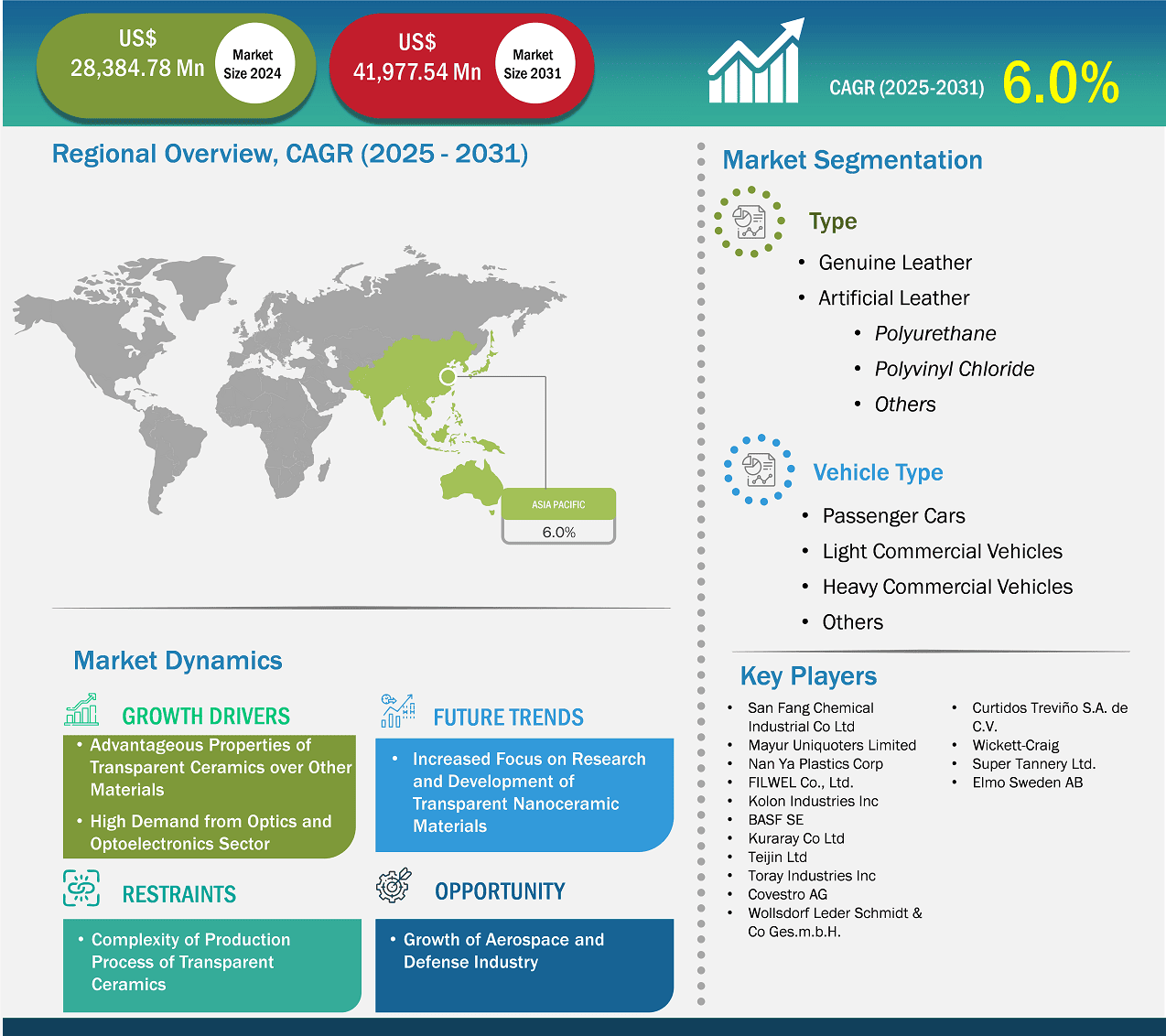

The Asia Pacific leather for automotive seats market size is expected to reach US$ 41,977.54 million by 2031 from US$ 28,384.78 million in 2024. The market is estimated to record a CAGR of 6.0% from 2025 to 2031.

Asia Pacific is home to major automotive companies, including Toyota Motor Corp, Tata Motors Ltd, Hyundai Motor Co, Nissan Motor Co Ltd, and Honda Motor Co Ltd. Further, Asia Pacific is a center for automotive manufacturing, with a significant presence of international and domestic players in the region. The growing vehicle production, increasing demand for luxury vehicles, and rising electric vehicle production are anticipated to create lucrative opportunities for manufacturers of leather for automotive seat applications. Research from the International Renewable Energy Agency indicates that 20 percent of all vehicles in Southeast Asia will be electric by 2025. China has emerged as the global leader in electric vehicles (EVs), having sold over 11 million cars in 2024. Due to the country's expertise in this area, many Chinese manufacturers have expanded into Asia and are experiencing notable success.

The Indian government has set a target for 30 percent of all vehicles sold in the country to be electric by 2030. This would result in approximately 13 million EVs on the road, exceeding previous projections. In 2024, the top 5 automobile producing countries are China, with more than 30 million vehicles; Japan, with ~9 million vehicles; India, with ~5.9 million vehicles; South Korea, with more than 4 million vehicles; and Thailand, with ~1.9 million vehicles leather is primarily used in automobiles for decorative coverings. According to ‘China's Automotive Leather Market Analysis Report’ published by the Italian Trade Agency in September 2024, the majority of automotive leather (i.e., ~85%) is utilized for seats, while the remaining 15% is allocated for other applications. Automotive leather is known for its breathability, durability, and ease of maintenance, contributing to the overall aesthetics, quality, and comfort of the car interior. Thus, the growing automotive industry in the Asia Pacific is expected to create lucrative business opportunities for the leather for automotive seats market players in the region during the forecast period.

Key segments that contributed to the derivation of the Asia Pacific leather for automotive seats market analysis are type and vehicle type.

The rise in fuel prices and the environmental impact of conventional gasoline vehicles have paved the way for alternative fuel vehicles across the globe. Buyers are gradually getting inclined to use battery-powered or hybrid automobiles, which is anticipated to boost the demand for electric vehicles in emerging and developing countries. According to the International Energy Agency's annual Global Electric Vehicle Outlook, China registered 6.4 million electric vehicles in 2024, an increase from 5.4 million in 2024. As the automotive industry witnesses a transformative shift toward electric vehicles (EVs), the demand for leather for automotive seat applications increases.

To promote the sale of EVs, governments are providing attractive laws and incentives. Reduced selling costs, no registration fees or minimal registration fees, and free EV infrastructure charging at various charging points are a few of these incentives. Furthermore, due to various subsidies, many countries worldwide exclude import, purchase, and road taxes. These auto industry incentives have led to a rise in the manufacture of electric vehicles. Governments have also created beneficial policies and invested heavily in infrastructure.

Electric vehicles often feature leather seats, which provide a premium and elegant look. Leather seats are relatively easy to clean and maintain compared to fabric, and they resist stains and odors better, making them a preferable choice for EV manufacturers. Thus, the growing adoption of electric vehicles drives the demand for leather for automotive seat applications.

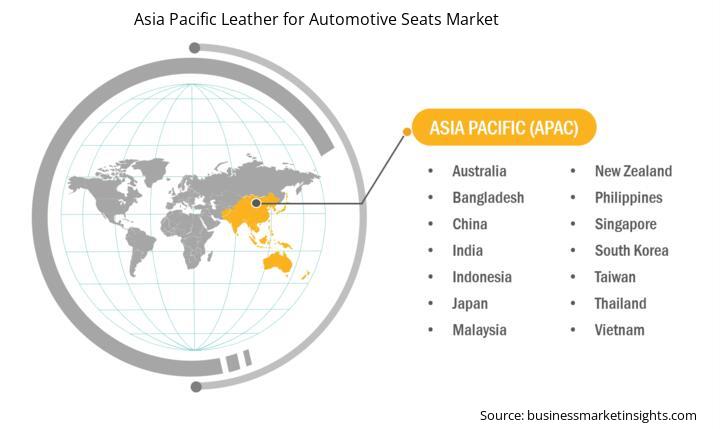

Based on country, the Asia Pacific leather for automotive seats market comprises Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China held the largest share in 2024.

China's government aims to increase the cumulative production capacity of automobile manufacturers in the country to 35 million units by 2025. The country has taken several initiatives to fulfill this goal. As per the report published by China Automotive Technology and Research Center and China Auto Standardization Research Institute in November 2024, automotive sales in China reached 24.62 million units from January to October 2024.

China continues to be the largest automotive market globally. According to an APLF report published in January 2025 in China, vehicle sales are projected to be ~31.5 million units in 2024. It is estimated that ~20–25% of these vehicles will feature leather seats, which translates to ~6.3 to 7.8 million vehicles with leather interiors in 2024 alone. Modern leather seats in China are being increasingly incorporated with smart features such as sensors for posture detection, heating, cooling, and massage functions. For instance, in May 2025, a high-end Chinese brand such as Li Auto introduced models with luxury interiors featuring leather seats with massage functions. The 2025 Li Auto L9 offers an 18-point hot-stone massage for first and second-row seats. The overall market's growth was primarily driven by the growing preference for comfort and luxury in automobiles. Leather seats are mainly found in higher-end car models, particularly those from renowned luxury brands. These brands play a significant role in the premium leather seat market by presenting leather interiors as a symbol of luxury and comfort. The country marks the presence of major passenger as well as luxury car manufacturers such as Hyundai Motor Company, Tesla Inc, Automobili Lamborghini SpA, and Dr. Ing. h.c. F. Porsche AG. Therefore, the rise in vehicle sales in the country is expected to drive the leather for automotive seats market in China.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 28,384.78 Million |

| Market Size by 2031 | US$ 41,977.54 Million |

| CAGR (2025 - 2031) | 6.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia Pacific

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include San Fang Chemical Industrial Co Ltd; Mayur Uniquoters Limited; Nan Ya Plastics Corp; FILWEL Co., Ltd.; Kolon Industries Inc; BASF SE; Kuraray Co Ltd; Teijin Ltd; Toray Industries Inc; Covestro AG; Wollsdorf Leder Schmidt & Co Ges.m.b.H.; Curtidos Treviño S.A. de C.V.; Wickett-Craig; Super Tannery Ltd.; and Elmo Sweden AB among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insights Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Asia Pacific Leather for Automotive Seats Market is valued at US$ 28,384.78 Million in 2024, it is projected to reach US$ 41,977.54 Million by 2031.

As per our report Asia Pacific Leather for Automotive Seats Market, the market size is valued at US$ 28,384.78 Million in 2024, projecting it to reach US$ 41,977.54 Million by 2031. This translates to a CAGR of approximately 6.0% during the forecast period.

The Asia Pacific Leather for Automotive Seats Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Leather for Automotive Seats Market report:

The Asia Pacific Leather for Automotive Seats Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Leather for Automotive Seats Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Leather for Automotive Seats Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)