North America Acne Medication Market

No. of Pages: 121 | Report Code: BMIRE00030656 | Category: Life Sciences

No. of Pages: 121 | Report Code: BMIRE00030656 | Category: Life Sciences

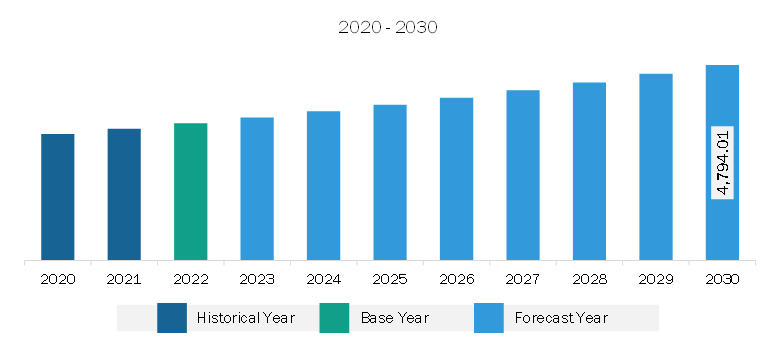

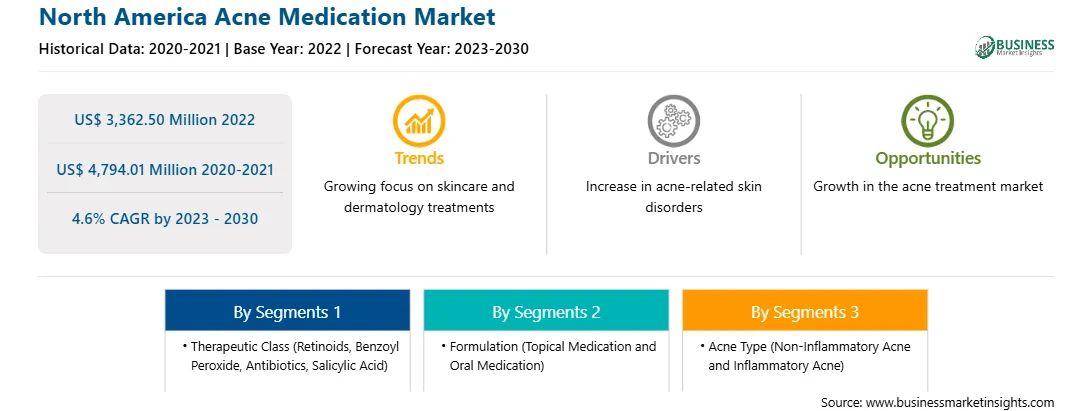

The North America acne medication market was valued at US$ 3,362.50 million in 2022 and is expected to reach US$ 4,794.01 million by 2030; it is estimated to register at a CAGR of 4.6% from 2023 to 2030.

Upsurge in Need for Organic and Natural Treatments Fuels North America Acne Medication Market

As people are becoming more conscious of the potentially harmful effects of synthetic ingredients and chemicals used in traditional skincare products, the demand for natural and organic alternatives that are deemed to be safer, gentler, and more environmentally friendly is on the rise across the world. Consumers are increasingly seeking products free from harsh chemicals, artificial fragrances, and potentially irritating substances, opting for formulations that harness the power of plant-based ingredients, botanical extracts, essential oils, and other natural compounds known for their skincare benefits. In response to this trend, many skincare brands and manufacturers are developing a wide range of natural and organic acne treatment products that cater to the needs of health-conscious consumers. These products often feature ingredients such as tea tree oil, witch hazel, aloe vera, green tea extract, and salicylic acid derived from natural sources, offering a more holistic and sustainable approach to treating acne without compromising efficacy. In July 2022, MÁDARA, an organic skincare business, introduced two new and natural everyday skincare products—a microbiome-balancing moisturizer and a non-drying face cleanser. The company claims that these products were developed by blending science and nature, and were specifically formulated to offer gentle treatment for people of different complexions, who are prone to acne. Both products are made with natural, organic, and vegan ingredients—Northern Juniper Stem Cells, fermented polysaccharides, and lichen and Maté tea extracts—which deal specifically with imperfections, keeping the skin unharmed. Adults and teenagers can both utilize this product. Thus, the increasing preference for natural and organic acne treatment options is expected to continue shaping the future of the North America acne medication market in the coming years.

The shift toward natural and organic acne treatment options is also driven by the increasing stringency of regulatory scrutiny and complications associated with industry standards. Regulatory agencies emphasize ingredient transparency, safety, and sustainability, prompting companies to reformulate their products to meet evolving consumer preferences for cleaner and greener skincare solutions. Thus, as more consumers prioritize natural ingredients and eco-friendly formulations in their skincare routines, the North America acne medication market is expected to experience new growth trends in the coming years.

North America Acne Medication Market Overview

The acne medication market in North America is segmented into the US, Canada, and Mexico. The US held the largest North American acne medication market share in 2022. Acne is a skin condition brought on by debris, oil, sebum, and dead skin cells clogging hair follicles. According to the American Academy of Dermatology, acne is the most prevalent illness in the US, up to 50 million Americans suffer from acne each year, making it the most common skin ailment in the country. The acne medication market in this country is projected to expand due to the increased incidence of acne in Americans and the subsequent launch of various innovative acne medications.

North America Acne Medication Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Acne Medication provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Acne Medication refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Acne Medication Strategic Insights

North America Acne Medication Report Scope

Report Attribute

Details

Market size in 2022

US$ 3,362.50 Million

Market Size by 2030

US$ 4,794.01 Million

CAGR (2023 - 2030) 4.6%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Therapeutic Class

By Formulation

By Acne Type

By Distribution Channel

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Acne Medication Regional Insights

North America Acne Medication Market Segmentation

The North America acne medication market is segmented based on therapeutic class, formulation, type, acne type, and distribution channel, and country.

Based on therapeutic class, the North America acne medication market is segmented into retinoids, benzoyl peroxide, antibiotics, salicylic acid, and others. The retinoids segment held the largest share in 2022.

In terms of formulation, the North America acne medication market is bifurcated into topical medication and oral medication. The topical medication segment held a larger largest share in 2022.

By type, the North America acne medication market is bifurcated into prescription medicine and over-the-counter medicine. The prescription medicine segment held a larger largest share in 2022.

Based on acne type, the North America acne medication market is bifurcated into non-inflammatory acne and inflammatory acne. The inflammatory acne segment held a larger share in 2022.

In terms of distribution channel, the North America acne medication market is segmented into pharmacies and drug stores, retail stores, and e-commerce. The pharmacies and drug stores segment held the largest share in 2022.

Based on country, the North America acne medication market is categorized into US, Canada, and Mexico. The US dominated the North America acne medication market in 2022.

Sun Pharmaceutical Industries Ltd, Teva Pharmaceutical Industries Ltd, Almirall SA, Johnson & Johnson, Bausch Health Companies Inc, Centro Internacional de Cosmiatria SA de CV, Galderma SA, Pfizer Inc, GSK Plc, Viatris Inc, Somar Sapi De CV, and Italmex SA are some of the leading companies operating in the North America acne medication market.

1. Teva Pharmaceutical Industries Ltd

2. Almirall SA

3. Johnson & Johnson

4. Sun Pharmaceutical Industries Ltd

5. Bausch Health Companies Inc

6. Centro Internacional de Cosmiatria SA de CV

7. Galderma SA

8. Pfizer Inc

9. GSK Plc

10. Viatris Inc

11. Somar Sapi De CV

12. Italmex SA

The North America Acne Medication Market is valued at US$ 3,362.50 Million in 2022, it is projected to reach US$ 4,794.01 Million by 2030.

As per our report North America Acne Medication Market, the market size is valued at US$ 3,362.50 Million in 2022, projecting it to reach US$ 4,794.01 Million by 2030. This translates to a CAGR of approximately 4.6% during the forecast period.

The North America Acne Medication Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Acne Medication Market report:

The North America Acne Medication Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Acne Medication Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Acne Medication Market value chain can benefit from the information contained in a comprehensive market report.