North America Abrasive Market

No. of Pages: 126 | Report Code: BMIRE00030649 | Category: Chemicals and Materials

No. of Pages: 126 | Report Code: BMIRE00030649 | Category: Chemicals and Materials

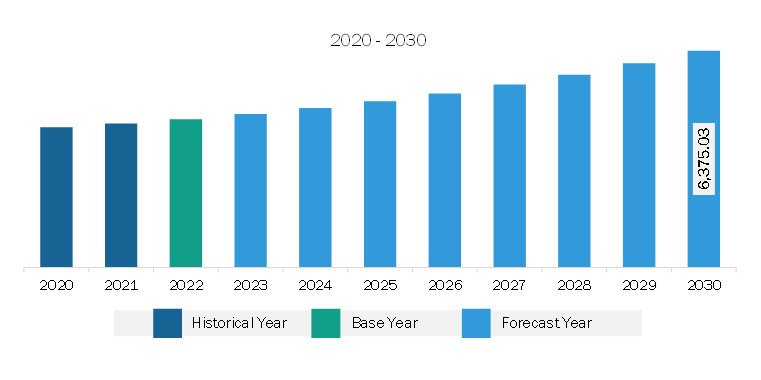

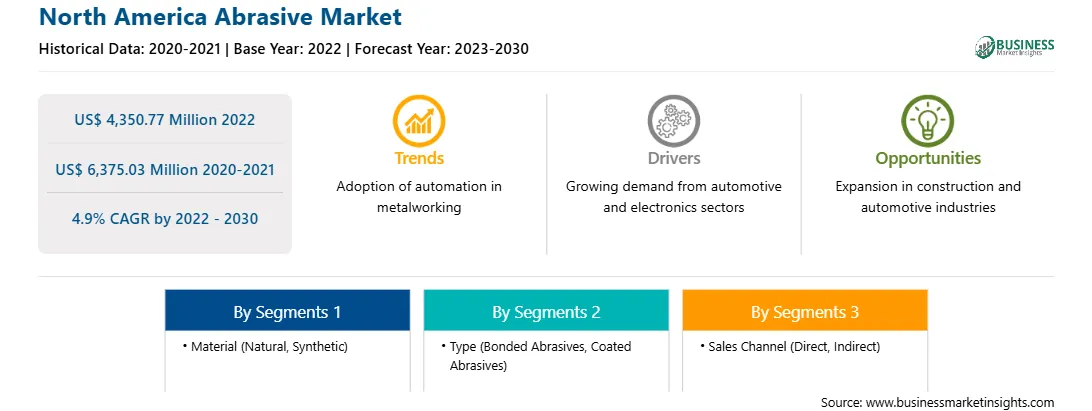

The North America abrasive market was valued at US$ 4,350.77 million in 2022 and is expected to reach US$ 6,375.03 million by 2030; it is estimated to register a CAGR of 4.9% from 2022 to 2030. Development of Sustainable Abrasives Fuels North America Abrasive Market

Governments of various countries have imposed a few regulations on using sustainable materials to manufacture products in processing industries, including chemicals & materials, to ensure better protection of human health and the environment. These regulations are set to reduce greenhouse emissions and have compelled manufacturing companies to increase investments in developing naturally derived raw materials. Rising awareness regarding greenhouse gas (GHG) emissions and environmental pollution is projected to surge the demand for bio-based and sustainable products. Governments of various countries are adopting several initiatives to increase the awareness and development of sustainable materials. Emerging trends in sustainability have spurred innovation in the abrasive market. Advancements in abrasive manufacturing techniques, such as precision engineering and surface modification, are leveraged to enhance efficiency and reduce waste generation. Several manufacturers are also focused on minimizing energy consumption and emissions caused during the production and usage of abrasives. Therefore, the development of sustainable abrasives is expected to drive the abrasive market during the forecast period.North America Abrasive Market Overview

North America holds extensive growth opportunities for abrasive manufacturers owing to the increasing demand from end-use industries such as construction, automotive, aerospace, electrical & electronics, energy, semiconductor, and metalworking. The manufacturing sector plays a pivotal role, as abrasives are essential in various industrial processes such as metal fabrication, automotive production, and machinery manufacturing. The region's robust manufacturing industry, driven by technological advancements and innovation, contributes significantly to the demand for abrasives. In addition, the construction and infrastructure development in North America contributes to the demand for abrasives. The construction sector in North America is rapidly developing due to a robust economy and increased federal and state financing for public works and institutional structures. Rapid development and urbanization are also driving the North American abrasive market. According to a report released by the US Census Bureau, the value of total construction (private and public) investment in 2023 was US$ 1,978.7 billion, a 7% increase from investments in 2022 of US$ 1,848.7 billion. The use of abrasive in applications involving surface preparation, concrete polishing, and stone cutting is crucial in the construction sector. As the region experiences continuous growth and urbanization, the demand for abrasives in construction activities is likely to remain high. In North America, passenger vehicles are the most common mode of transportation, and their use is increasing with the rise in per capita income. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), vehicle production in North America increased by 10%, from ~13.5 million in 2021 to 14.8 million vehicles in 2022. As the automotive sector expands, there is a parallel increase in the demand for abrasives, which are utilized to remove paint and rust and polish or smooth surfaces. In addition, according to the International Energy Agency, electric car sales accounted for 630,000 in 2021. In addition, according to the International Energy Agency, between August 2022 (when the Inflation Reduction Act was passed) and March 2023, major electric vehicle and battery makers announced investments totaling a minimum of US$ 52 billion in electric vehicle supply chains in North America. Technological advancements are increasing the adoption of abrasive tools in various sectors, including electronics, aerospace, and healthcare. Governments of countries in North America have significantly invested in technology and research programs in the aerospace & defense sector. The region is a hub for major aircraft, aircraft components, and defense equipment manufacturing companies such as Raytheon Technologies Corporation, Boeing, GE Aviation, Bombardier Inc., and Lockheed Martin Corporation. Abrasives play a crucial role in the manufacturing process of aerospace and defense components, where precision and quality are paramount. The need for lightweight, high-strength materials in aircraft and defense systems necessitates advanced machining and finishing techniques, further driving the demand for specialized abrasives.

North America Abrasive Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Abrasive provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Abrasive refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Abrasive Strategic Insights

North America Abrasive Report Scope

Report Attribute

Details

Market size in 2022

US$ 4,350.77 Million

Market Size by 2030

US$ 6,375.03 Million

CAGR (2022 - 2030) 4.9%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Material

By Type

By Sales Channel

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Abrasive Regional Insights

North America Abrasive Market Segmentation

The North America abrasive market is categorized into material, type, application, sales channel, and country.

By material, the North America abrasive market is bifurcated into natural and synthetic. The synthetic segment held a larger share of North America abrasive market in 2022.

In terms of type, the North America abrasive market is bifurcated into bonded abrasives and coated abrasives. The bonded abrasives segment held a larger share of North America abrasive market in 2022. Furthermore, the bonded abrasives segment is subcategorized into discs, wheels, and others. Additionally, the coated abrasives segment is subcategorized into flap discs, fiber discs, hook a loop discs, belts, rolls, and others.

By application, the North America abrasive market is segmented into automotive, aerospace, marine, metal fabrication, woodworking, electrical & electronics, and others. The automotive segment held the largest share of North America abrasive market in 2022.

Based on sales channel of hearing loss, the North America abrasive market is bifurcated into direct and indirect. The indirect segment held a larger share of North America abrasive market in 2022.

By country, the North America abrasive market is segmented into the US, Canada, and Mexico. The US dominated the North America abrasive market share in 2022.

Deerfos Co., Ltd; CUMI AWUKO Abrasives GmbH; Robert Bosch GmbH; Tyrolit Schleifmittelwerke Swarovski AG & Co KG; Sun Abrasives Co Ltd; Compagnie de Saint-Gobain S.A.; sia Abrasives Industries AG; RHODIUS Abrasives GmbH; and 3M Co are some of the leading companies operating in the North America abrasive market.

1. Deerfos Co., Ltd

2. CUMI AWUKO Abrasives GmbH

3. Robert Bosch GmbH

4. Tyrolit Schleifmittelwerke Swarovski AG & Co KG

5. Sun Abrasives Co Ltd

6. Compagnie de Saint-Gobain S.A.

7. sia Abrasives Industries AG

8. RHODIUS Abrasives GmbH

9. 3M Co

10. Ekamant AB

The North America Abrasive Market is valued at US$ 4,350.77 Million in 2022, it is projected to reach US$ 6,375.03 Million by 2030.

As per our report North America Abrasive Market, the market size is valued at US$ 4,350.77 Million in 2022, projecting it to reach US$ 6,375.03 Million by 2030. This translates to a CAGR of approximately 4.9% during the forecast period.

The North America Abrasive Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Abrasive Market report:

The North America Abrasive Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Abrasive Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Abrasive Market value chain can benefit from the information contained in a comprehensive market report.