Military modernization, economic prosperity, increase in terrorist activities, and territorial disputes have positively influenced the growth of the defense industry across Asia Pacific countries over the last decade. This has also propelled the demand for advanced defense equipment, such as smart weapons, armored and unarmored military vehicles, missile defense systems, and C4ISR systems. These factors are fueling the growth of the aerospace and defense industry across the region. Rising investments by government bodies across countries, such as China, India, and Japan, to support the manufacturing of aircraft and military vehicles coupled with their investments in the acquisition of military aircrafts contribute to the growth of the backshell market across the region. For instance, in June 2017, Lockheed Martin and Tata Advanced Systems, under the Make in India initiative, entered a strategic partnership to manufacture F-16 Block 70 aircraft in India. Such initiatives are expected to increase the demand for components required in the manufacturing of aircraft, which is fueling the growth of the backshell market in Asia Pacific.

The COVID-19 pandemic has severely impacted APAC due to wide disease spread; countries in this region are among the highly populated countries in the world, which leads to the greater risk infection spread. Many global brands and technological companies are headquartered in the region. According to the Organization for Economic Co-operation and Development (OECD), the pandemic has affected major economies such as China, India, Australia, and Japan, which are experiencing inflation. The rapid outbreak of the COVID-19 pandemic has led to strict lockdowns across the region since the starting of 2020. Some part of the region like India are still facing lockdowns owing to the rising cases across the country. The lockdown of various factories in China affects the global supply chains and negatively impacts development, delivery schedules of various products and services. Even as the factories in China are beginning to reopen, several businesses have reduced or hit pause on their operations. The region comprises of several developing countries, which consist of large number of manufacturing facilities. The temporary closure of all economic activities and travel restrictions have drastically reduced the airline passengers leading to low demand for aircrafts among them. Moreover, the travel restriction imposed across the nations have also led to the disruption of supply chain of both manufacturing components and final products from major economies like India and China. These factors have negatively impacted the market due to the outbreak of COVID-19.

Strategic insights for the Asia Pacific Backshell provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

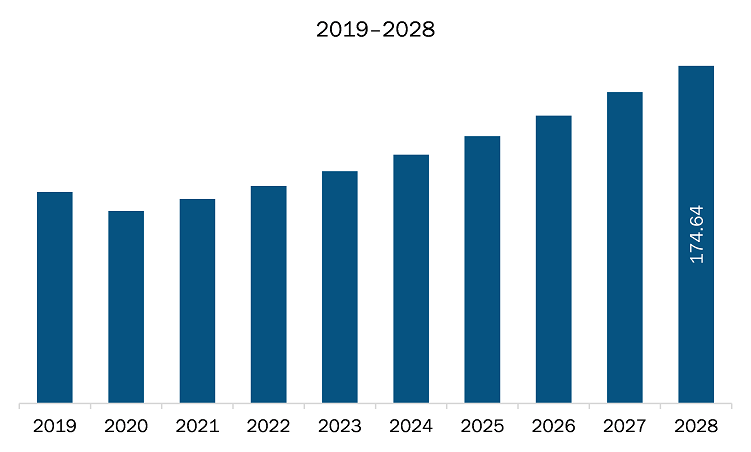

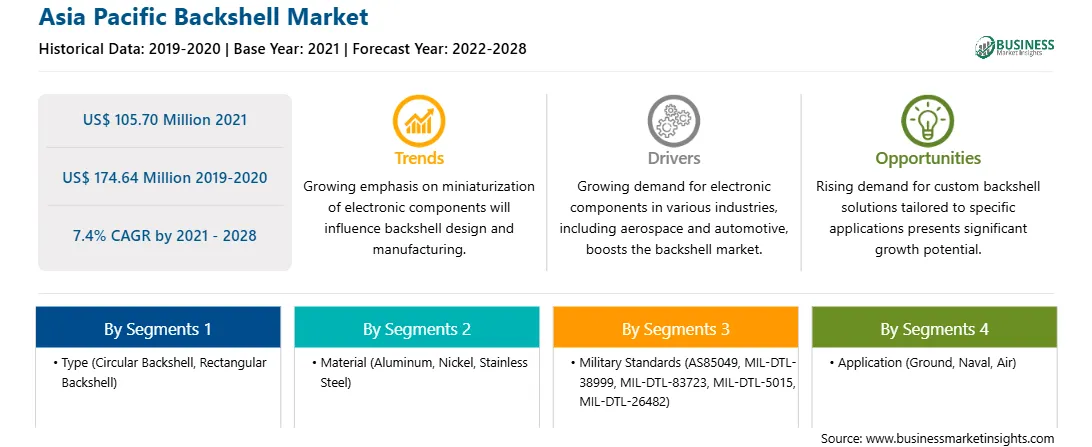

| Market size in 2021 | US$ 105.70 Million |

| Market Size by 2028 | US$ 174.64 Million |

| CAGR (2021 - 2028) | 7.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

|

The geographic scope of the Asia Pacific Backshell refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The backshell market in Asia Pacific is expected to grow from US$ 105.70 million in 2021 to US$ 174.64 million by 2028; it is estimated to grow at a CAGR of 7.4% from 2021 to 2028. As world warfare continues to emerge in different ways, various nations plan and undertake measures to improve and recapitalize their defense status. Threats are continually evolving, i.e., from the conventional land-based force on force to hybrid warfare. To address security threats and tackle terrorism, governments of several nations have already started to increase their defense budgets. The China and India are among the leading countries that are increasing their defense budget year on year. A substantial amount of military budget is getting allocated for the procurement of advanced military carrier and combat aircraft, vehicles, and naval vessels. The AS85049 Series, MIL-DTL-38999, MIL-DTL-83723, MIL-DTL-5015, and MIL-DTL-26482 are a few major military-grade connectors that are widely used across the components of advanced military carrier and combat aircraft, vehicles, and naval vessels. To safeguard the connectors, several backshells with a similar military grade to the above-mentioned connectors are being produced by various manufacturers. This is catalyzing the growth of the backshell market in the current scenario. From the production perspective of military aircraft, military ground vehicles, and naval ships, the production volume is surging at a decent rate, which is supporting the growth of the backshell market.

In terms of type, the circular segment held a larger share in 2020. Based on material, the stainless steel segment held the largest share in 2020. Based on military standard, the AS85049 series segment held the largest share in 2020. Based on application, the ground segment held the largest share in 2020.

A few major primary and secondary sources referred to for preparing this report on the backshell market in Asia Pacific are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Amphenol Corporation; Collins Aerospace; TE Connectivity; Souriau Sunbank; Arrow Electronics, Inc.; Glenair, Inc.; Curtiss-Wright Corporation; and PEI-Genesis.com among others.

The Asia Pacific Backshell Market is valued at US$ 105.70 Million in 2021, it is projected to reach US$ 174.64 Million by 2028.

As per our report Asia Pacific Backshell Market, the market size is valued at US$ 105.70 Million in 2021, projecting it to reach US$ 174.64 Million by 2028. This translates to a CAGR of approximately 7.4% during the forecast period.

The Asia Pacific Backshell Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Backshell Market report:

The Asia Pacific Backshell Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Backshell Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Backshell Market value chain can benefit from the information contained in a comprehensive market report.