The US, Canada, and Mexico are among the major countries in North America. The US is a developed country in terms of modern technology, standard of living, infrastructure, etc. Moreover, owing to a increasing customer demand for high-quality products and services, companies are continuously innovating their offerings to serve their customers in the best possible way. Autonomous driving has gained huge importance in North America. Technology leaders are collaborating with manufacturing enterprises and automotive companies for the successful implementation in the automotive industry. North America has a developed automotive market and is considered as one of the largest commercial vehicle producers and consumers nations in the world. The demand for commercial and military heavy-duty vehicles is the all-time high in the region due to a continuously high need for logistics and transportation in countries such as the US, Canada, and Mexico. Thus, North America has recorded the significant sales of trucks, trailers, and other heavy-duty vehicles in recent years. The adoption of tire pressure monitoring systems (TPMS) on all commercial vehicles has been mandated by the US government. In addition, the Greenhouse Gas (GHG) regulation implemented by the US Environmental Protection Agency (EPA) is anticipated to catalyze the use of electric vehicles (EVs), thereby boosting the demand for automotive ECUs in the region.

In case of COVID-19, North America is highly affected specially the US. An exponential rise in the number of COVID-19 cases compelled governments in North American countries to impose lockdown in the respective countries. The majority of the manufacturing plants were shut down, municipalities were functioning at a slower pace than that in the past, and the automotive industry has been at a halt, which adversely affected the North American automotive ECU market in 2020. North America accounts for a major share of automotive ECU sales, and declining sales of ECU in North America might affect the growth of the lobal automotive ECU industry. The impact of the pandemic is expected to persist for a short term. The short-term effect of COVID-19 would not affect the recovery of the overall sales performance of the automotive industry; this is mainly attributed to the continuous promotion of passenger vehicles by various companies in the North America. However, the automotive sector is regaining its pace with the resumption of operations at manufacturing units, which would boost the adoption of automotive ECUs in the coming years.

Strategic insights for the North America Automotive ECU provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

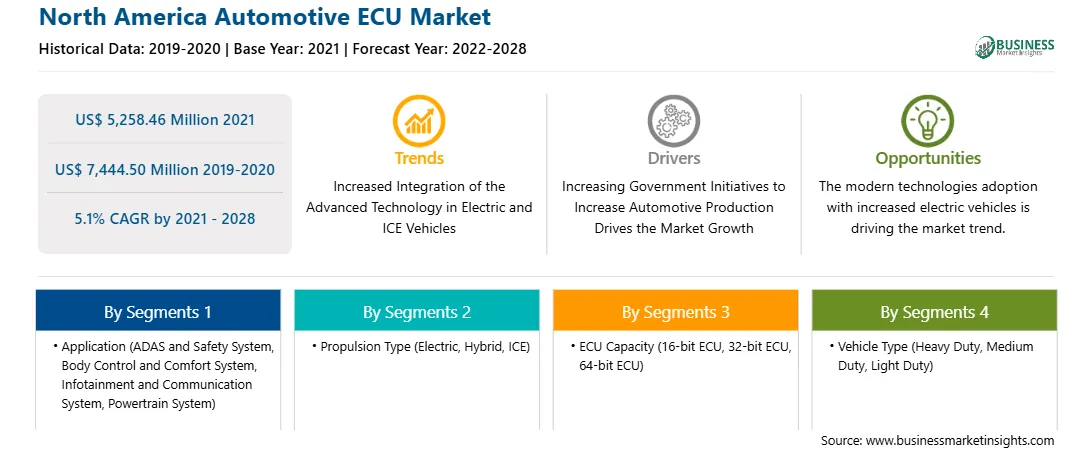

| Market size in 2021 | US$ 5,258.46 Million |

| Market Size by 2028 | US$ 7,444.50 Million |

| Global CAGR (2021 - 2028) | 5.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Automotive ECU refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America automotive ECU market is expected to grow from US$ 5,258.46 million in 2021 to US$ 7,444.50 million by 2028; it is estimated to grow at a CAGR of 5.1% from 2021 to 2028. The demand for automotive electronic control unit (ECU) is increasing at a notable rate in the SUVs segment of the automotive sector. The rising demand for SUVs is thus boosting the growth of automotive ECU market. The popularity of SUVs continues to grow in almost every market in the region. As the marketplace has experienced tremors due to trade tensions and a slowdown in the market, car manufacturers look for new ways to expand their presence. The shifting interest of customers from sedan or hatchbacks to SUVs started 7 years ago and is still progressing strong, which has encouraged vehicle manufacturers to focus on integrating advance automotive ECUs in these vehicles. GM keeps the lead but it squandered some of its market share to Toyota, Nissan, Ford, and Honda. FCA, the second-largest player, overtook shares on the back of its new offerings—Jeep Wrangler and Compass. VW Group, Hyundai-Kia, Mazda, Subaru, and BMW Group are among the other major SUV market shareholders in the region. Thus, the proliferation of SUV market is driving the demand and adoption of automotive ECUs in the North America region.

In terms of application, the ADAS and Safety System segment accounted for the largest share of the North America automotive ECU market in 2020. In terms of propulsion type, the ICE segment held a larger market share of the North America automotive ECU market in 2020. In terms of ECU capacity, the 32-bit ECU segment held a larger market share of the North America automotive ECU market in 2020. Further, the light duty segment held a larger share of the North America automotive ECU market based on vehicle type in 2020.

A few major primary and secondary sources referred to for preparing this report on the North America automotive ECU market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Aptiv PLC; Continental AG; Denso Corporation; Hitachi, Ltd.; Mitsubishi Electric Corporation; Pektron; Robert Bosch GmbH; TRANSTRON Inc.; Veoneer Inc; and ZF Friedrichshafen AG among others.

The North America Automotive ECU Market is valued at US$ 5,258.46 Million in 2021, it is projected to reach US$ 7,444.50 Million by 2028.

As per our report North America Automotive ECU Market, the market size is valued at US$ 5,258.46 Million in 2021, projecting it to reach US$ 7,444.50 Million by 2028. This translates to a CAGR of approximately 5.1% during the forecast period.

The North America Automotive ECU Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Automotive ECU Market report:

The North America Automotive ECU Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Automotive ECU Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Automotive ECU Market value chain can benefit from the information contained in a comprehensive market report.