Middle East & Africa Upstream Bioprocessing Market

No. of Pages: 117 | Report Code: BMIRE00030686 | Category: Life Sciences

No. of Pages: 117 | Report Code: BMIRE00030686 | Category: Life Sciences

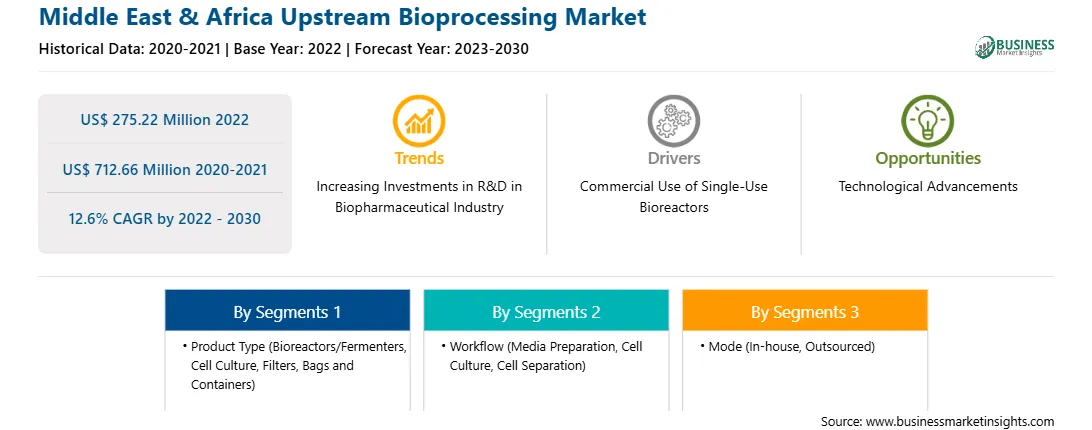

The Middle East & Africa upstream bioprocessing market was valued at US$ 275.22 million in 2022 and is expected to reach US$ 712.66 million by 2030; it is estimated to grow at a CAGR of 12.6% from 2022 to 2030. Increasing Investments in R&D in Biopharmaceutical Industry Bolster Middle East & Africa Upstream Bioprocessing Market

Increasing investments in research and development (R&D) in the biopharmaceutical industry are likely to bring new trends into the upstream bioprocessing market in the coming years. In March 2020, Culture Biosciences announced securing the funds of US$ 15 million (13.4 million) in the Series A investment round, citing the backing of new and existing venture capital backers. According to Culture Biosciences, the money has been used to treble the capacity of bioreactors as well as to develop more cloud-based software monitoring and development tools for biomanufacturing research and development. The company states that this investment will help scientists manage their whole R&D workflow via software applications, hence supporting the digitization of biomanufacturing R&D.

As R&D investments continue to surge, particularly in novel biologics, advanced therapies, and personalized medicine, there is a parallel emphasis on optimizing upstream bioprocessing technologies and methodologies. This trend is leading to the development of innovative bioreactor systems, cell culture media formulations, and process automation solutions to enhance the efficiency, scalability, and productivity of biopharmaceutical production operations. Furthermore, the focus on R&D investments favors the development of cutting-edge bioprocessing platforms that cater to the evolving landscape of biopharmaceuticals, including next-generation therapeutic modalities and biosimilars. Additionally, dedicating R&D funds for bioprocessing trends such as continuous bioprocessing and advanced analytics for process monitoring is expected to reshape the future of upstream bioprocessing, driving the adoption of state-of-the-art technologies and establishing new benchmarks for process performance, quality, and regulatory compliance.Middle East & Africa Upstream Bioprocessing Market Overview

The Middle East & Africa upstream bioprocessing market is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. The UAE is the largest market for upstream bioprocessing. The market is driven by extensive research projects undertaken by several research institutes, and the availability of infrastructure and facilities for fundamental as well as advanced research, particularly in the UAE and Saudi Arabia.

Middle East & Africa Upstream Bioprocessing Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Middle East & Africa Upstream Bioprocessing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Upstream Bioprocessing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Upstream Bioprocessing Strategic Insights

Middle East & Africa Upstream Bioprocessing Report Scope

Report Attribute

Details

Market size in 2022

US$ 275.22 Million

Market Size by 2030

US$ 712.66 Million

CAGR (2022 - 2030) 12.6%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product Type

By Workflow

By Mode

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Upstream Bioprocessing Regional Insights

Middle East & Africa Upstream Bioprocessing Market Segmentation

The Middle East & Africa upstream bioprocessing market is segmented based on product type, workflow, usage type, mode, and country. Based on product type, the Middle East & Africa upstream bioprocessing market is segmented into bioreactors/fermenters, cell culture, filters, bags and containers, and others. The cell culture services held the largest market share in 2022.

Based on workflow, the Middle East & Africa upstream bioprocessing market is categorized into media preparation, cell culture, and cell separation. The cell separation held the largest market share in 2022.

Based on usage type, the Middle East & Africa upstream bioprocessing market is bifurcated into single-use and multi-use. The single-use held a larger market share in 2022

Based on mode, the Middle East & Africa upstream bioprocessing market is bifurcated into in-house and outsourced. The outsourced held a larger market share in 2022.

Based on country, the Middle East & Africa upstream bioprocessing market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. South Africa dominated the Middle East & Africa upstream bioprocessing market share in 2022.

Thermo Fisher Scientific Inc, Esco Micro Pte Ltd, Sartorius AG, Danaher Corp, Getinge AB, Merck KGaA, and Corning Inc are some of the leading companies operating in the Middle East & Africa upstream bioprocessing market.

1. Thermo Fisher Scientific Inc

2. Esco Micro Pte Ltd

3. Sartorius AG

4. Danaher Corp

5. Getinge AB

6. Merck KGaA

7. Corning Inc.

The Middle East & Africa Upstream Bioprocessing Market is valued at US$ 275.22 Million in 2022, it is projected to reach US$ 712.66 Million by 2030.

As per our report Middle East & Africa Upstream Bioprocessing Market, the market size is valued at US$ 275.22 Million in 2022, projecting it to reach US$ 712.66 Million by 2030. This translates to a CAGR of approximately 12.6% during the forecast period.

The Middle East & Africa Upstream Bioprocessing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Upstream Bioprocessing Market report:

The Middle East & Africa Upstream Bioprocessing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Upstream Bioprocessing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Upstream Bioprocessing Market value chain can benefit from the information contained in a comprehensive market report.