Middle East & Africa Abrasive Market

No. of Pages: 134 | Report Code: BMIRE00030652 | Category: Chemicals and Materials

No. of Pages: 134 | Report Code: BMIRE00030652 | Category: Chemicals and Materials

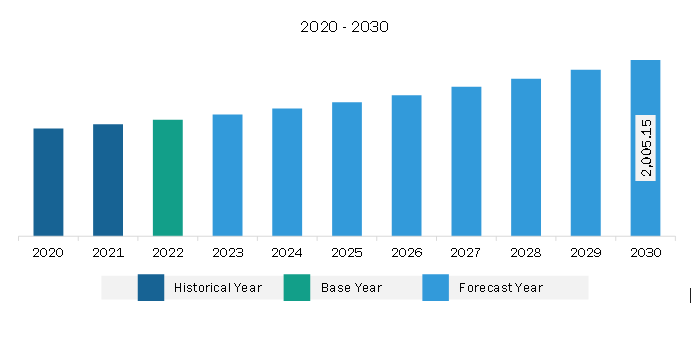

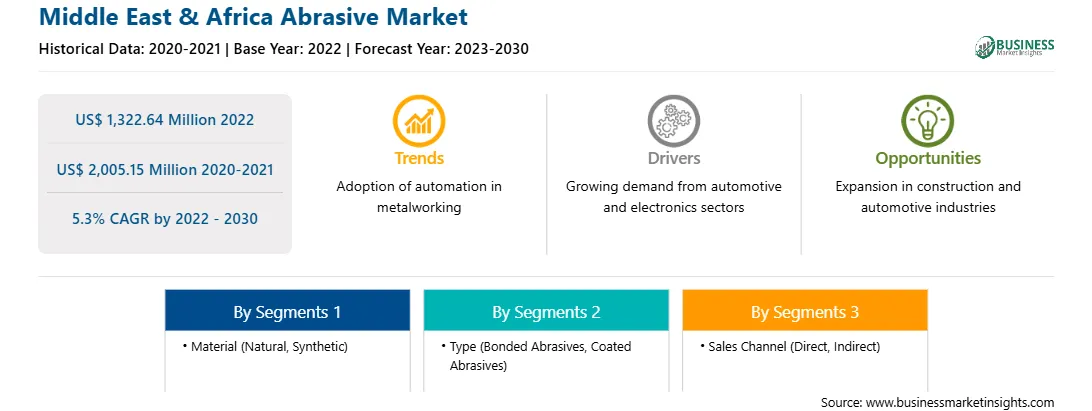

The Middle East & Africa abrasive market was valued at US$ 1,322.64 million in 2022 and is expected to reach US$ 2,005.15 million by 2030; it is estimated to register a CAGR of 5.3% from 2022 to 2030. Growing Automotive and Metal Fabrication Industry Bolsters Middle East & Africa Abrasive Market

Abrasives are used in a broad range of automotive applications such as surface grinding, deburring, polishing, and casting for wheel manufacturing; cutting & grinding body components; weld removal and edge chamfering; plating & surfacing in automotive rack processing and shaping. By the end of November 2022, Morocco's automotive sector had broken sales records on a significant year-over-year upswing of 30%. The Moroccan automobile industry has clearly changed its attention to manufacturing high-value components, such as engines, research and development, and between 40,000 and 50,000 electric vehicles each year. In September, Stellantis, which was established in January 2021 through the merging of PSA and Fiat Chrysler, declared that the PSA facility in Kenitra, northeast of Rabat, would serve as the production site for its supermini electric car, the Opel Rocks-e. The plant has the potential to produce 200,000 vehicles annually. By 2025, Stellantis, the fourth-biggest automaker in the world, wants to spend ~US$ 3.21 billion instead of ~US$ 643 million on Moroccan-made parts. Also, BYD, a Chinese manufacturer of electric vehicles, inked a memorandum of understanding with the Moroccan government to construct a plant in Kenitra. Concurrently, the Casablanca-based US company STMicroelectronics just began producing the primary transmitter for Tesla automobiles in Morocco. Moreover, the expansion goals of the South African automotive sector have been centered on achieving a high degree of integration into the global automotive environment through increasing trade and foreign direct investment. The goal of the South African Automotive Masterplan (SAAM) 2021-2035 is to build 1.4 million automobiles annually, or 1% of the world's total vehicle production, in South Africa by 2035. This will significantly raise the nation's standing and position in the world's vehicle production rankings. Metal fabrication industries consist of services such as metal stamping, cutting, punching, forming, folding, shearing, welding, and machining. The automotive industry is one of the major consumers of sheet metal fabrication services. Further, the growth in the utilization of aluminum sheets in the transportation industries and increased demand for lightweight materials have created a demand for efficient tools for grinding, polishing, and cutting applications. Therefore, growth in the automotive and metal fabrication industry is driving the abrasive market. Middle East & Africa Abrasive Market Overview

Countries in the Middle East & Africa are rapidly developing their public infrastructure, including airports, hospitals, and administrative buildings. This has resulted in the spurred demand for abrasives. A surge in demand for abrasives in residential building construction, coupled with rapid urbanization in the region, has enhanced construction activities, which is expected to support the abrasive market during the forecast period. The construction of shopping malls and commercial complexes has increased due to the rising tourism industry and the growing number of immigrants. Governments in the Middle East & Africa are investing heavily in large-scale construction projects, including iconic skyscrapers, modern transportation networks, and expansive residential and commercial complexes. According to the United Nations Development Programme, in the Arab region, the total population residing in urban areas reached 55.8% in 2015 and will continue to grow to 58% by 2030. Rapid urbanization, along with an increase in government spending on infrastructure development through programs such as Saudi Vision 2030 and Abu Dhabi Economic Vision 2030 in the Middle East & Africa, is accelerating construction activities. This emphasis on infrastructure expansion has created a sustained need for abrasives. Therefore, the utilization of volumes of abrasives in the construction of commercial buildings is expected to provide significant growth opportunities to the market players. Furthermore, the manufacturing sector in the Middle East & Africa contributes to the demand for abrasives. As various industries, including automotive, aerospace, and electronics, continue to thrive, there is a continuous need for precision tools to shape and finish metal components. Abrasives are crucial in enhancing the quality and precision of manufactured goods, supporting the region's industrial growth and diversification.

With its vast energy resources, the oil & gas industry in the Middle East is another key player in driving demand for abrasives. From shaping metal components in drilling equipment to maintaining pipelines and refineries, abrasives are essential in ensuring the efficiency and integrity of equipment in this critical sector. Harsh environmental conditions and stringent quality requirements make abrasives indispensable tools in the oil & gas industry's operations. The market in the Middle East & Africa is evolving due to the increasing passenger vehicle production. The demand for vehicles made in the region is growing consistently. Rising middle-class income, growing population, and increasing passenger vehicle production are also driving the market. In September 2022, Renault Group Morocco announced that its two factories in Tangier and Casablanca, Morocco, produced 350,000 vehicles in 2022, a 15.3% increase over the production numbers in 2021.

Middle East & Africa Abrasive Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Middle East & Africa Abrasive provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Abrasive refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Middle East & Africa Abrasive Strategic Insights

Middle East & Africa Abrasive Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,322.64 Million

Market Size by 2030

US$ 2,005.15 Million

CAGR (2022 - 2030) 5.3%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Material

By Type

By Sales Channel

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Abrasive Regional Insights

Middle East & Africa Abrasive Market Segmentation

The Middle East & Africa abrasive market is categorized into material, type, application, sales channel, and country.

By material, the Middle East & Africa abrasive market is bifurcated into natural and synthetic. The synthetic segment held a larger share of Middle East & Africa abrasive market in 2022.

In terms of type, the Middle East & Africa abrasive market is bifurcated into bonded abrasives and coated abrasives. The bonded abrasives segment held a larger share of Middle East & Africa abrasive market in 2022. Furthermore, the bonded abrasives segment is subcategorized into discs, wheels, and others. Additionally, the coated abrasives segment is subcategorized into flap discs, fiber discs, hook a loop discs, belts, rolls, and others.

By application, the Middle East & Africa abrasive market is segmented into automotive, aerospace, marine, metal fabrication, woodworking, electrical & electronics, and others. The automotive segment held the largest share of Middle East & Africa abrasive market in 2022.

Based on sales channel, the Middle East & Africa abrasive market is bifurcated into direct and indirect. The indirect segment held a larger share of Middle East & Africa abrasive market in 2022.

By country, the Middle East & Africa abrasive market is segmented into South Africa, Ghana, Kenya, Ethiopia, Egypt, Turkey, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa abrasive market share in 2022.

CUMI AWUKO Abrasives GmbH, Robert Bosch GmbH, Tyrolit Schleifmittelwerke Swarovski AG & Co KG, Sun Abrasives Co Ltd, Compagnie de Saint-Gobain S.A., sia Abrasives Industries AG, RHODIUS Abrasives GmbH, 3M Co, and Ekamant AB are some of the leading companies operating in the Middle East & Africa abrasive market.

1. CUMI AWUKO Abrasives GmbH

2. Robert Bosch GmbH

3. Tyrolit Schleifmittelwerke Swarovski AG & Co KG

4. Sun Abrasives Co Ltd

5. Compagnie de Saint-Gobain S.A.

6. sia Abrasives Industries AG

7. RHODIUS Abrasives GmbH

8. 3M Co

9. Ekamant AB

The Middle East & Africa Abrasive Market is valued at US$ 1,322.64 Million in 2022, it is projected to reach US$ 2,005.15 Million by 2030.

As per our report Middle East & Africa Abrasive Market, the market size is valued at US$ 1,322.64 Million in 2022, projecting it to reach US$ 2,005.15 Million by 2030. This translates to a CAGR of approximately 5.3% during the forecast period.

The Middle East & Africa Abrasive Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Abrasive Market report:

The Middle East & Africa Abrasive Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Abrasive Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Abrasive Market value chain can benefit from the information contained in a comprehensive market report.