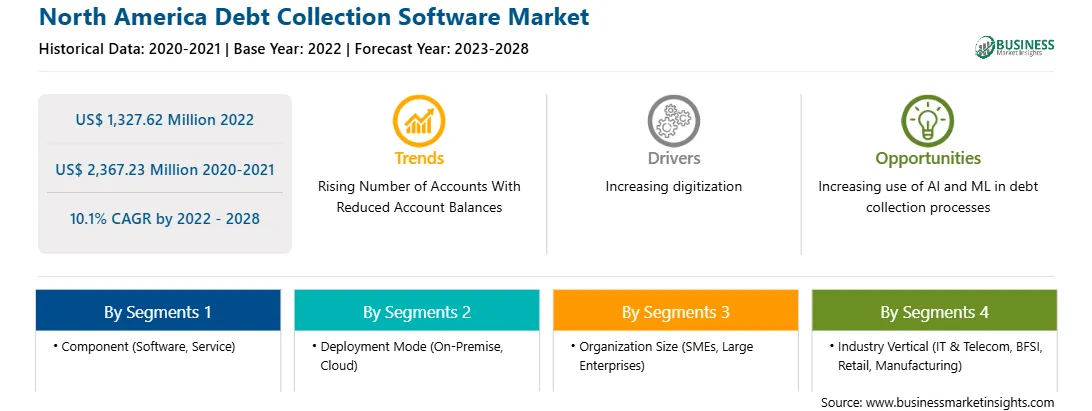

北美债务催收软件市场预测至 2028 年 - COVID-19 影响和区域分析(按组件(软件和服务)、部署模式(本地和云)、组织规模(中小企业和大型企业)和行业垂直领域(IT 和行业))电信、BFSI、零售、制造等)

No. of Pages: 110 | Report Code: BMIRE00027336 | Category: Technology, Media and Telecommunications

No. of Pages: 110 | Report Code: BMIRE00027336 | Category: Technology, Media and Telecommunications

北美收债软件市场越来越多地采用自助支付模式

市场增长归因于收债软件的采用增加,对收债软件的需求不断增加自助支付模式。人们越来越倾向于使用催收软件来简化催收流程并自动化贷款催收流程,预计这将推动市场增长。随着企业越来越多地实施自助支付平台来跟踪客户、跟踪账单支付和维护信誉,收债软件市场预计将出现强劲增长。我在这。此外,对与债务人进行多渠道沟通并通过自动化改进催收流程的需求不断增长,预计将在预测期内推动催收软件行业的增长。自助支付解决方案帮助行业提高交易效率、客户体验和新商机。该系统可以为无银行账户或银行服务不足的客户实现所有支付服务的自动化,同时消除昂贵的个人支付处理过程。逾期和拖欠账户管理是金融科技整体资金管理的一个重要组成部分。 TrueAccord 利用获得专利的机器学习和来自数百万客户的交互数据,提供个性化的自助服务体验,推动消费者参与和尖端成果。为了满足消费者对数字优先服务的偏好,TrueAccord 利用了多种渠道,包括电子邮件、短信、语音邮件抑制等。减少噪音并加强免费客户服务和入站沟通。因此,自助支付模式的日益普及推动了北美收债软件市场的需求。

北美债务催收软件市场概览

北美分为美国、加拿大和墨西哥。预计在预测期内,对自助支付模式加速收债流程的需求不断增加,将推动该地区对收债软件的需求。北美国家一直在积极采用基于云的平台和数字技术,以控制不断上升的坏账率。该地区拥有大量提供收债软件解决方案的主要参与者,在它们之间创造竞争并进一步推动市场发展。其中包括 North American Recovery、FIS、FICO、TransUnion LLC、Pegasystems Inc.、Chetu Inc.、KATABAT、Gaviti、Metropolitan Credit Adjusters Ltd.、Ameyo、LeadSquared、receeve GmbH 和其他参与者。大流行的出现造成了财务负担,导致某些企业负债累累。尽管 2021 年经济面临重大阻力,但通胀、供应短缺以及多项业务运营受到限制等因素仍造成了债务环境。

< h3>

北美债务催收软件市场细分

< /p>

北美债务催收软件市场根据组件、部署类型、组织规模、垂直行业和国家/地区进行细分。根据组件,收债软件市场分为软件和服务。软件细分市场将在 2022 年获得更大的市场份额。

根据部署类型,北美收债软件市场分为- 前提和云。云细分市场将在 2022 年占据更大的市场份额。

根据组织规模,北美收债软件市场分为小型和小型企业。中型企业(SME)和大型企业。大型企业细分市场在 2022 年将占据更大的市场份额。

根据垂直行业,北美收债软件市场细分为 IT &电信、BFSI、制造、零售等。 BFSI 细分市场在 2022 年占据最大的市场份额。

根据国家/地区,北美收债软件市场分为美国、加拿大、墨西哥。美国在 2022 年占据主导市场份额。

CGI INC.;切图公司; CSS 公司;益百利信息解决方案公司;埃克苏斯;费埃哲;金融信息服务;佩加系统公司;和Quantrax Corporation, Inc. 是北美收债软件市场的领先公司。

Strategic insights for North America Debt Collection Software involve closely monitoring industry trends, consumer behaviours, and competitor actions to identify opportunities for growth. By leveraging data analytics, businesses can anticipate market shifts and make informed decisions that align with evolving customer needs. Understanding these dynamics helps companies adjust their strategies proactively, enhance customer engagement, and strengthen their competitive edge. Building strong relationships with stakeholders and staying agile in response to changes ensures long-term success in any market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,327.62 Million |

| Market Size by 2028 | US$ 2,367.23 Million |

| Global CAGR (2022 - 2028) | 10.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By 组件

|

| Regions and Countries Covered | 北美

|

| Market leaders and key company profiles |

The regional scope of North America Debt Collection Software refers to the geographical area in which a business operates and competes. Understanding regional nuances, such as local consumer preferences, economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved regions or adapting their offerings to meet regional demands. A clear regional focus allows for more effective resource allocation, targeted marketing, and better positioning against local competitors, ultimately driving growth in those specific areas.

The North America Debt Collection Software Market is valued at US$ 1,327.62 Million in 2022, it is projected to reach US$ 2,367.23 Million by 2028.

As per our report North America Debt Collection Software Market, the market size is valued at US$ 1,327.62 Million in 2022, projecting it to reach US$ 2,367.23 Million by 2028. This translates to a CAGR of approximately 10.1% during the forecast period.

The North America Debt Collection Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Debt Collection Software Market report:

The North America Debt Collection Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Debt Collection Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Debt Collection Software Market value chain can benefit from the information contained in a comprehensive market report.