Country Markets

- Cybex International, Inc.

- Draper, Inc.

- EGYM

- Johnson Health Tech

- LES MILLS INTERNATIONAL LTD

- Life Fitness

- Nautilus, Inc.

- Precor Incorporated

- Technogym S.p.A

- TRUE Fitness Technology, Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the North America connected gym equipment market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in North America connected gym equipment market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the connected gym equipment market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution