Implementation of collaborative robots to bridge the skill gaps

Collaborative robots or cobots are designed to safely work alongside humans in tedious, dull, and hazardous environments. Unlike traditional industrial robots working in fenced facilities to avoid proximity with humans, cobots operate in a shared workspace alongside human labor. Conventional industrial robots have long allowed manufacturers to take advantage of automation and compensate for labor shortages, but they are often designed to perform a specific task. Furthermore, they lack cognitive capabilities due to which humans need to reprogram their operations based on new circumstances. In contrast, cobots do not require heavy, pre-programmed actuators to drive them. Cobot’s movements are directed by computer-controlled operators, such as robotic arms, which humans monitor. Thus, cobots facilitate effective human-machine collaboration in the workplace. Cobots can be programmed to perform a wide range of tasks in a factory setting, such as handling materials, assembling items, palletizing, packaging, labeling, inspecting product quality, welding, press-fitting, driving screws and nuts, and tending machines. While cobots attend these mind-numbing tasks, human workers can focus on tasks that require skills and reasoning. These all advantages of cobots will propel the growth of the robotic welding cell market during the forecast period.

Market Overview

The robotic welding cell market in Asia Pacific is segmented into China, India, Japan, Australia, South Korea, and the Rest of APAC. Robotics technology is increasingly being adopted in the Asia Pacific due to the growing need to automate processes, improve efficiency and productivity, and reduce human errors. Various automotive, healthcare, defense, and aerospace industries adopted robotics technology for process automation and efficient resource management. Industrial robots are mainly used in Asia Pacific because of the dominant automotive industry and low-cost manufacturing units. The rising aging population in this region also drives the demand for service robots in countries such as China and Japan. Increased application of robots in diverse industries, including entertainment, education, and healthcare, further supplements the growth of this market. The factors limiting the market's growth include high initial investment and stringent safety regulations. Advancements in technologies, including swarm robotics, cloud robotics, and bio-mimetics, would provide numerous growth opportunities in the market in the region.

Strategic insights for the Asia Pacific Robotic Welding Cell provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

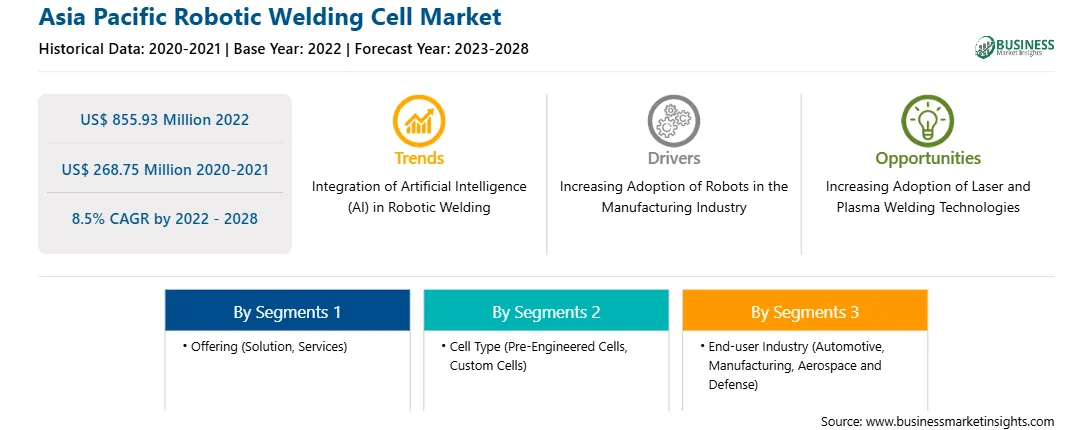

| Market size in 2022 | US$ 855.93 Million |

| Market Size by 2028 | US$ 268.75 Million |

| CAGR (2022 - 2028) | 8.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

|

The geographic scope of the Asia Pacific Robotic Welding Cell refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Robotic welding Cell Market Segmentation

The Asia Pacific robotic welding cell market is segmented into offering, cell type, end user, and country.

Based on offering, the market is segmented into solution and services. The solution segment registered the largest market share in 2022. Based on cell type, the market is categorized into pre-engineered cells and custom cells. The pre-engineering segment held the largest market share in 2022. Based on end user, the Asia Pacific robotic welding cell market is segmented into automotive, manufacturing, and aerospace and defense. The manufacturing segment held the largest market share in 2022. Based on country, the market is segmented into Australia, China, India, Japan, South Korea, and Rest of APAC. China dominated the market share in 2022. ABB Ltd; The Lincoln Electric Company; Kuka AG; Kawasaki Heavy Industries, Ltd.; Zeman Bauelemente Produktionsgesellschaft mbH; and Phoenix Industrial Solutions are the leading companies operating in the robotic welding cell market in the region.

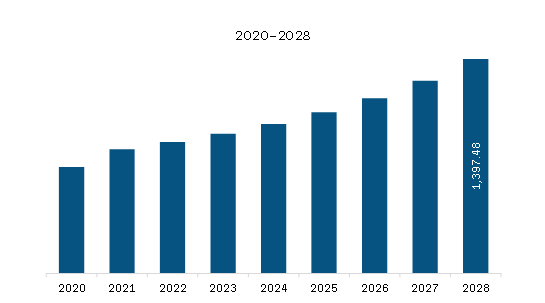

The Asia Pacific Robotic Welding Cell Market is valued at US$ 855.93 Million in 2022, it is projected to reach US$ 268.75 Million by 2028.

As per our report Asia Pacific Robotic Welding Cell Market, the market size is valued at US$ 855.93 Million in 2022, projecting it to reach US$ 268.75 Million by 2028. This translates to a CAGR of approximately 8.5% during the forecast period.

The Asia Pacific Robotic Welding Cell Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Robotic Welding Cell Market report:

The Asia Pacific Robotic Welding Cell Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Robotic Welding Cell Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Robotic Welding Cell Market value chain can benefit from the information contained in a comprehensive market report.