In the past years, market players have experienced major developments in mine detection systems to offer new and advanced systems to end users, including defense forces, paramilitary forces, and border security forces. This increase in investment in new product development is attributed to the rising demand for advanced mine detection systems among military and naval forces across the region. The key players operating in the Asia Pacific mine detection system market are BAE Systems; Israel Aerospace Industries Ltd.; L3Harris Technologies, Inc.; Northrop Grumman Corporation; and Raytheon Technologies Corporation. Further, major developments were registered in the Asia Pacific mine detection system market. For instance, in February 2021, Pearson Engineering launched its air-scatterable and surface-placed mine clearance systems. The products consist of a machine learning-based mine detection and avoidance system and an emergency deployed self-extraction mine clearance instrument. Thus, such high investments by market players in the development of mine detection systems to ensure enhanced efficiency for detecting metallic and non-metallic mines are driving the Asia Pacific mine detection system market.

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Asia Pacific mine detection system market growth at a notable CAGR during the forecast period.

Asia Pacific Mine Detection System Market Segmentation

The Asia Pacific mine detection system market is segmented into deployment, detection capability and end user. Based on deployment, the market is bifurcated into vehicle mounted and handheld. Based on detection capability, the Asia Pacific mine detection system market is bifurcated into above surface and underground. Based on end user, the market is divided into defense and homeland security. By country, the Asia Pacific mine detection system market is segmented into Australia, India, China, Japan, South Korea, and the Rest of Asia Pacific.

Asia Pacific Mine Detection System Market - Companies Mentioned

BAE Systems; Chemring Group PLC; Israel Aerospace Industries Ltd.; L3Harris Technologies, Inc.; Northrop Grumman Corporation; Raytheon Technologies Corporation; and Schiebel Corporation are among the leading companies operating in the Asia Pacific mine detection system market.

| Report Attribute | Details |

|---|---|

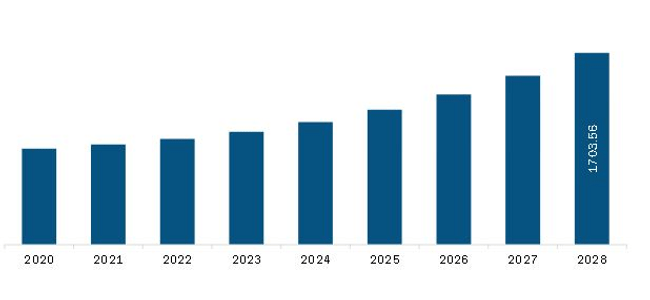

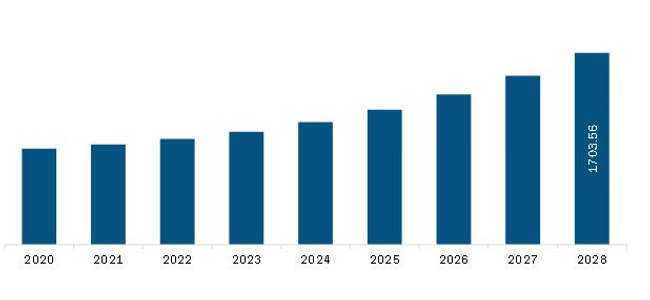

| Market size in 2021 | US$ 889.86 Million |

| Market Size by 2028 | US$ 1703.56 Million |

| CAGR (2021 - 2028) | 9.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

The Asia Pacific Mine Detection System Market is valued at US$ 889.86 Million in 2021, it is projected to reach US$ 1703.56 Million by 2028.

As per our report Asia Pacific Mine Detection System Market, the market size is valued at US$ 889.86 Million in 2021, projecting it to reach US$ 1703.56 Million by 2028. This translates to a CAGR of approximately 9.7% during the forecast period.

The Asia Pacific Mine Detection System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Mine Detection System Market report:

The Asia Pacific Mine Detection System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Mine Detection System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Mine Detection System Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)