Swift developments in technologies, initiatives from governments, digitalization of economies, and increase in disposable income of the middle-income class group are among the factors propelling the overall economic growth of the region, driving it from a developing to developed phase. Several countries in the region are introducing smart grid concept for better transmission and distribution of energy. For instance, China is one of the most potential countries deploying smart grid systems. Japan developed a new interface standard, ECHONET Lite, for implementing the policy of direct communication interface between home energy management systems and smart meters, which further requires the installation of UPS battery. Japan—through its Energy Conversation Act sanctioned in 1979 and further revised in 2010—focuses on taking efficient measures for the comprehensible use of energy by buildings and factories, among other sites. With continuous investments by hyperscale and cloud service providers, the installation of data centers in APAC is on rise. For instance, in 2019, Hong Kong and China were the leading countries in terms of data center development, followed by Australia, India, Japan, and Singapore. Apart from these countries, Thailand, Indonesia, and Malaysia also made a substantial effort for the development of data centers. The commencement of 5G in several countries, the partnerships between telecommunication providers and service providers, in creating edge data centers throughout the forecast period. The rising number of data centers in APAC countries is triggering the adoption of UPS batteries.

Furthermore, in case of COVID-19, APAC is highly affected specially India. APAC is characterized by the presence of a large number of developing countries, positive economic outlook, high industrial presence, huge population, and rising disposable income. All these factors make APAC a major growth driving region for various markets including UPS battery. The lockdown of various plants and factories in China is affecting the global supply chains and negatively impacting manufacturing, delivery schedules, and sales of various products and services. APAC is a global manufacturing hub with countries such as China, Japan, South Korea, and India leading the global manufacturing industry growth. The ongoing COVID-19 caused huge disruptions in the growth of various industries of the region. For instance, China is the global hub of manufacturing and largest raw material supplier for various industries, and it is one of the worst affected COVID-19 countries. The lockdown of various plants and factories in China is affected the global supply chains and negatively impacted manufacturing, and sales of various products and services. APAC is a crucial region in terms of manufacturing and data center growth and any disruptions may negatively impact the growth of the region. With the global outbreak, the region experienced a negative impact based on UPS battery production and sales during Q1 and Q2 2020 because a majority of the battery industry supply chain is concentrated in China. The governments of various countries of this region are taking drastic measures to reduce the effects coronavirus outbreak by announcing lockdowns, travel, and trade bans. All these measures are expected to have a negative impact on the adoption and growth of UPS battery till mid-2021.

Strategic insights for the Asia-Pacific UPS Battery provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

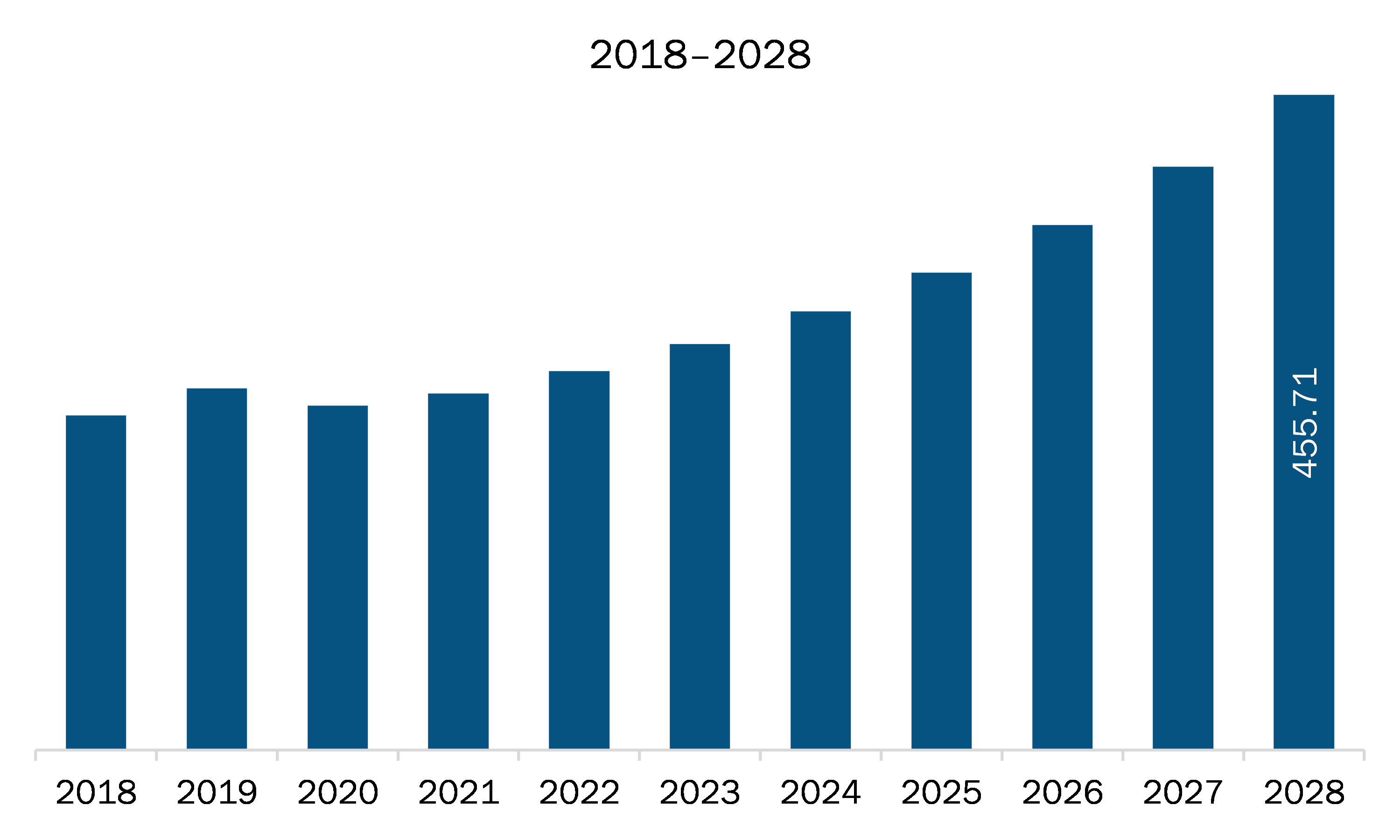

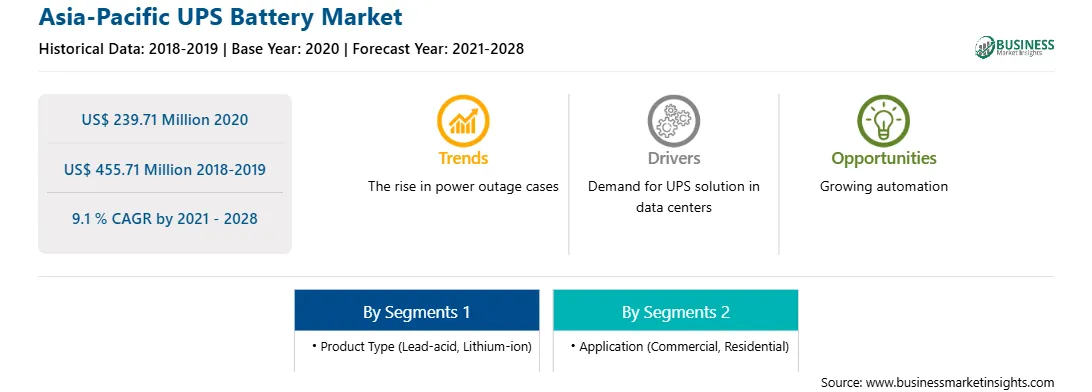

| Market size in 2020 | US$ 239.71 Million |

| Market Size by 2028 | US$ 455.71 Million |

| Global CAGR (2021 - 2028) | 9.1 % |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia-Pacific UPS Battery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC UPS battery market is expected to grow from US$ 239.71 million in 2020 to US$ 455.71 million by 2028; it is estimated to grow at a CAGR of 9.1 % from 2021 to 2028. Mounting emphasis of Li-Ion battery will accelerate the APAC UPS battery market. Presently, the Li-ion battery—which is highly used for energy storage and power supply—is being heavily adopted for various industrial applications. Several benefits of Li-ion batteries such as higher energy efficiency and extended battery life provided are leading to wider adoptions in commercial and residential applications. Use of Li-ion battery for UPS provides better operating parameters, safer chemistries, strong materials, and less stressed user environments. Li-ion batteries are extensively used across APAC region in order to introduce economical and energy-efficient battery technology. Li-ion battery is 40–60% lighter than their valve regulated lead acid (VRLA) counterparts and ~40% smaller in terms of size, which makes UPS simpler to deploy, offering flexibility in installation options. Integrating Li-ion batteries reduces the size and weight of UPS and offers long working life, which leads to fewer costly replacements. These factors benefit customers with decreases in operating expense (OPEX) and capital expenditure (CAPEX) and make Li-ion battery a captivating solution for UPS applications. Due to the cost-effectiveness of Li-ion battery, there is a swift shift from lead-acid to Li-ion technology, which is propelling the market growth. Thus, the rise in the use of Li-ion batteries is fueling the growth of the APAC UPS battery market.

In terms of product type, the lead-acid segment accounted for the largest share of APAC UPS battery market in 2020. In terms of application, the commercial segment held a larger market share of the APAC UPS battery market in 2020.

A few major primary and secondary sources referred to for preparing this report on the APAC UPS battery market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are CSB Battery Co., Ltd., East Penn Manufacturing Company, Eaton Corporation plc, Exide Industries Limited, FIAMM Energy Technology S.p.A., GS Yuasa International Ltd., leoch International Technology Limited Inc, Schneider Electric SE, and Vertiv Group Corporation.

The Asia-Pacific UPS Battery Market is valued at US$ 239.71 Million in 2020, it is projected to reach US$ 455.71 Million by 2028.

As per our report Asia-Pacific UPS Battery Market, the market size is valued at US$ 239.71 Million in 2020, projecting it to reach US$ 455.71 Million by 2028. This translates to a CAGR of approximately 9.1 % during the forecast period.

The Asia-Pacific UPS Battery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific UPS Battery Market report:

The Asia-Pacific UPS Battery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific UPS Battery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific UPS Battery Market value chain can benefit from the information contained in a comprehensive market report.