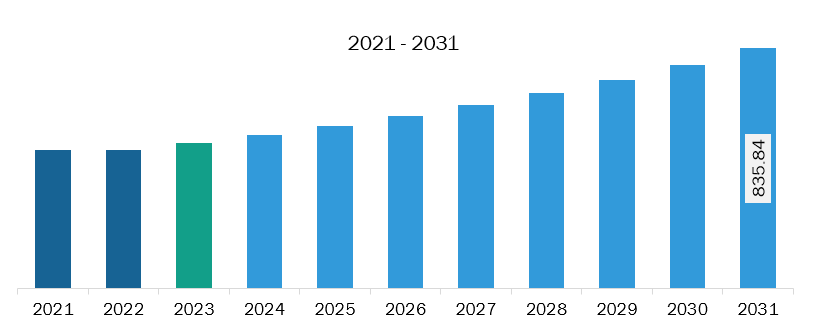

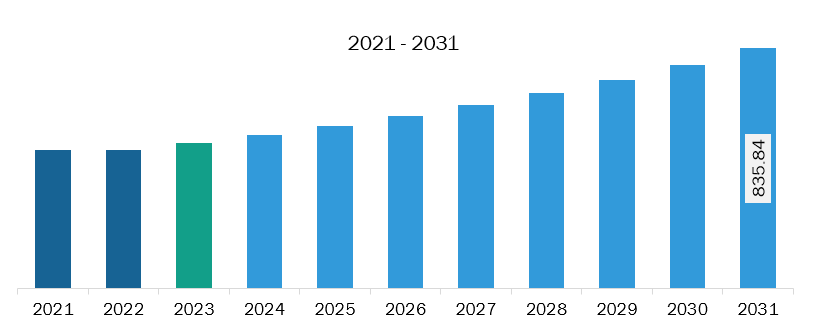

The Middle East & Africa decaf coffee market was valued at US$ 506.20 million in 2023 and is expected to reach US$ 835.84 million by 2031; it is estimated to record a CAGR of 6.5% from 2023 to 2031.

Cultural Shift and Young Population Bolsters Middle East & Africa Decaf Coffee Market

In the Middle East & Africa region, the cultural shift and the young population are significant drivers for the growing demand for decaf coffee. The region has a large, youthful demographic, with a considerable portion of the population under the age of 30. This younger generation is more open to experimenting with new food and beverage trends, including healthier alternatives like decaffeinated coffee. As younger consumers increasingly focus on maintaining healthier lifestyles, there is a growing preference for products that align with their health-conscious values.

This demographic is also more exposed to global trends and brands, partly due to increased access to the internet, social media, and international travel. Young people in urban centers such as Dubai, Abu Dhabi, Cairo, and Johannesburg are increasingly adopting coffee culture, influenced by Western coffee trends, including the popularity of decaf options. In these areas, international coffee chains such as Starbucks have played a major role in promoting coffee consumption, offering a wide variety of coffee, including decaf beverages. The younger population, more attuned to global health and wellness trends, is embracing decaf coffee as a beverage that allows them to enjoy coffee without the associated jitters or sleep disruptions caused by caffeine.

Moreover, as the region's younger generation becomes more focused on mental health and well-being, the demand for decaffeinated coffee aligns with their interest in reducing stress, improving sleep quality, and managing anxiety. As such, this cultural shift toward more health-conscious living is creating a robust market for decaf coffee in the Middle East & Africa, contributing to its rising popularity among young adults.

Middle East & Africa Decaf Coffee Market Overview

In the Middle East & Africa, the disposable income is rising among growing middle-class population. With the improved purchasing power, consumers are more inclined to explore a variety of products, including premium and exotic options. The presence of supermarket chains in countries across the Middle East further facilitates the availability and accessibility of decaf coffee. Local preferences for Arabic coffee, coupled with international trends, open avenues for decaf innovations in the region. According to the Saudi Press Agency report, Saudi Arabia imports between 70,000 and 90,000 tons of coffee every year, which is predicted to increase by 5% by 2026. The shifting consumer preferences and health trends are driving the decaf coffee market.

Middle East & Africa Decaf Coffee Market Revenue and Forecast to 2031 (US$ Million)

Middle East & Africa Decaf Coffee Market Segmentation

The Middle East & Africa decaf coffee market is categorized into form, nature, category, distribution channel, and country.

Based on form, the Middle East & Africa decaf coffee market is categorized into whole bean, ground, and others. The ground segment held the largest market share in 2023.

In terms of nature, the Middle East & Africa decaf coffee market is bifurcated into plain and flavored. The flavored segment held a larger market share in 2023.

By category, the Middle East & Africa decaf coffee market is bifurcated into conventional and organic. The conventional segment held a larger market share in 2023.

Based on distribution channel, the Middle East & Africa decaf coffee market is segmented into supermarkets and hypermarkets, convenience store, online retail, and others. The supermarkets and hypermarkets segment held the largest market share in 2023.

By country, the Middle East & Africa decaf coffee market is segmented into South Africa, South Korea, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa decaf coffee market share in 2023.

Nestle SA, illycaffè S.p.A, Luigi Lavazza SPA, Kraft Heinz Co, Fresh Roasted Coffee LLC, Lifeboost Coffee LLC, Koffee Kult Corp, JDE Peet’s NV, Reily Foods Co, Snowy Elk Coffee Co, Lucaffe Pty Ltd, Karam Foods Industries Co. L.L.C, J M Smucker Co, Keurig Dr Pepper Inc, Esselon Coffee Roasting Inc, Christopher Bean Coffee Co, Crazy Cups, Caffè Vergnano, Massimo Zanetti Beverage Group, and Don Pablo Coffee are some of the leading companies operating in the Middle East & Africa decaf coffee market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 506.20 Million |

| Market Size by 2031 | US$ 835.84 Million |

| CAGR (2023 - 2031) | 6.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Form

|

| Regions and Countries Covered |

Middle East & Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Decaf Coffee Market is valued at US$ 506.20 Million in 2023, it is projected to reach US$ 835.84 Million by 2031.

As per our report Middle East & Africa Decaf Coffee Market, the market size is valued at US$ 506.20 Million in 2023, projecting it to reach US$ 835.84 Million by 2031. This translates to a CAGR of approximately 6.5% during the forecast period.

The Middle East & Africa Decaf Coffee Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Decaf Coffee Market report:

The Middle East & Africa Decaf Coffee Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Decaf Coffee Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Decaf Coffee Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)