Raising Adoption of Laser and Plasma Welding Technologies

A laser welding robot uses a laser beam, developed using carbon dioxide, and aims to utilize optics at parts to weld different parts together. Laser welding technology offers significant advantages in mass production of medium and large batch sizes of output products at a low unit cost. It provides high welding speeds, reduces rework, provides high reliability, ensures increased weld quality, and offers high precision. This technology allows narrow welds requiring minimal modification to the welded items. Laser welding technology is used in remote locations that are difficult to assess. It can also be used in high-volume applications requiring greater precision in the automotive, transportation, electrical, electronics, and aerospace and defense industries. Similarly, plasma welding technology offers various advantages, including high power density, clean and smooth welds, high welding speed, low distortion, and improved gap bridging. The welds produced through plasma welding are very strong and less visible. Plasma arc welding is an advanced form of tig welding. In the case of tig, it is an open arc shielded by argon or helium, while plasma uses a special torch where the nozzle is used to shrink the arc, and shielding gas is supplied separately by the torch. The arc is cut using a water-cooled nozzle to compress the arc, increasing its pressure, temperature, and heat intensely, thus improving arc stability, arc shape, and heat transfer characteristics. Plasma arcs are formed using gas in 2 forms: The first is laminar (low pressure and low flow), and the second is turbulent flow (high pressure and high flow). The gases used are argon, helium, hydrogen, or a mixture of them. In the case of plasma welding, laminar flow (low pressure and low flow of plasma gas) is used to ensure that the molten metal is not blown out of the weld zone. These factors are providing lucrative opportunities for the growth of the robotic welding cell market.

Market Overview

The robotic welding cell market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of the MEA. The region is expected to witness a rapid increase in commercialization and industrialization, further boosting the growth of various sectors. Gulf countries are economically developed, while African countries are yet to match up to the economic conditions of these countries. The robotic welding cell market in the region is in its infant stage. However, the adoption of industrial robots is anticipated to increase with time, as the region comprises several oil and gas refineries. Further, the manufacturing sector of the Middle East is flourishing, and the governments are taking major steps to encourage homegrown manufacturing. For instance, Dubai established one of the biggest industrial centers for attracting new manufacturers. The UAE’s Department of Economic Development stated that the manufacturing sector is gaining pace and accounting for ~80% of the country’s trade that does not include oil. Hence, representing the manufacturing sector as one of the biggest contributors to the country’s economy.

Middle East & Africa Robotic welding Cell Market Segmentation

The Middle East & Africa robotic welding cell market is segmented into offering, cell type, end user, and country.

Based on offering, the market is segmented into solution and services. The solution segment registered the largest market share in 2022. Based on cell type, the market is categorized into pre-engineered cells and custom cells. The pre-engineering segment held the largest market share in 2022. Based on end user, the Middle East & Africa robotic welding cell market is segmented into automotive, manufacturing, and aerospace and defense. The manufacturing segment held the largest market share in 2022. Based on country, the market is segmented into South Africa, Saudi Arabia, the UAE, and Rest of MEA. South Africa dominated the market share in 2022. ABB Ltd; The Lincoln Electric Company; Kuka AG; Kawasaki Heavy Industries, Ltd.; WEC Group Ltd; and Phoenix Industrial Solutions are the leading companies operating in the robotic welding cell market in the region.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 56.52 Million |

| Market Size by 2028 | US$ 67.19 Million |

| CAGR (2022 - 2028) | 2.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

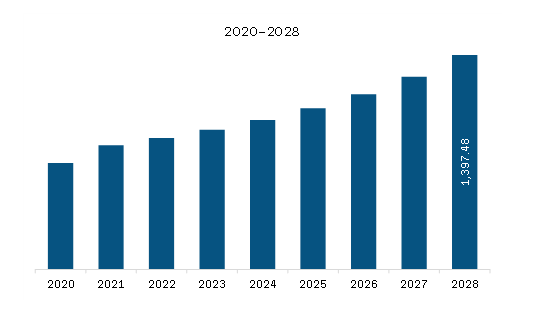

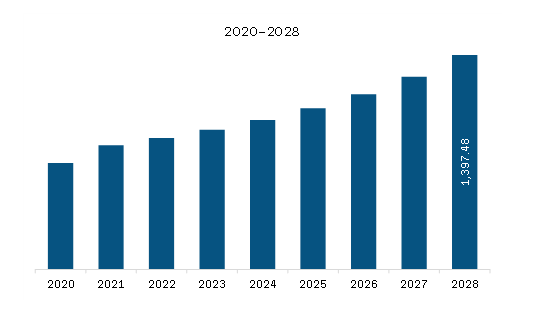

The Middle East & Africa Robotic Welding Cell Market is valued at US$ 56.52 Million in 2022, it is projected to reach US$ 67.19 Million by 2028.

As per our report Middle East & Africa Robotic Welding Cell Market, the market size is valued at US$ 56.52 Million in 2022, projecting it to reach US$ 67.19 Million by 2028. This translates to a CAGR of approximately 2.9% during the forecast period.

The Middle East & Africa Robotic Welding Cell Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Robotic Welding Cell Market report:

The Middle East & Africa Robotic Welding Cell Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Robotic Welding Cell Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Robotic Welding Cell Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)