Mine countermeasures are undergoing a significant transformation, owing to the evolution of disruptive technologies, such as traditional mine hunting with grey ship mine hunters and the utilization of unmanned autonomous vehicles. Over the past decade, unmanned and autonomous systems operating above and below the water have steadily progressed, reaching a level of maturity that can now be used as a mine detector. Ensuring the safety of naval personnel and preventing casualties are the most critical aspects of mine countermeasures. The integration of unmanned and autonomous technologies is significant progress in this field. This has encouraged companies such as Thales group to provide mine detection products that can be easily integrated with autonomous vehicles.

For instance, the Thales Group offers M-CUBE, a mine countermeasure management system. The open and modular architecture of the M-CUBE mission system ensures effective management, including the most complicated activities. The full functionality of the system incorporates cutting-edge technology and covers all elements of mine countermeasure missions, such as planning, execution, supervision, assessment, debriefing, and training. It is easily configured to fit any type of deployed sensor and is equipped with various built-in support tools. M-CUBE notably minimizes operator workload while assuring maximum efficiency and safety. Thus, such factors are expected to support the growth of the Middle East & Africa mine detection system market over the forecast period.

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Middle East & Africa mine detection system market growth at a notable CAGR during the forecast period.

Middle East & Africa Mine Detection System Market Segmentation

The Middle East & Africa mine detection system market is segmented into deployment, detection capability and end user. Based on deployment, the market is bifurcated into vehicle mounted and handheld. Based on detection capability, the Middle East & Africa mine detection system market is bifurcated into above surface and underground. Based on end user, the market is divided into defense and homeland security. By country, the Middle East & Africa mine detection system market is segmented into Saudi Arabia, UAE, South Africa, and Rest of Middle East & Africa.

Middle East & Africa Mine Detection System Market - Companies Mentioned

BAE Systems; Chemring Group PLC; DCD Ltd.; Israel Aerospace Industries Ltd.; L3Harris Technologies, Inc.; Northrop Grumman Corporation; Raytheon Technologies Corporation; and Schiebel Corporation are among the leading companies operating in the Middle East & Africa mine detection system market.

| Report Attribute | Details |

|---|---|

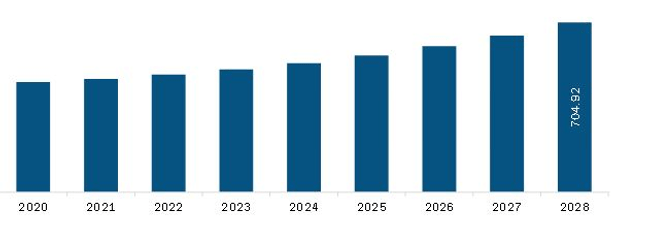

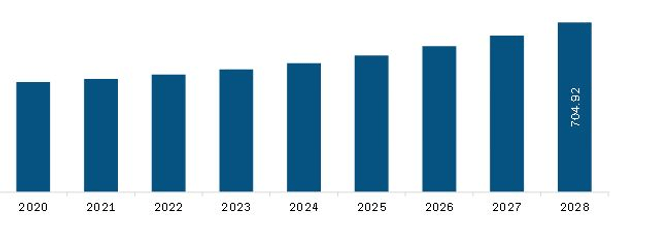

| Market size in 2021 | US$ 471.27 Million |

| Market Size by 2028 | US$ 704.92 Million |

| CAGR (2021 - 2028) | 5.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

The Middle East and Africa Mine Detection System Market is valued at US$ 471.27 Million in 2021, it is projected to reach US$ 704.92 Million by 2028.

As per our report Middle East and Africa Mine Detection System Market, the market size is valued at US$ 471.27 Million in 2021, projecting it to reach US$ 704.92 Million by 2028. This translates to a CAGR of approximately 5.9% during the forecast period.

The Middle East and Africa Mine Detection System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East and Africa Mine Detection System Market report:

The Middle East and Africa Mine Detection System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East and Africa Mine Detection System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East and Africa Mine Detection System Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)