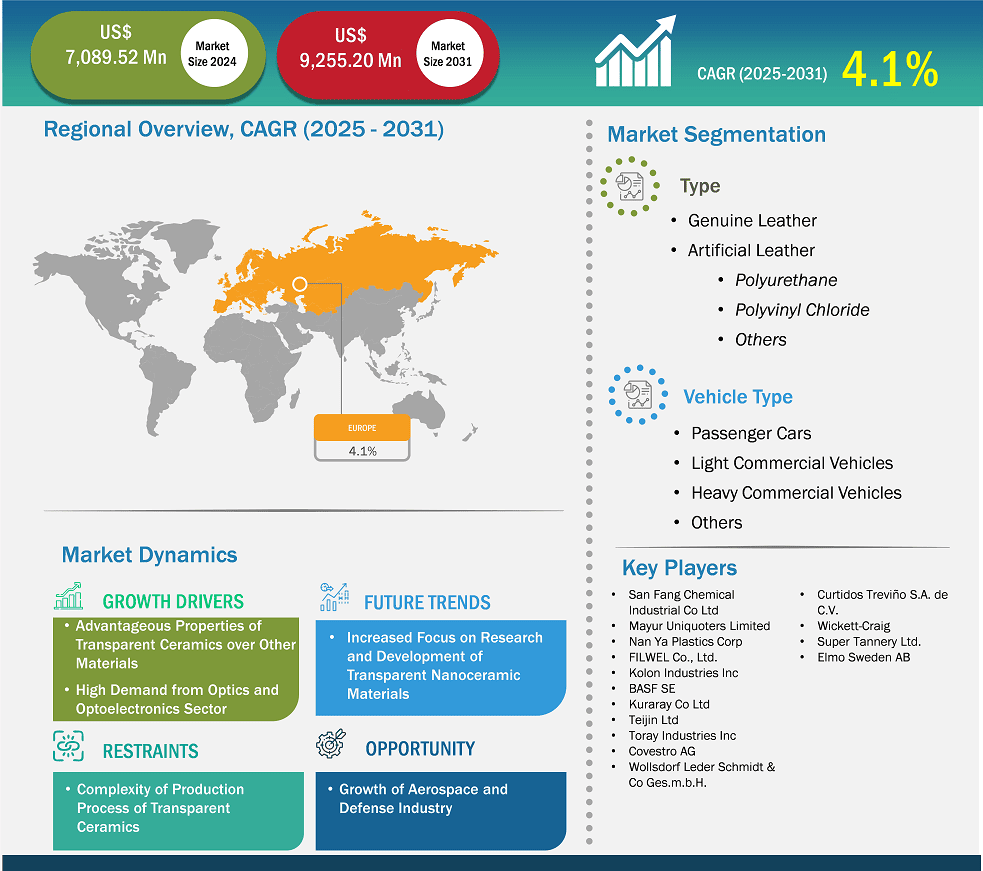

The Europe leather for automotive seats market size is expected to reach US$ 9,255.20 million by 2031 from US$ 7,089.52 million in 2024. The market is estimated to record a CAGR of 4.1% from 2025 to 2031.

According to a European Automobile Manufacturers Association report, the European car market experienced a 0.8% growth in 2024 compared to 2024, reaching 10.6 million units in volume. According to the report published by Eurostat in April 2025, the European Union (EU) exported 5.4 million cars and imported 4.0 million cars in 2024. In terms of value, the EU exported US$ 174.76 billion (€ 165.2 billion) worth of cars and imported US$ 80.29 billion (€ 75.9 billion), resulting in a trade surplus of US $ 94.47 billion (€ 89.3 billion). Compared to 2019, exports increased by 17.7%, while imports rose by 20.0%. The increased investment in the automotive industry creates lucrative opportunities for automotive components and materials manufacturers.

Further, Europe has some of the strictest emissions regulations in the world, driving the development of more fuel-efficient and environmentally friendly vehicles to meet such standards. Automotive leather manufacturers are looking for innovation and increased sustainability of vegan leather. For instance, in May 2024, BMW, a leading car manufacturer, launched BMW 5 Series Touring models in Europe. This new innovation is equipped with interiors made from a vegan leather called Veganza. This move demonstrates the automobile industry's commitment to developing and investing in more environmentally and animal-friendly materials. Therefore, the widespread presence of the automotive industry across Europe is expected to fuel the leather for automotive seats market growth in Europe during the forecast period.

Key segments that contributed to the derivation of the Europe leather for automotive seats market analysis are type and vehicle type.

Synthetic or artificial leather is composed of a fabric base, such as polyester, which is given an intimate finish and texture of leather with dye, wax, polyurethane (PU), or polyvinyl chloride (PVC). The demand for artificial leather has grown significantly. This type of leather possesses several advantageous properties compared to genuine leather. While genuine leather is known for its durability, artificial leather has been proven to be equally or even more resistant to wear, water, and sunlight. It is also easy to maintain and does not fade or crack as quickly as genuine leather when exposed to sunlight.

Artificial leather can also be coated with various finishes and colors, allowing more design flexibility than genuine leather. This makes it ideal for automotive applications, providing buyers with more efficient and sustainable solutions. It is also cost-effective and more efficient in its manufacturing process, allowing automakers to provide high-quality materials at more affordable prices for consumers and greater versatility. Moreover, genuine leather production has notable environmental impacts, including high water usage and chemical tanning processes. Consumers increasingly favor synthetic leather variants as more eco-friendly options that reduce the carbon footprint.

Several automotive manufacturers are shifting toward synthetic leather in their automotive interior applications to contribute to a circular economy. In August 2024, in collaboration with German start-up Revoltech GmbH, Volkswagen announced the development of innovative sustainable imitation leather materials, such as LOVR, made from industrial hemp and fully bio-based adhesives. This material is designed to be a leather-free, recyclable, and compostable alternative for automotive interiors. Tesla also uses synthetic leather car seats in the Model 3, Model S, Model X, and Model Y series.

Consequently, the affordability of synthetic leather, along with increased awareness and sustainable production practices, has led to a higher preference for synthetic leather among automakers and consumers, providing growth opportunities to the market.

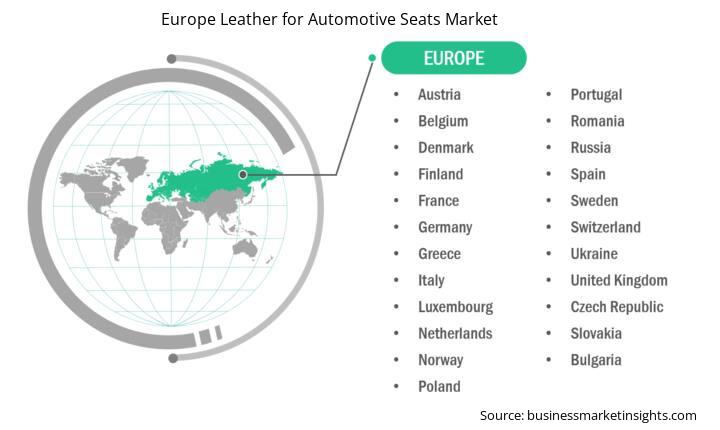

Based on country, the Europe leather for automotive seats market comprises Germany, France, the UK, Italy, Russia, Spain, and the Rest of Europe. The Rest of Europe held the largest share in 2024.

The Netherlands, Spain, Sweden, Norway, Denmark, Switzerland, Poland, and Belgium are among the prominent countries contributing to the leather for automotive seats market in the Rest of Europe. These countries have a strong automotive manufacturing base, creating substantial employment opportunities in the region. There is a growing demand for elastomers owing to the increasing vehicle production. These countries focus on enhancing their automotive vehicle industries, leading to a rise in leather consumption. Moreover, the aftermarket plays a significant role in leather for automotive seats demand for replacement parts. As the automotive sector in these countries adopts new technologies, the market is expected to grow in the Rest of Europe during the forecast period.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 7,089.52 Million |

| Market Size by 2031 | US$ 9,255.20 Million |

| CAGR (2025 - 2031) | 4.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include San Fang Chemical Industrial Co Ltd; Mayur Uniquoters Limited; Nan Ya Plastics Corp; FILWEL Co., Ltd.; Kolon Industries Inc; BASF SE; Kuraray Co Ltd; Teijin Ltd; Toray Industries Inc; Covestro AG; Wollsdorf Leder Schmidt & Co Ges.m.b.H.; Curtidos Treviño S.A. de C.V.; Wickett-Craig; Super Tannery Ltd.; and Elmo Sweden AB among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insights Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Europe Leather for Automotive Seats Market is valued at US$ 7,089.52 Million in 2024, it is projected to reach US$ 9,255.20 Million by 2031.

As per our report Europe Leather for Automotive Seats Market, the market size is valued at US$ 7,089.52 Million in 2024, projecting it to reach US$ 9,255.20 Million by 2031. This translates to a CAGR of approximately 4.1% during the forecast period.

The Europe Leather for Automotive Seats Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Leather for Automotive Seats Market report:

The Europe Leather for Automotive Seats Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Leather for Automotive Seats Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Leather for Automotive Seats Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)