Diagnostic test is done to identify the cause of symptoms or identify a disease. For other purposes, the test may be used to identify specific strengths and weaknesses of the disease. Diagnostic tests may also be used to determine the cause of a behavior or characteristic of the disease.

The Brazil diagnostic labs market is segmented on the basis of lab type, testing services, revenue source, and country. The market report offers insights and in-depth analysis of the market, emphasizing parameters such as market size, trends, technological advancements, and market dynamics, and competitive landscape analysis of the leading market players.

According to World Population Ageing 2019, Brazil had 19.526 million people aged above 65 years in 2019, and the number is expected to reach 52.026 million by 2050. Older people are highly prone to chronic diseases. Therefore, increase in geriatric population raises the prevalence rate of liver cancer and other age-related diseases in the country. Additionally, leukemia is the most common cancer in children and has the incidence rates in developed countries. As per the GLOBOCAN 2020, Brazil recorded 11,396 leukemia cases in males and females of all ages in 2020. Therefore, the demand for acute myeloid leukemia treatment is rising in the country. Thus, owing to the increasing prevalence of aging-related diseases and chronic diseases, healthcare innovation is essential to improve health services. For example, innovation in diagnostics with the support of information and communication technology (ICT) is used in several settings that assist individuals in diagnosing, treating, and managing chronic diseases efficiently. Also, ICT interventions in diagnostics provide solutions to some challenges associated with aging and chronic diseases. Thus, the aforementioned factors drive the growth of the diagnostic lab market in Brazil.

Shortage of skilled professionals hinders the growth of the Brazil diagnostic labs market. According to the WHO report, there is a drastic shortage of healthcare professionals or workers trained to use diagnostic equipment. For example, ultrasound imaging (sonography) is widely used in Brazil. It shows movements of the body's internal organs and blood flowing through the blood vessels. The procedure is safe with low risk for pregnant women. However, the risk may increase with unnecessary prolonged exposure to ultrasound energy or in cases of untrained healthcare professionals operating the device. For example, the utility of diagnostic imaging devices by untrained professionals could expose the foetus to prolonged and unsafe energy levels and could provide information that is interpreted incorrectly by the user.

Major factors fueling the growth of the Brazil diagnostic labs market are the high prevalence of chronic diseases and the increasing use of point-of-care diagnostics. The industry is booming with the growing number of patients under the Universal Health System (SUS), the growing elderly population (above 65 years), the rising number of patients suffering from chronic diseases among the geriatric population, and growing investment in increasing the number of patient service centers.

The major players in the Brazil diagnostic labs market are also increasing involvement in collaborations, acquisitions, joint ventures, and partnerships. Furthermore, the investment levels in the market are rapidly growing. Various companies and investment firms are investing heavily in mergers, acquisitions, and collaborations. Collaboration agreements between research institutions and companies, licensing agreements and partnerships among companies, and augmented R&D investments in diagnostic labs are observed in the market growth. For instance: In September 2021, Sweetch, a digital therapeutics innovator, announced partnership with Grupo Fleury, one of Brazil's leading healthcare providers. As a part of substantial multi-year contract, Fleury will implement "Saúde iD telemedicine" services to improve healthcare outcomes for patients suffering from chronic conditions.

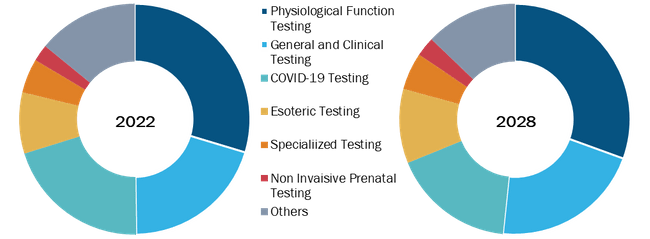

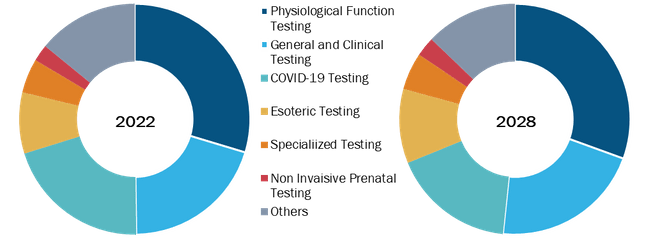

Testing Services Insights

Based on testing services, the Brazil diagnostic labs market is segmented into physiological function testing, general and clinical testing, esoteric testing, specialized testing, noninvasive prenatal testing, COVID-19 testing, and others. The market for the physiological function testing segment is further segmented into endoscopy, X-ray, CT, ECG, MRI, echo, and others. In 2022, the physiological function testing segment holds the largest market share. However, the esoteric testing segment is expected to register the highest CAGR of 14.1% from 2022 to 2028.

Lab Type Insights

By lab type, the Brazil diagnostic labs market is segmented into hospital-based laboratories, single/independent laboratories, physician office laboratories, and others. The hospital-based laboratories segment holds the largest share of the market in 2022. However, the single/independent laboratories segment is anticipated to register the highest CAGR of 10.8% during the forecast period.

Revenue Source Insights

Based on revenue source, the diagnostic labs market is segmented into healthcare plan operators and insurers, out-of-pocket, and public system. In 2022, the healthcare plan operators & insurers segment holds the largest share of the market. Moreover, the same segment is expected to register the highest CAGR of 10.7% during 2022–2028.

Several companies adopt strategies, such as product launches and approvals, to expand their footprints and product portfolios. Moreover, the diagnostic labs market players implement the partnership strategy to enlarge their clientele, which permits them to maintain their brand name. The market share is anticipated to flourish with the introduction of new innovative diagnostic products by market players. Dasa Labs, Quest Diagnostics Incorporated, SYNLAB-Solutions in Diagnostics, Grupo Fleury, Hospital Israelita Albert Einstein, Alliar, Boris Berenstein Diagnostic Center, Clínica da Imagem do Tocantins, Abramed (BP Medicina Diagnóstica), and Hermes Pardini are among the leading companies operating in the Brazil diagnostic labs market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 13,367.60 Million |

| Market Size by 2028 | US$ 24,334.07 Million |

| CAGR (2022 - 2028) | 10.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Lab Type

|

| Regions and Countries Covered |

Brazil

|

| Market leaders and key company profiles |

|

The Brazil Diagnostic Labs Market is valued at US$ 13,367.60 Million in 2022, it is projected to reach US$ 24,334.07 Million by 2028.

As per our report Brazil Diagnostic Labs Market, the market size is valued at US$ 13,367.60 Million in 2022, projecting it to reach US$ 24,334.07 Million by 2028. This translates to a CAGR of approximately 10.5% during the forecast period.

The Brazil Diagnostic Labs Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Brazil Diagnostic Labs Market report:

The Brazil Diagnostic Labs Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Brazil Diagnostic Labs Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Brazil Diagnostic Labs Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)