美国氮气发生器市场规模和预测(2021 - 2031 年)、区域份额、趋势和增长机会分析报告范围:按类型(PSA 氮气发生器、膜氮气发生器和低温氮气发生器)和最终用户(石油和天然气、食品和饮料、医疗和制药、运输、化学品等)

No. of Pages: 84 | Report Code: BMIRE00031038 | Category: Electronics and Semiconductor

No. of Pages: 84 | Report Code: BMIRE00031038 | Category: Electronics and Semiconductor

Strategic insights for US Nitrogen Generator involve closely monitoring industry trends, consumer behaviours, and competitor actions to identify opportunities for growth. By leveraging data analytics, businesses can anticipate market shifts and make informed decisions that align with evolving customer needs. Understanding these dynamics helps companies adjust their strategies proactively, enhance customer engagement, and strengthen their competitive edge. Building strong relationships with stakeholders and staying agile in response to changes ensures long-term success in any market.

| Report Attribute | Details |

|---|---|

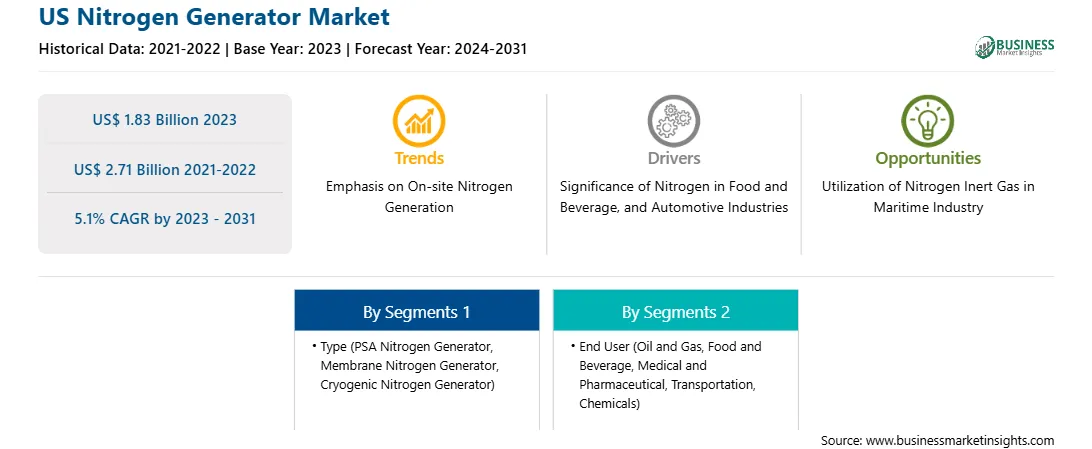

| Market size in 2023 | US$ 1.83 Billion |

| Market Size by 2031 | US$ 2.71 Billion |

| Global CAGR (2023 - 2031) | 5.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By 类型

|

| Regions and Countries Covered | 美国

|

| Market leaders and key company profiles |

The regional scope of US Nitrogen Generator refers to the geographical area in which a business operates and competes. Understanding regional nuances, such as local consumer preferences, economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved regions or adapting their offerings to meet regional demands. A clear regional focus allows for more effective resource allocation, targeted marketing, and better positioning against local competitors, ultimately driving growth in those specific areas.

The US Nitrogen Generator Market is valued at US$ 1.83 Billion in 2023, it is projected to reach US$ 2.71 Billion by 2031.

As per our report US Nitrogen Generator Market, the market size is valued at US$ 1.83 Billion in 2023, projecting it to reach US$ 2.71 Billion by 2031. This translates to a CAGR of approximately 5.1% during the forecast period.

The US Nitrogen Generator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Nitrogen Generator Market report:

The US Nitrogen Generator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Nitrogen Generator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Nitrogen Generator Market value chain can benefit from the information contained in a comprehensive market report.