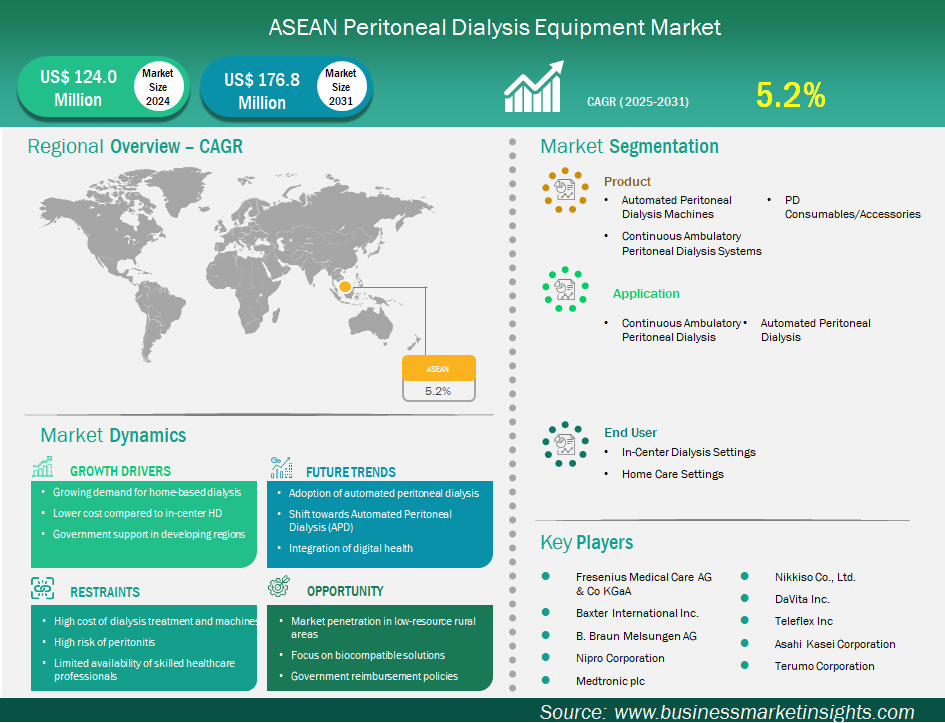

The ASEAN peritoneal dialysis equipment market size is expected to reach US$ 176.8 million by 2031 from US$ 124.0 million in 2024. The market is estimated to record a CAGR of 5.2% from 2025 to 2031.

The peritoneal dialysis equipment market in ASEAN is experiencing significant growth driven by growing demand for home-based dialysis, lower cost compared to in-center HD, and government support in developing regions. The ASEAN peritoneal dialysis (PD) equipment market is a rapidly growing market driven by the immense burden of chronic kidney disease (CKD) and end-stage renal disease (ESRD), particularly from high rates of diabetes and hypertension. The region's health system is often challenged by limited resources and a large, geographically scattered population, making PD an attractive and durable option to hemodialysis. The Consumables segment is mainly fueled by dialysate solutions demand, which are continuously needed for every treatment. Continuous ambulatory peritoneal dialysis (CAPD) dominates the application landscape due to its simplicity, low equipment costs, and suitable for home-based care. As economies grow and healthcare infrastructure improves, urban areas are exhibiting a growing trend toward automated peritoneal dialysis (APD), which is induced by patient preference for convenience and better quality of life. Government policies greatly affect market development, which aim to make renal care more accessible and inexpensive.

Key segments that contributed to the derivation of the peritoneal dialysis equipment market analysis are product, application, and end user.

The ASEAN peritoneal dialysis equipment market is segmented into Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. The outlook for the ASEAN peritoneal dialysis market is highly promising, with a clear trajectory toward increased adoption. The primary motive force is the developing policies via governments, for instance, the "PD-first" policy is a more cost-effective and efficient way to manage the escalating wide variety of ESRD sufferers. This strategic shift intends to reduce the obligation on public hospitals and extend access to care. The marketplace is likewise poised to benefit from increasing investments in healthcare infrastructure and public-private partnerships. A key future trend is the deepening integration of digital health technology, including telemedicine and remote monitoring, to become critical for offering scientific support to patients in distant areas and improving treatment adherence. As disposable incomes increase and public focus on CKD and PD grows, patients will increasingly choose home-based treatments that provide greater flexibility and independence.

Based on country, the ASEAN peritoneal dialysis equipment market is segmented into Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. Indonesia held the largest share in 2024.

Adoption of peritoneal dialysis varies significantly in Asian member countries, which reflect various healthcare systems and policy environments. Despite its abundant and geographically dispersed population, Indonesia has emerged as a regional leader in using a national strategy to make renal care more accessible and affordable. This is a crucial development because the country faces the greatest burden of chronic kidney disease (CKD) and relies on the PD to reduce the immense pressure on its public health system. On the contrary, Thailand has seen success with a well-known "PD-first" policy. The Philippines is also a prominent country with a relatively high PD penal penetration rate, driven by a strong emphasis on home care to eliminate its dispersed population and limited hospital resources.

Meanwhile, despite their well-developed healthcare systems in countries like Malaysia and Singapore, the PD adoption rate is still modest than leaders like Indonesia and Thailand. A strong choice for the availability of in-center hemodialysis and advanced HD infrastructure are often responsible for this. This country-specific complexity illuminates that focusing on supportive government policies, targeted public health campaigns, and cost-effectiveness for adopting PDs in this region is crucial.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 124.0 Million |

| Market Size by 2031 | US$ 176.8 Million |

| CAGR (2025 - 2031) | 5.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

ASEAN

|

| Market leaders and key company profiles |

|

Fresenius Medical Care AG & Co KGaA; Baxter International Inc.; B. Braun SE; Nipro Corp; Medtronic Plc, Nikkiso Co Ltd, Teleflex Inc, Asahi Kasei Medical Co., Ltd., Terumo Corp, and DaVita Inc., are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The ASEAN Peritoneal Dialysis Equipment Market is valued at US$ 124.0 Million in 2024, it is projected to reach US$ 176.8 Million by 2031.

As per our report ASEAN Peritoneal Dialysis Equipment Market, the market size is valued at US$ 124.0 Million in 2024, projecting it to reach US$ 176.8 Million by 2031. This translates to a CAGR of approximately 5.2% during the forecast period.

The ASEAN Peritoneal Dialysis Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the ASEAN Peritoneal Dialysis Equipment Market report:

The ASEAN Peritoneal Dialysis Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The ASEAN Peritoneal Dialysis Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the ASEAN Peritoneal Dialysis Equipment Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)